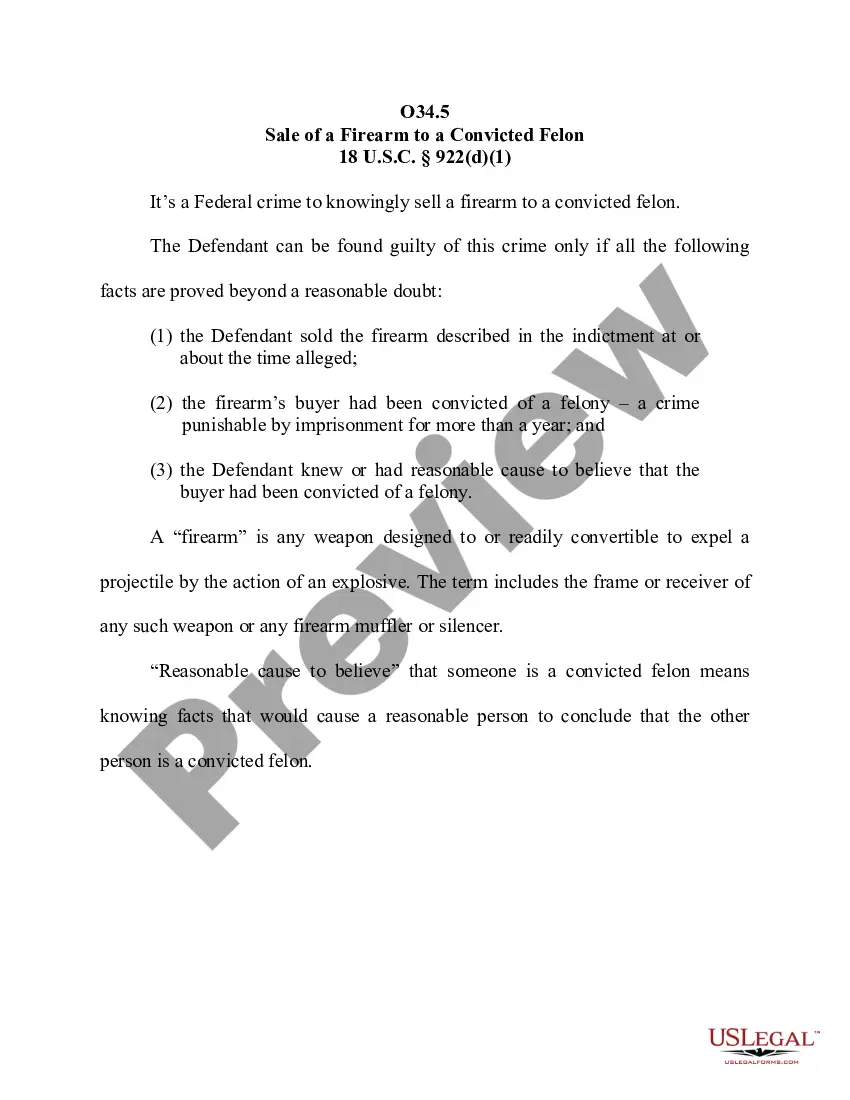

Jury Instruction - Sale Of Firearm To Convicted Felon

Description

How to fill out Jury Instruction - Sale Of Firearm To Convicted Felon?

Use the most extensive legal catalogue of forms. US Legal Forms is the best platform for finding updated Jury Instruction - Sale Of Firearm To Convicted Felon templates. Our platform provides 1000s of legal forms drafted by certified lawyers and sorted by state.

To obtain a sample from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our service, log in and select the template you are looking for and buy it. After purchasing forms, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- In case the template has a Preview function, use it to review the sample.

- If the template does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the template meets your requirements.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr credit/visa or mastercard.

- Choose a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill out the Form name. Join thousands of satisfied subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

Short You do not really need to mail Form 8949, but you do need to mail your supporting statements, such as your brokerage statements (Form 1099B) and Form 8453.Most people send their 1099-B forms received form their brokers as these usually contain all the information for the transactions.

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

IRS Form 8949 is used to report capital gains and losses from investments for tax purposes. The form segregates short-term capital gains and losses from long-term ones. Filing this form also requires a Schedule D and a Form 1099-B, which is provided by brokerages to taxpayers.

File Form 8949 with the Schedule D for the return you are filing. This includes Schedule D of Forms 1040, 1040-SR, 1041, 1065, 8865, 1120, 1120-S, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, 1120-PC, 1120-POL, 1120-REIT, 1120-RIC, and 1120-SF; and certain Forms 990-T.

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

Form 8453 is required to be filled out and mailed to the IRS when one or more of the forms below are included in an e-filed return.Form 5713, International Boycott Report. Form 8858, Foreign Disregarded Entities Information Return.

You'll need it to report short- and long-term capital gains to the IRS. Schedule D of Form 1040 is used to report most capital gain (or loss) transactions. But before you can enter your net gain or loss on Schedule D, you have to complete Form 8949.

Schedule D is used to report income or losses from capital assets. Assets owned by you are considered capital assets. These include your home, car, boat, furniture, and stocks, to name a few.

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.