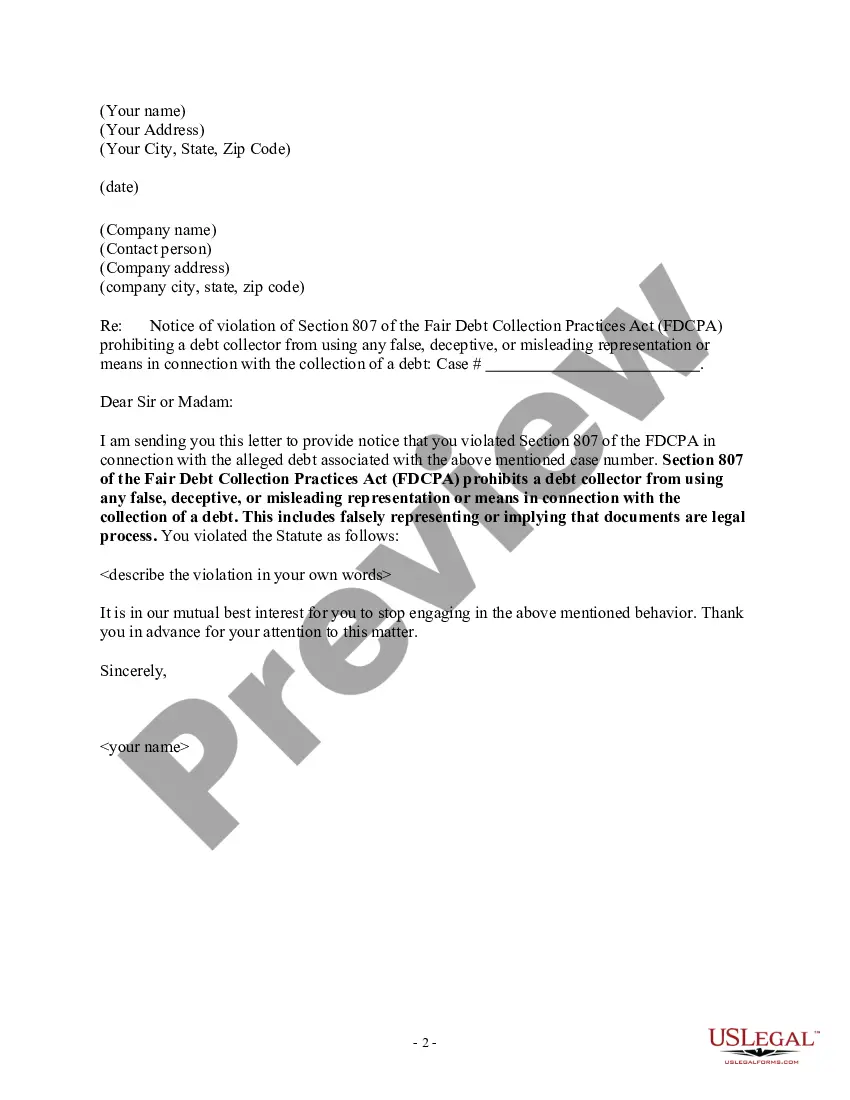

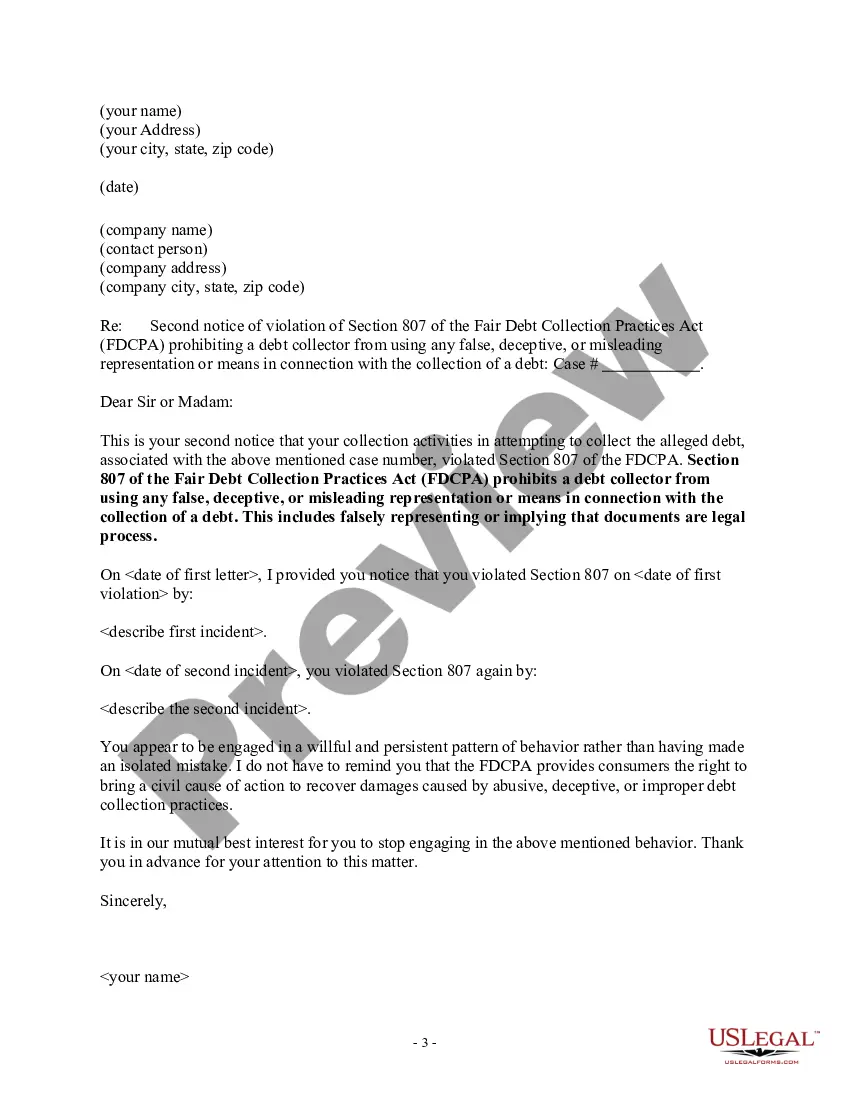

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Rhode Island Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

You can dedicate several hours online trying to discover the legal form template that fulfills the state and federal requirements you require. US Legal Forms offers an extensive array of legal documents that are evaluated by experts.

You can indeed obtain or print the Rhode Island Notice to Debt Collector - Falsely Representing a Document as Legal Process from the services.

If you currently possess a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, modify, print, or sign the Rhode Island Notice to Debt Collector - Falsely Representing a Document as Legal Process. Every legal form template you acquire is yours permanently.

Complete the payment. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of your file and download it onto your device. Make changes to your document if necessary. You can fill, modify, sign, and print the Rhode Island Notice to Debt Collector - Falsely Representing a Document as Legal Process. Download and print a vast array of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of any acquired form, go to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for the area/city of your choice. Review the form outline to confirm you have picked the right form.

- If available, use the Review button to examine the form template as well.

- If you wish to obtain another version of your form, use the Search section to find the template that fits your needs.

- Once you have identified the template you need, click on Get now to proceed.

- Select the pricing plan you want, enter your details, and register for your account on US Legal Forms.

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you. If the account has been sold to another creditor, then that creditor must prove that it has the right to sue to collect the debt.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

When writing the letter, request that the collection agency or creditor provide you with: Documentation that you owed the debt at some point, such as a contract you signed. How much you owe and the last outstanding action on the debt, which can be shown by documents such as the last statement or bill.