Rhode Island Complex Will - Income Trust for Spouse

Description

How to fill out Complex Will - Income Trust For Spouse?

Are you currently within a position in which you require papers for both organization or specific reasons virtually every time? There are plenty of lawful file layouts available online, but finding kinds you can trust isn`t effortless. US Legal Forms provides thousands of develop layouts, much like the Rhode Island Complex Will - Income Trust for Spouse, which are written to meet federal and state specifications.

When you are presently informed about US Legal Forms internet site and get a free account, basically log in. Afterward, you may down load the Rhode Island Complex Will - Income Trust for Spouse format.

Should you not come with an profile and wish to begin using US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is to the appropriate town/area.

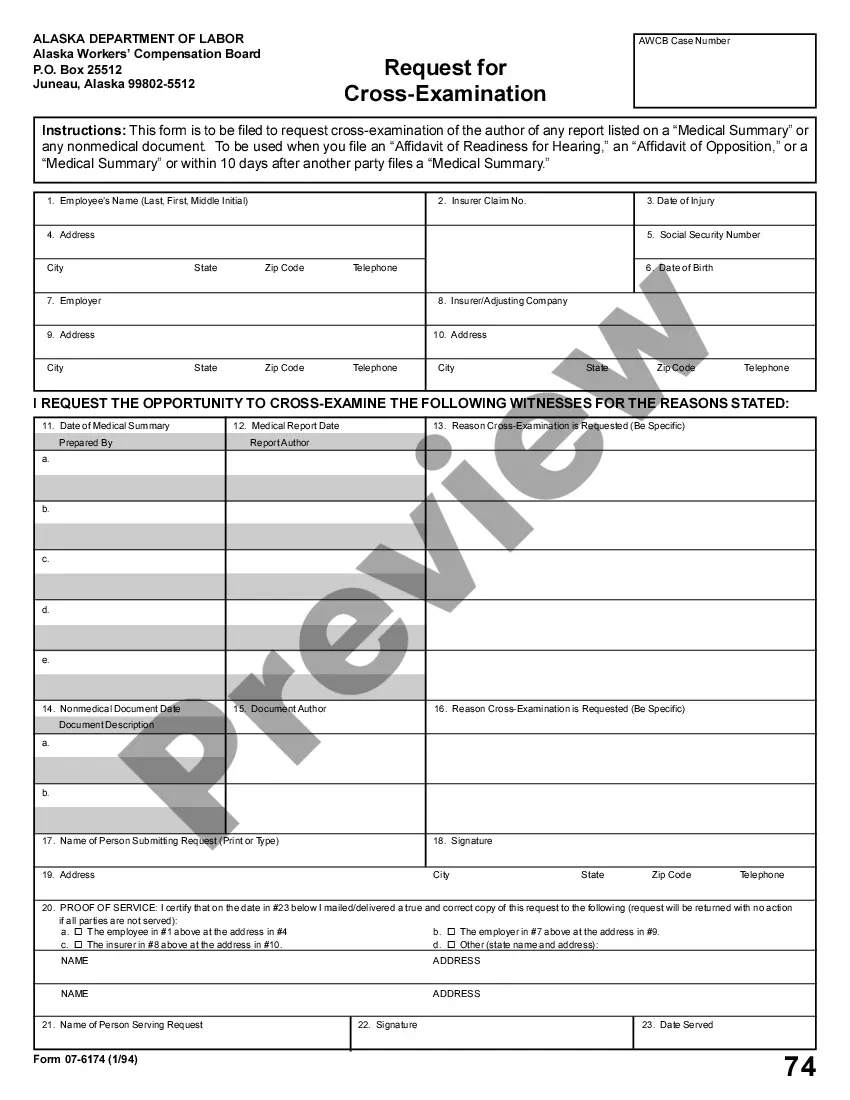

- Utilize the Preview key to review the shape.

- Read the explanation to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re seeking, use the Lookup industry to find the develop that meets your requirements and specifications.

- Whenever you find the appropriate develop, click Acquire now.

- Choose the rates plan you would like, complete the desired details to produce your bank account, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Choose a practical document formatting and down load your duplicate.

Locate every one of the file layouts you possess purchased in the My Forms food list. You can obtain a additional duplicate of Rhode Island Complex Will - Income Trust for Spouse whenever, if required. Just click the required develop to down load or print the file format.

Use US Legal Forms, one of the most substantial assortment of lawful forms, to conserve time as well as stay away from blunders. The services provides professionally produced lawful file layouts that you can use for a selection of reasons. Produce a free account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

For example, some states will look to the residency of the grantor or settlor at the time that the trust was created to determine whether the trust is a resident trust. Other states will look to the location of the fiduciary and administration of the trust to determine residency. Key Factors that Determine the Residency of Your Trust kmco.com ? insights ? key-factors-that-deter... kmco.com ? insights ? key-factors-that-deter...

Bare trusts are subject to the new trust reporting rules for tax years ending after December 30, 2023. ingly, a bare trust is required to file a T3 Return annually unless specific conditions are met. A bare trust is also required to complete Schedule 15 annually, unless it is a listed trust.

A T3 return must be filed when a trust does not have tax payable, however the trust holds property that is subject to subsection 75(2) and from which the trust received income, gains or profits during the year.

A trust's taxable income includes interest income, dividends, and capital gains, and it subtracts any fees, tax exemptions, and capital losses. For the DNI calculation, capital gains are subtracted back out, while tax exemptions and capital losses are added back in. Distributable Net Income (DNI) Definition, Formula, Example investopedia.com ? terms ? distributableneti... investopedia.com ? terms ? distributableneti...

Q: Do trusts have a requirement to file federal income tax returns? A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary. Abusive Trust Tax Evasion Schemes - Questions and Answers - IRS irs.gov ? small-businesses-self-employed ? a... irs.gov ? small-businesses-self-employed ? a...

Generally speaking, distributions from trusts are considered income and, therefore, may be subject to taxation depending on the type of trust and its purpose. Taxes on a trust fund in California: brackets, distributions & more! sambrotman.com ? blog ? taxes-on-a-trust-f... sambrotman.com ? blog ? taxes-on-a-trust-f...