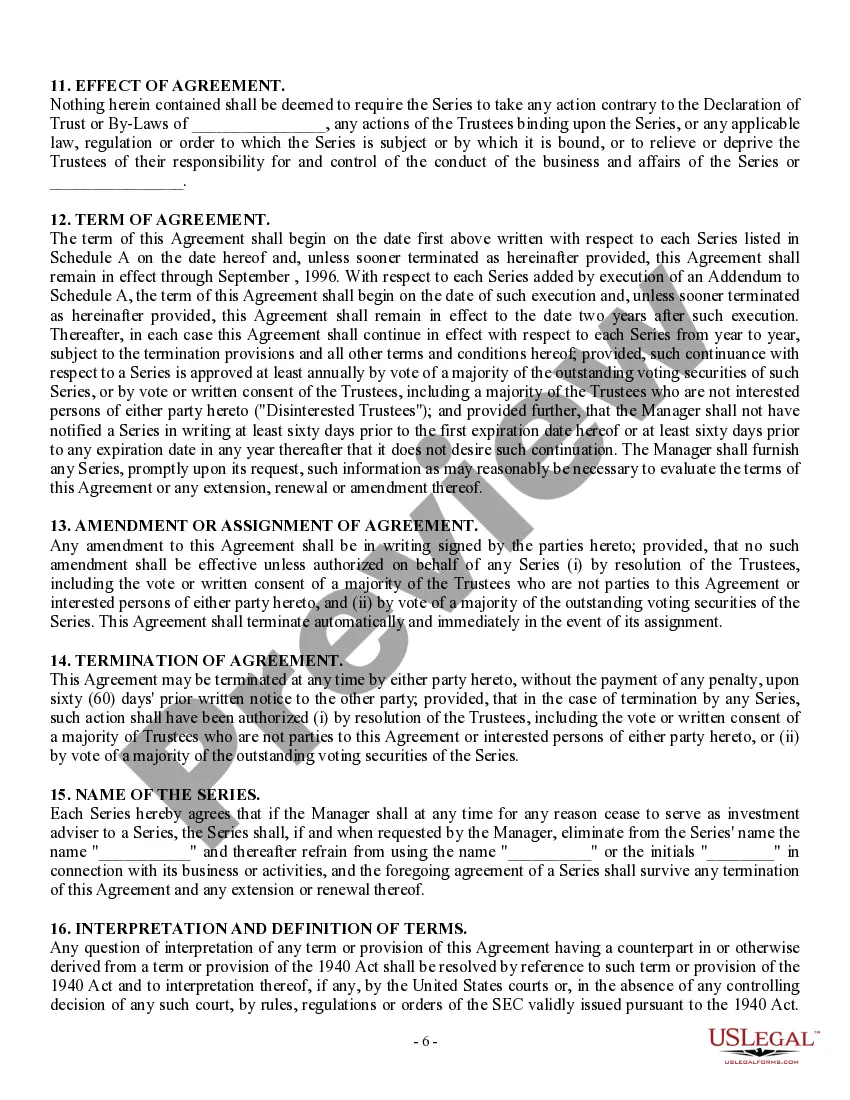

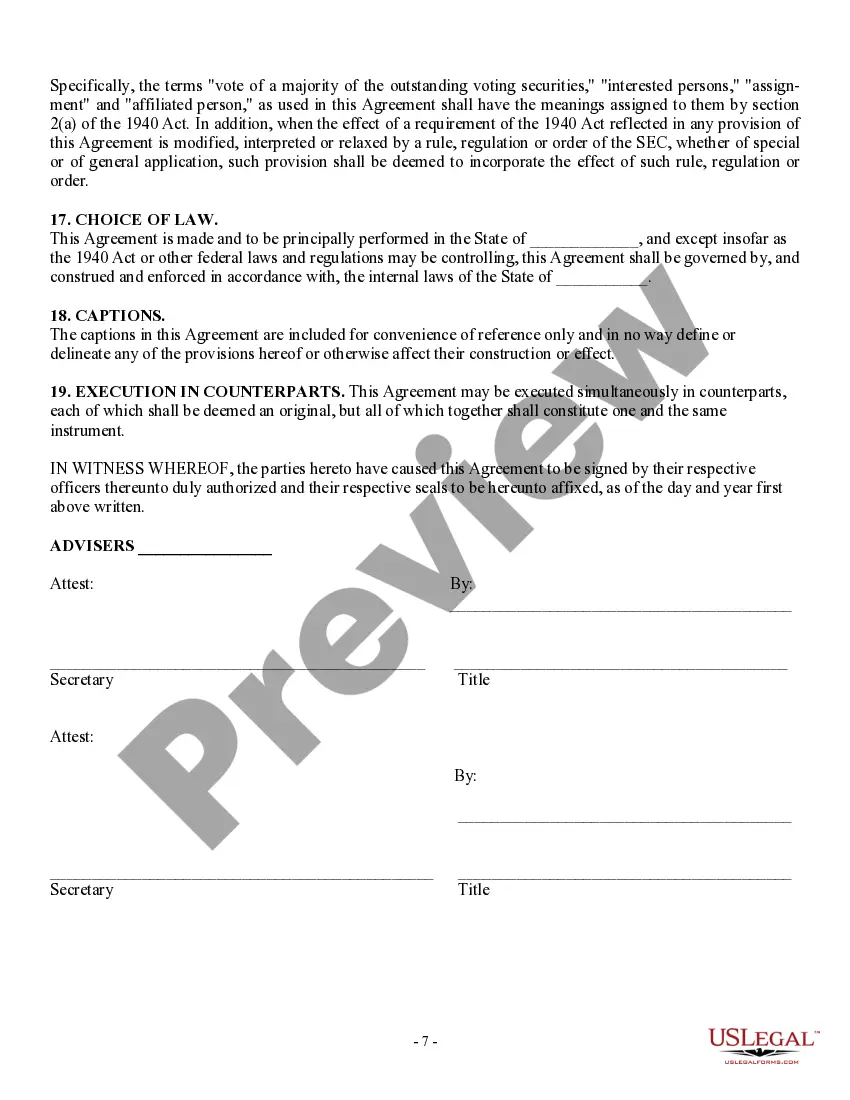

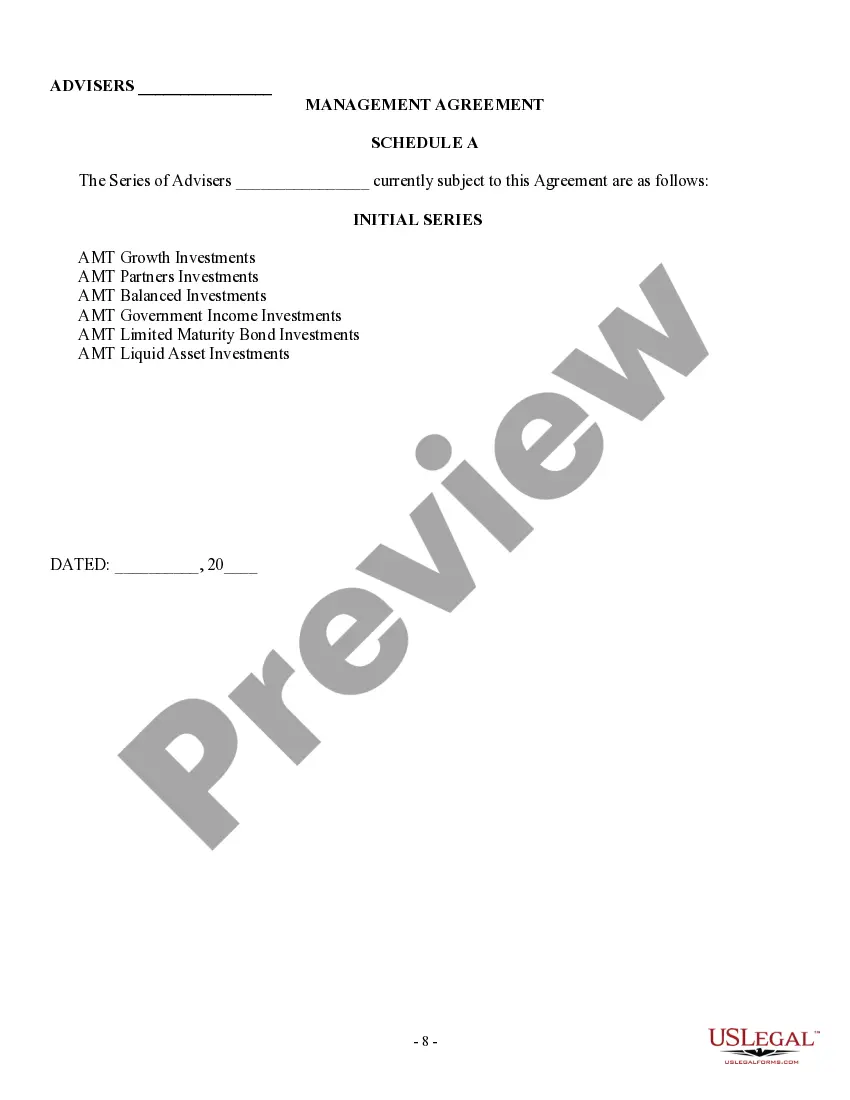

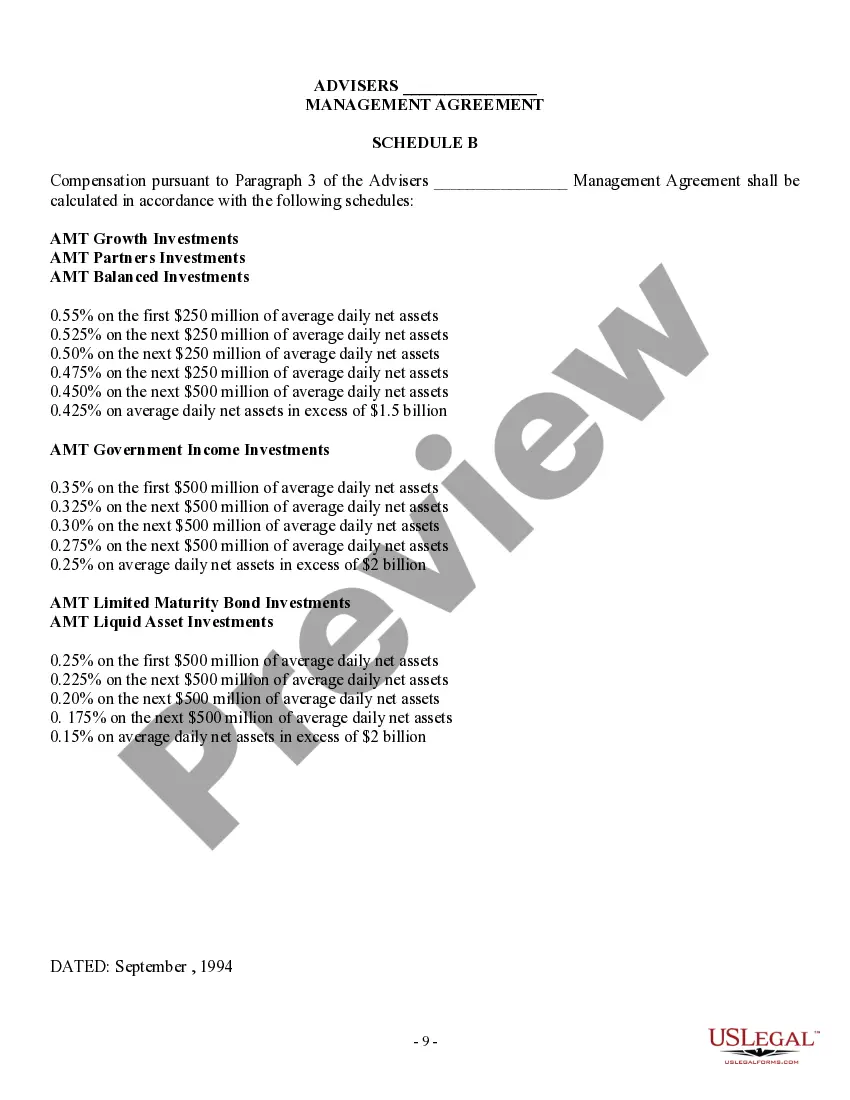

Rhode Island Management Agreement between a Trust and a Corporation

Description

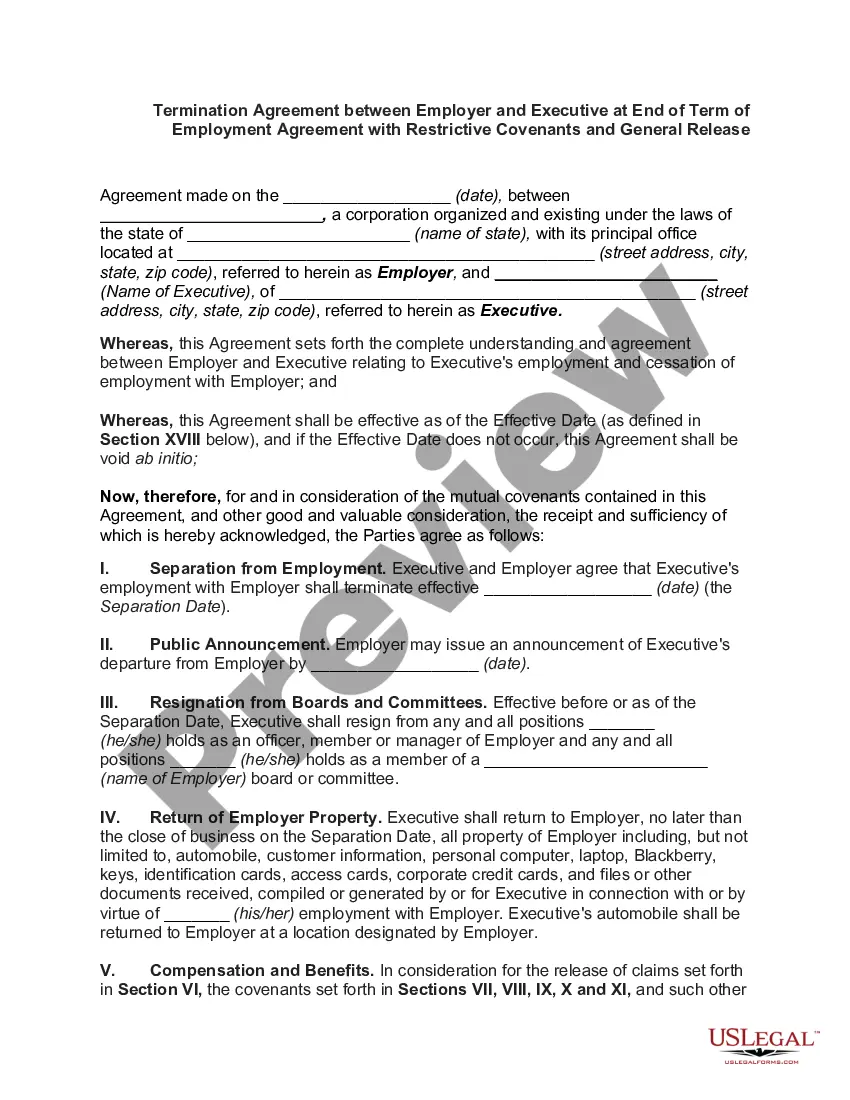

How to fill out Management Agreement Between A Trust And A Corporation?

Are you presently inside a placement in which you will need paperwork for sometimes business or personal reasons just about every day? There are tons of authorized record web templates available online, but locating types you can rely isn`t easy. US Legal Forms provides a large number of develop web templates, like the Rhode Island Management Agreement between a Trust and a Corporation, that happen to be composed to meet federal and state requirements.

If you are already familiar with US Legal Forms web site and also have a free account, basically log in. Following that, you may down load the Rhode Island Management Agreement between a Trust and a Corporation web template.

Unless you provide an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for the correct town/area.

- Utilize the Preview key to examine the shape.

- Browse the outline to actually have selected the proper develop.

- If the develop isn`t what you are searching for, use the Search area to discover the develop that meets your requirements and requirements.

- If you obtain the correct develop, click on Purchase now.

- Opt for the prices prepare you desire, complete the specified information to make your account, and purchase your order making use of your PayPal or charge card.

- Pick a hassle-free file file format and down load your duplicate.

Get all of the record web templates you have purchased in the My Forms food list. You may get a additional duplicate of Rhode Island Management Agreement between a Trust and a Corporation anytime, if required. Just click on the essential develop to down load or print the record web template.

Use US Legal Forms, probably the most extensive assortment of authorized types, to save time and steer clear of errors. The services provides expertly made authorized record web templates which can be used for an array of reasons. Make a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Q: Do trusts have a requirement to file federal income tax returns? A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption.

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes.

This means that you are the person responsible for overseeing the estate or trust?which includes filing all necessary tax returns. The IRS requires the filing of an income tax return for trusts and estates on Form 1041?formerly known as the fiduciary income tax return.

For decedents dying on or after January 1, 2023, the credit amount is $80,395, exempting from taxation the first $1,733,264 of an estate. This means that, in general, if a decedent passes away in 2023, a net taxable estate valued at $1,733,264, or less, will not be subject to Rhode Island's Estate Tax.

State of Rhode Island General Assembly. STATE HOUSE ? The budget bill passed by the House of Representatives today includes the Opioid Stewardship Act, a program to fund opioid treatment, recovery prevention and education services.

Public trust doctrine is rooted in English common law, the colony's 1663 charter, and the Rhode Island Constitution. This doctrine considers that some resources are so important that we entrust them to the government to maintain for the people.