Rhode Island Flex Time Request Form

Description

How to fill out Flex Time Request Form?

Selecting the appropriate authorized document template can be a challenge. Of course, there are numerous templates available online, but how do you find the official form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Rhode Island Flex Time Request Form, which can be used for both professional and personal purposes.

All templates are reviewed by experts and comply with federal and state regulations.

Once you are certain that the form is appropriate, choose the Buy Now option to acquire the form. Select the pricing method you prefer and enter the necessary information. Create your account and finalize the payment using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Rhode Island Flex Time Request Form. US Legal Forms is the largest repository of legal templates where you can find numerous document formats. Take advantage of the service to obtain professionally crafted documents that meet state requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Rhode Island Flex Time Request Form.

- Use your account to search for the legal forms you have previously obtained.

- Visit the My documents tab in your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

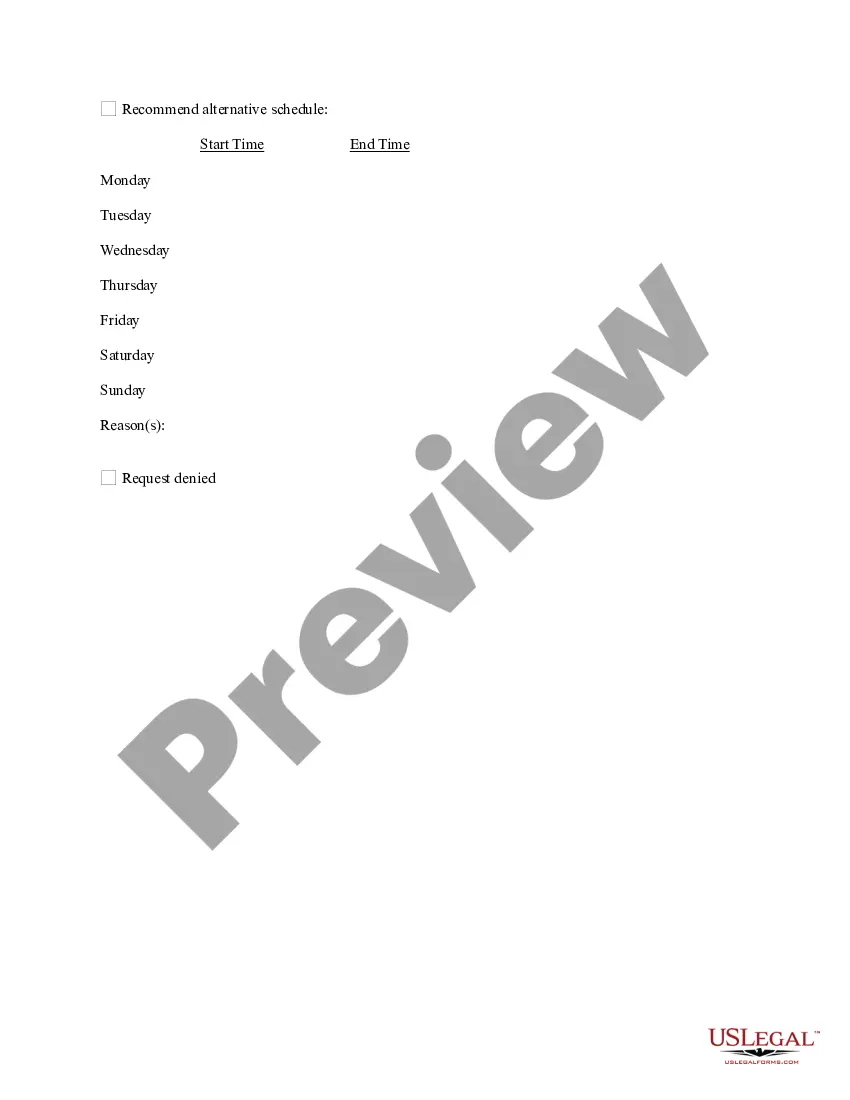

- First, confirm you have selected the correct form for your area. You can preview the form using the Preview option and read the description to ensure it suits your needs.

- If the form does not meet your requirements, use the Search field to find the right form.

Form popularity

FAQ

Job Protection: RI TCI is not job protected. However, job protection may be provided through other state or federal laws such as the federal Family and Medical Leave Act (FMLA) or Rhode Island Parental and Family Medical Leave Act (RI FMLA).

Once it has been accrued, the employer is legally required to pay it when the employee leaves or is discharged. Neither federal law nor the U.S. Department of Labor have issued any regulations or guidance on the issue.

Rhode Island has a state-run program that provides temporary disability insurance (TDI) for employees, paid for by a special tax withheld from employees' pay. Eligible employees who are unable to work due to illness, injury, or pregnancy can get a cash benefit to partially replace their lost wages.

Temporary Disability Insurance (TDI) Proof or documentation of the requirement to quarantine, such as communication from a public health official or place of work. For claims lasting longer than two weeks, a doctor's note is required.

Unemployment claimants can earn more and keep more of your benefits while working part-time. You can now earn up to 150% of your weekly benefit rate and still receive a partial benefit.

Payout of vacation at termination. Rhode Island law explicitly states that when an employer terminates an employee and the employee has completed at least 1 year of service, any vacation pay accrued according to policy or any other agreement is considered wages and must be paid by the next regular payday.

How long can I collect TDI? The duration of your claim is equal to 36% of your total base period wages divided by your weekly benefit rate (not including dependent's allowance. The most you are allowed to collect is an amount equal to 30 full weeks.

Accrued but unused sick leave must be carried over to the following calendar year, but total accrual may be capped at 32 hours in 2019 and 40 hours in subsequent years. Alternatively, employers may pay out accrued, unused sick time at year's end.

Vacation Leave According to Rhode Island law, an employer must pay an employee who has completed at least one (1) year of service, upon separation from employment, for any vacation pay accrued in accordance with company policy or contract on the next regular payday for the employee.

Unlike most states, Rhode Island does have a law that defines what counts as part-time and full-time employment. In Rhode Island, any employee who works at least 30 hours per week and does not earn less than 150% of the minimum wage is considered full-time.