Rhode Island Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

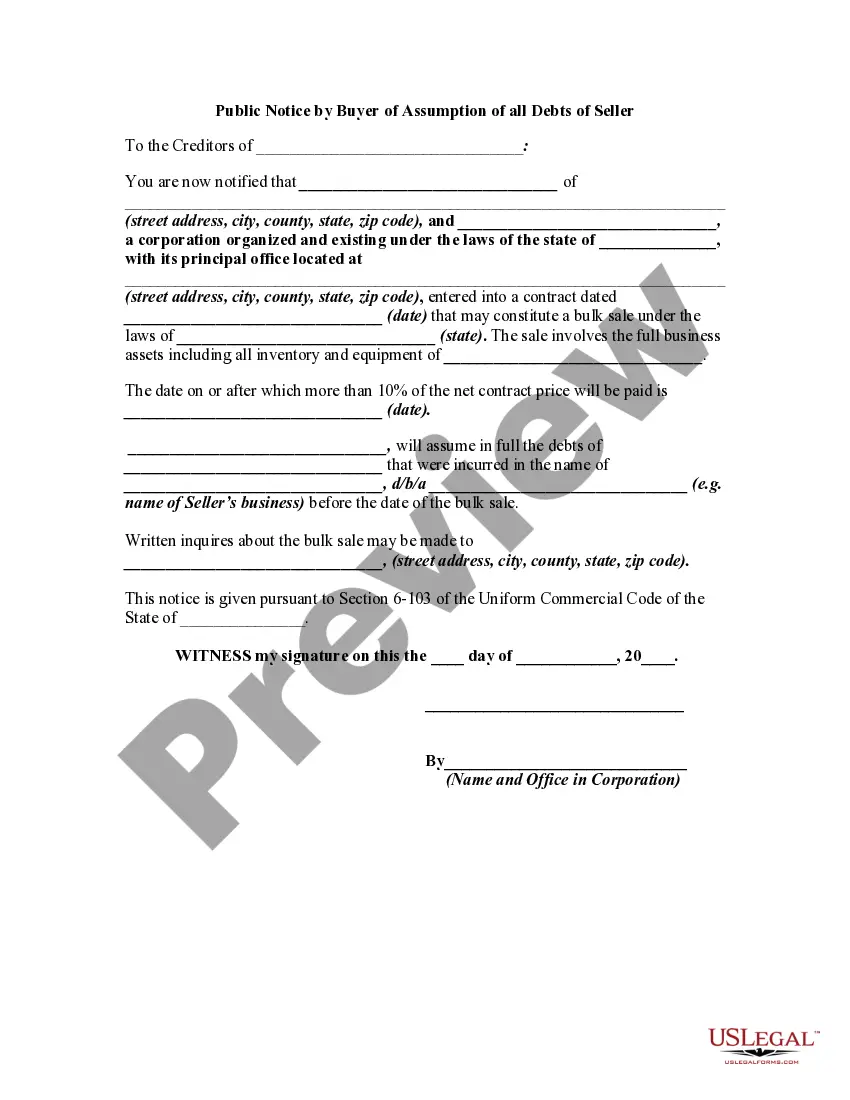

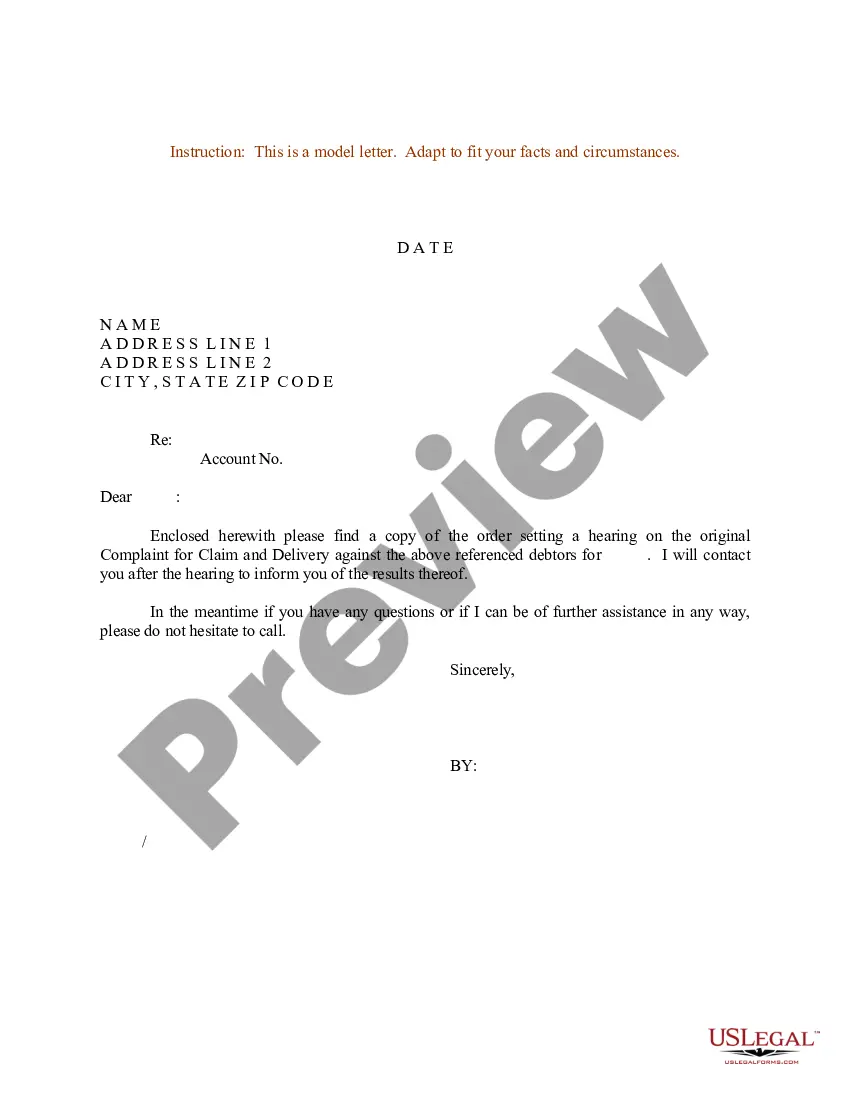

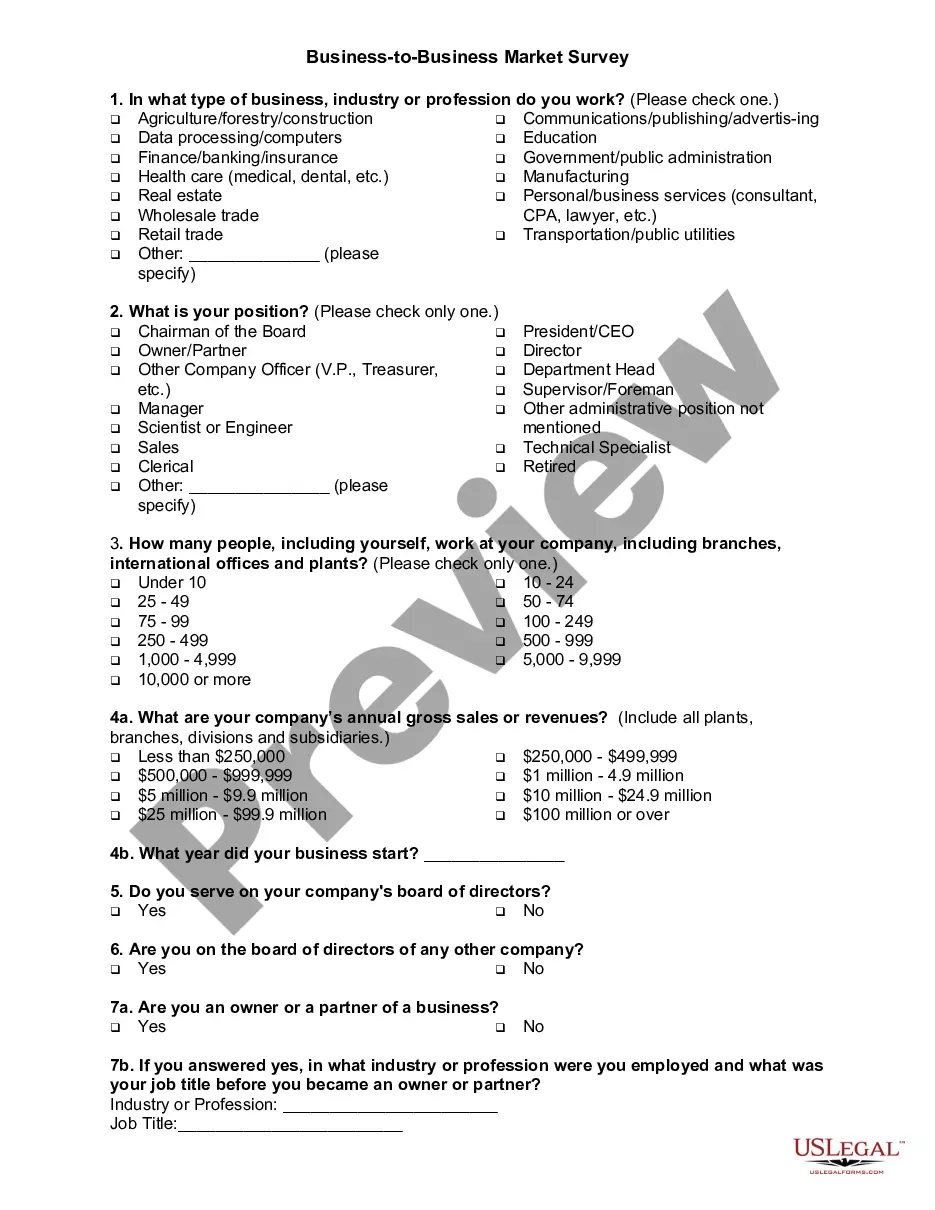

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

If you want to be thorough, acquire, or create legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Leverage the site’s straightforward and user-friendly search to obtain the documents you need. Various templates for business and personal purposes are categorized by type and state, or keywords.

Use US Legal Forms to access the Rhode Island Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you’ve downloaded from your account. Go to the My documents section to select a form to print or download again.

Stay competitive and obtain, and print the Rhode Island Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment through US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to get the Rhode Island Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the template for your appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Don't forget to check the description.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the page to find other variations of the legal form template.

- Step 4. Once you have located the desired form, click the Get now button. Choose your preferred pricing plan and provide your information to register for an account.

- Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Rhode Island Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

Form popularity

FAQ

The process of dissolving a company is done by the company's directors by submitting a DS01 form and paying the relevant fee. A notice is then placed in the Gazette stating the company's intention to strike itself from the register. If no objections are received, the company will be dissolved.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

Closing Correctly Is Important Officially dissolving an LLC is important. If you don't, you can be held personally liable for the unpaid debts and taxes of the LLC. A few additional fees you should look for; Many states also levy a fee against LLCs each year.

To dissolve your Rhode Island LLC, submit the completed Articles of Dissolution to the Rhode Island Secretary of State (SOS) by mail or in person. Your LLC has to be in good standing to dissolve, so make sure you have filed all annual reports and maintained a Rhode Island registered agent.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To dissolve your Rhode Island LLC, submit the completed Articles of Dissolution to the Rhode Island Secretary of State (SOS) by mail or in person. Your LLC has to be in good standing to dissolve, so make sure you have filed all annual reports and maintained a Rhode Island registered agent.