Rhode Island Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

Are you presently in a position where you require documents for either professional or personal activities almost all the time.

There are numerous credible document templates accessible online, but locating ones you can trust isn't simple.

US Legal Forms offers thousands of template options, such as the Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, which can be tailored to meet federal and state requirements.

Choose the pricing plan you want, fill in the necessary information to create your account, and purchase the order using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

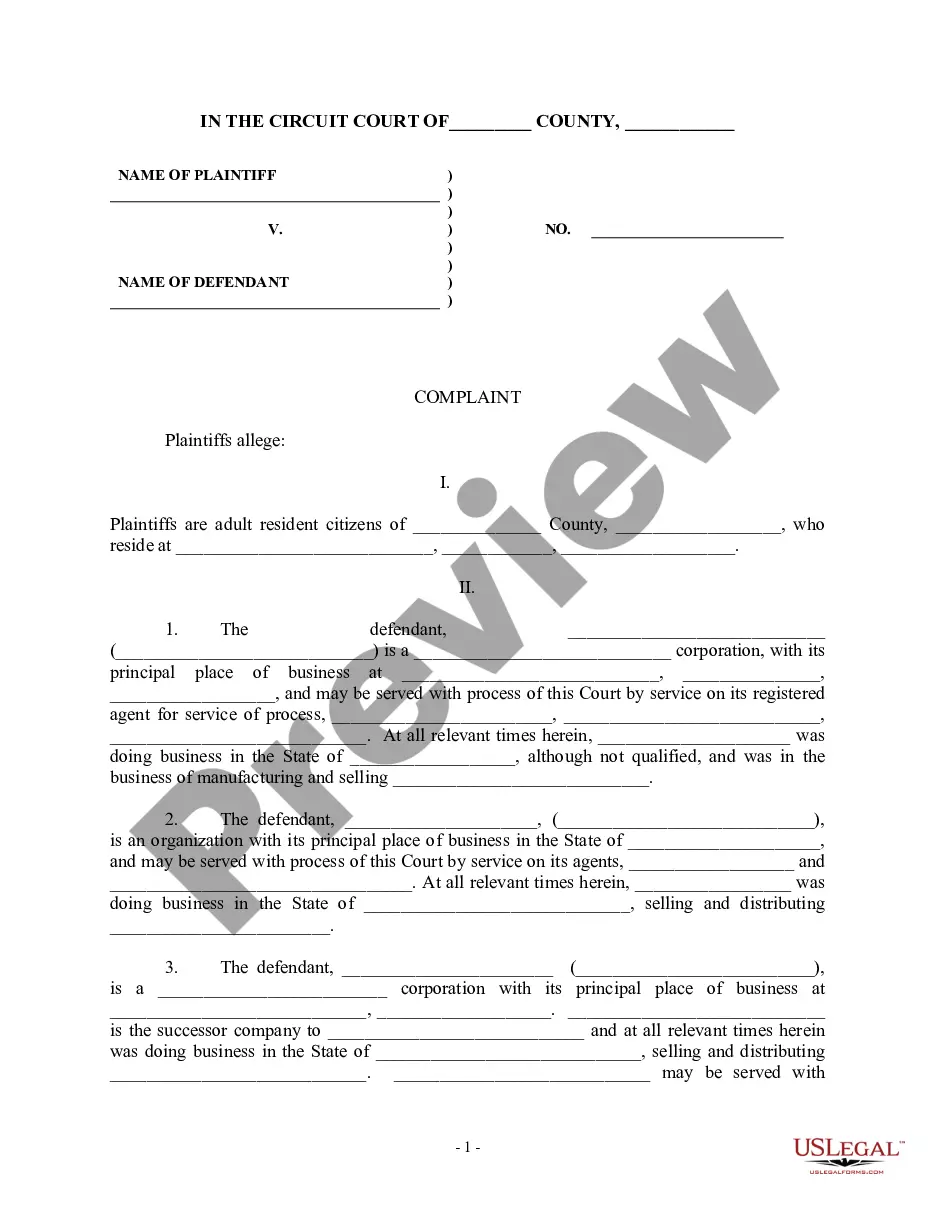

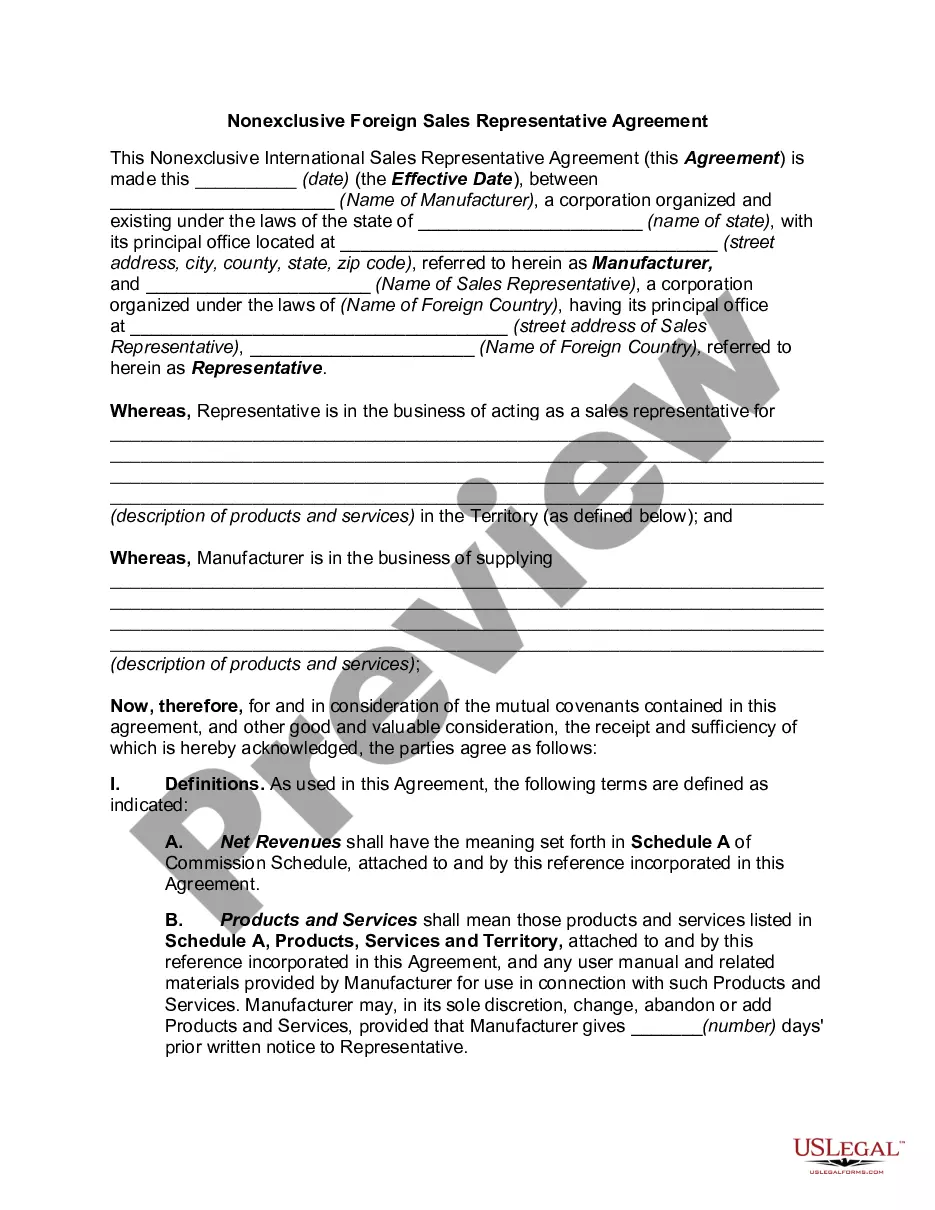

- Utilize the Review button to examine the document.

- Read the description to ensure you have selected the right form.

- If the form isn't what you require, use the Search field to find a document that suits your needs and specifications.

- Once you locate the appropriate form, click on Get now.

Form popularity

FAQ

In California, rentals of tangible personal property, including equipment, are generally subject to sales tax. When engaging in a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it is important to consult local tax regulations to ensure compliance. Understanding these tax implications helps businesses avoid unexpected costs. Consider exploring the resources available through US Legal Forms for guidance on tax obligations related to equipment leasing.

tomonth lease agreement in Rhode Island specifies the terms of a rental arrangement that lasts for one month, renewing automatically unless terminated. This type of agreement is ideal for tenants who need shortterm housing or for businesses leasing equipment temporarily. If you require a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding the specifics of such arrangements can significantly impact your business planning.

tomonth contract is a rental agreement that renews every month, providing ongoing, automatic renewals until canceled by either party. This type of contract is beneficial for parties seeking flexibility in their arrangements. In the context of a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, this means you can adjust your leasing terms or even purchase options as your needs evolve.

A contract of lease is a legal document that outlines the terms and conditions under which one party rents property from another. It includes details such as the rental amount, duration, and responsibilities of both parties. If you are considering a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's crucial to thoroughly review this document to understand your obligations and rights.

To terminate a month-to-month lease in Rhode Island, either party must provide written notice to the other party, typically 30 days in advance. This ensures that both parties have adequate time to adjust their plans. Understanding these termination protocols is vital, especially if you're involved in a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, as it helps avoid potential disputes and ensures a smooth transition.

In Rhode Island, a month-to-month lease is an agreement that continues for one month at a time until either party decides to terminate it. This type of lease often benefits tenants who anticipate changes in their housing needs. It's an essential option for those considering a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, providing adaptability for acquiring equipment depending on future requirements.

Indeed, equipment rental is generally taxable in Rhode Island. If you plan to use a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, anticipate sales tax implications during your rental process. Consulting with uslegalforms could provide you with valuable insights and resources to navigate these tax obligations.

Rhode Island offers exemptions for certain items, including specific food items and medical supplies. However, when dealing with a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, be aware that equipment rental typically does not qualify for these exemptions. It's smart to consult the Rhode Island Division of Taxation or a tax expert to determine applicable exemptions.

Rentals in Texas, including equipment rentals, are generally subject to sales tax. Understanding the implications of a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase can ensure you manage these tax duties effectively. Consider reaching out to uslegalforms for resources tailored to your rental business needs.

Yes, Rhode Island assesses a personal property tax on vehicles. If you own a vehicle categorized under a Rhode Island Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, be prepared for potential tax liabilities. Consulting with a tax professional can help clarify any questions regarding your specific situation.