Rhode Island Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

If you want to be thorough, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's simple and user-friendly search to locate the documents you require.

Different templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to all forms you have downloaded in your account. Click the My documents section and select a form to print or download again.

Act promptly to acquire and print the Rhode Island Monthly Retirement Planning with US Legal Forms. There are thousands of professional and state-specific forms available for your personal or business needs.

- Utilize US Legal Forms to find the Rhode Island Monthly Retirement Planning in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to access the Rhode Island Monthly Retirement Planning.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct state/country.

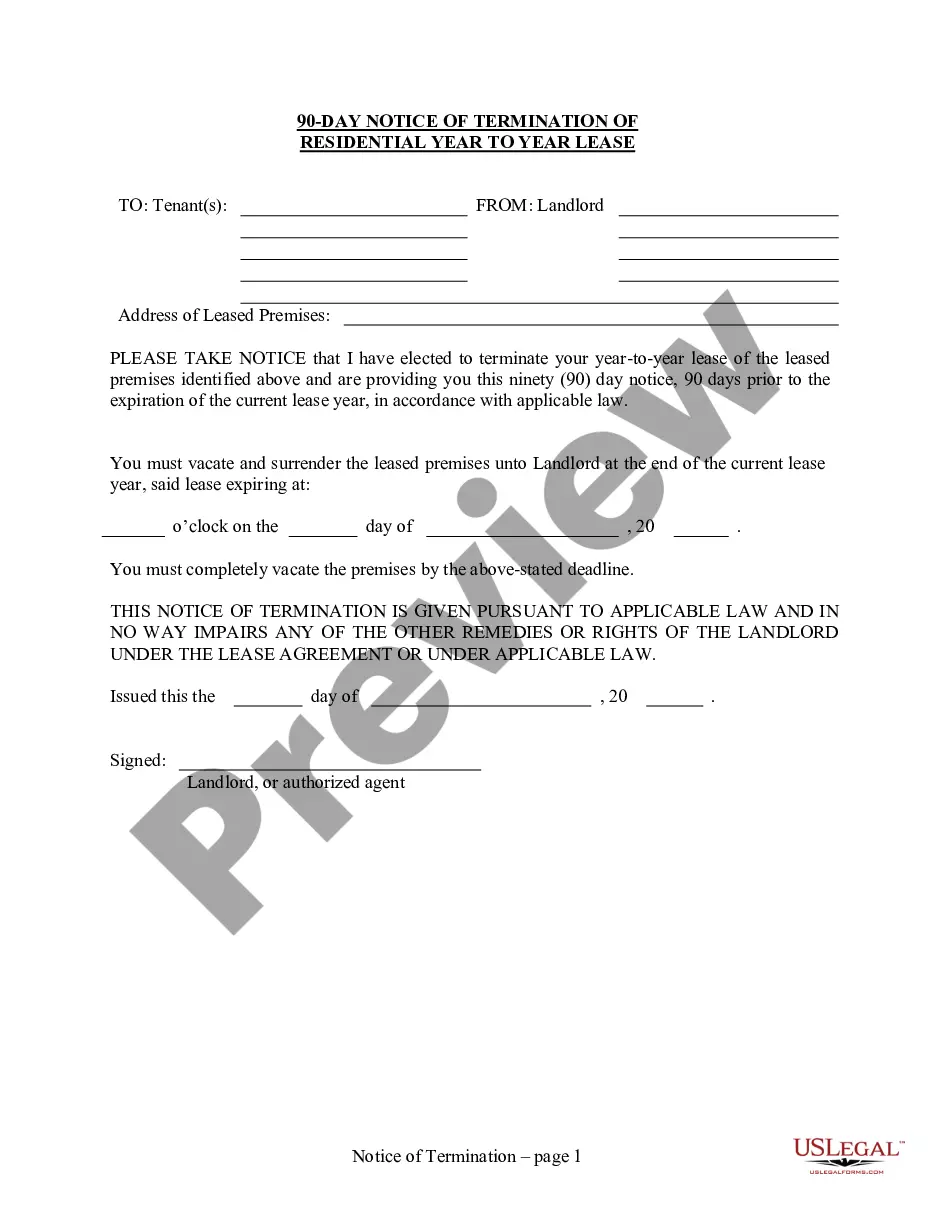

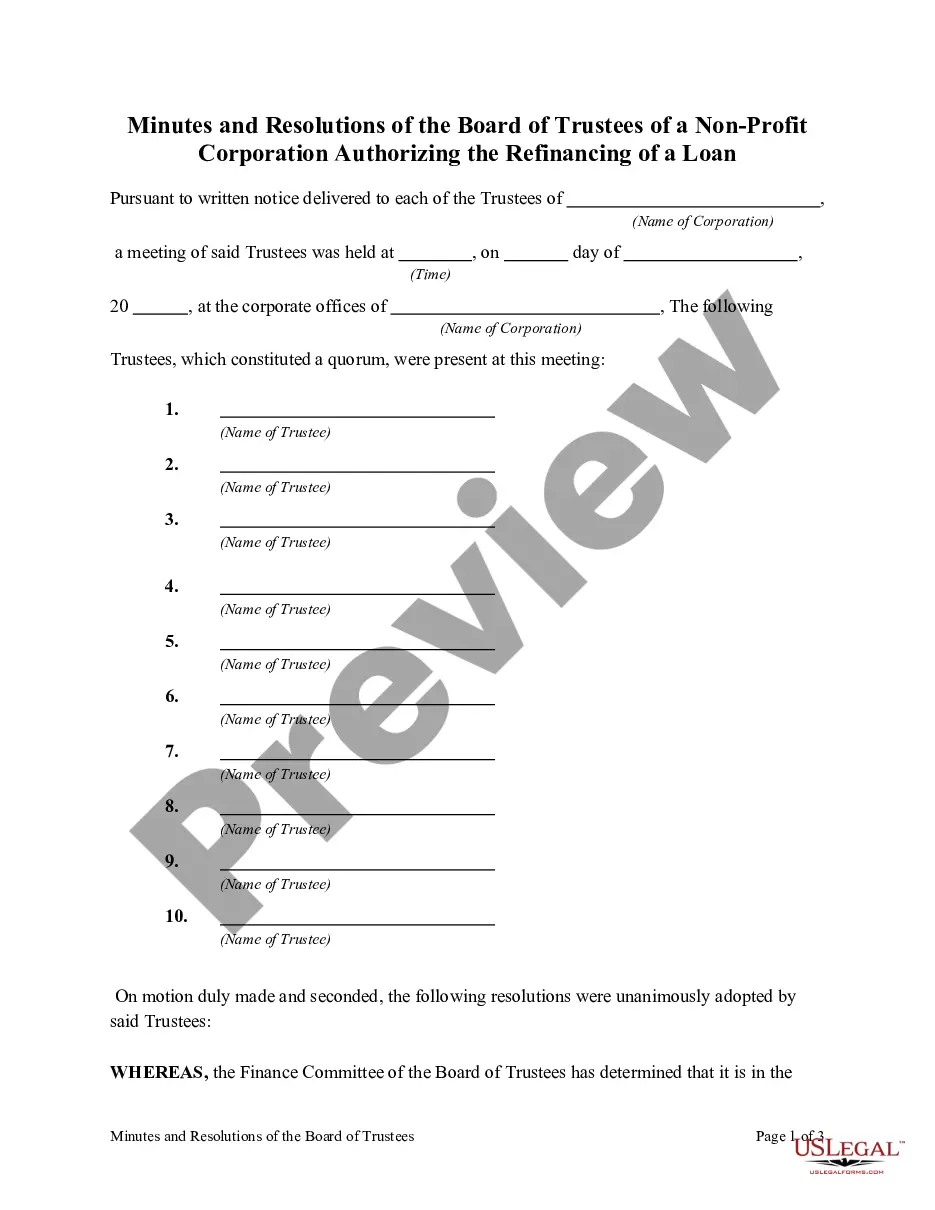

- Step 2. Use the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you find the form you need, click the Download now button. Choose your preferred payment plan and enter your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Rhode Island Monthly Retirement Planning.

Form popularity

FAQ

The full retirement age is 65 for persons born before 1938. The age gradually rises until it reaches 67 for persons born in 1960 or later. Social Security benefits are payable at full retirement age (with reduced benefits available as early as age 62) for anyone with enough Social Security credits.

Fully vested after 5 years of State employment (i.e., employees will be entitled to a future pension benefit upon reaching retirement eligibility even if they leave State service prior to retirement).

Yes. There is nothing that precludes you from getting both a pension and Social Security benefits.

Everyone born in 1929 or later needs 40 credits to be eligible for Social Security retirement benefits. Since you can earn 4 credits per year, you need at least 10 years of work that subject to Social Security to become eligible for Social Security retirement benefits.

The full retirement age is 65 for persons born before 1938. The age gradually rises until it reaches 67 for persons born in 1960 or later. Social Security benefits are payable at full retirement age (with reduced benefits available as early as age 62) for anyone with enough Social Security credits.

A pension is a source of guaranteed retirement income provided by an employer to employees who have qualified for this benefit. To be eligible for a pension benefit you usually need to work for an employer for a certain number of years. (That number can vary.)

So, all state employees, roughly half of all teachers and 95 percent of retired municipal, police and firefighters in the state retirement system get Social Security. The remaining two groups of retirees in the state system are judges and state police.

Unlike workers in the private sector, not all state and local employees are covered by Social Security. Some only have their public pension coverage, some only have Social Security coverage, and other government employees have both a public pension and Social Security coverage.

The plan covers 13,350 active employees and 10,213 retirees and beneficiaries. Teachers contribute 9.5% of salary out of each paycheck to the pension fund. The average teacher benefit is $41,735 per year, or $3,478 per month.

In half of traditional state and local government pension plans, employees must serve at least 20 years to receive a pension worth more than their own contributions. More than a fifth of traditional plans require more than 25 years of service.