Rhode Island General Form of Assignment as Collateral for Note

Description

How to fill out General Form Of Assignment As Collateral For Note?

Finding the appropriate valid document template can be a challenge.

Of course, there are many templates accessible online, but how do you obtain the valid form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Rhode Island General Form of Assignment as Collateral for Note, which can be utilized for business and personal needs.

If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you want and enter the required information. Create your account and pay for the transaction using your PayPal account or credit/debit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Rhode Island General Form of Assignment as Collateral for Note. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- All forms are checked by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Rhode Island General Form of Assignment as Collateral for Note.

- Use your account to search through the legal forms you have purchased before.

- Go to the My documents section of your account and get another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

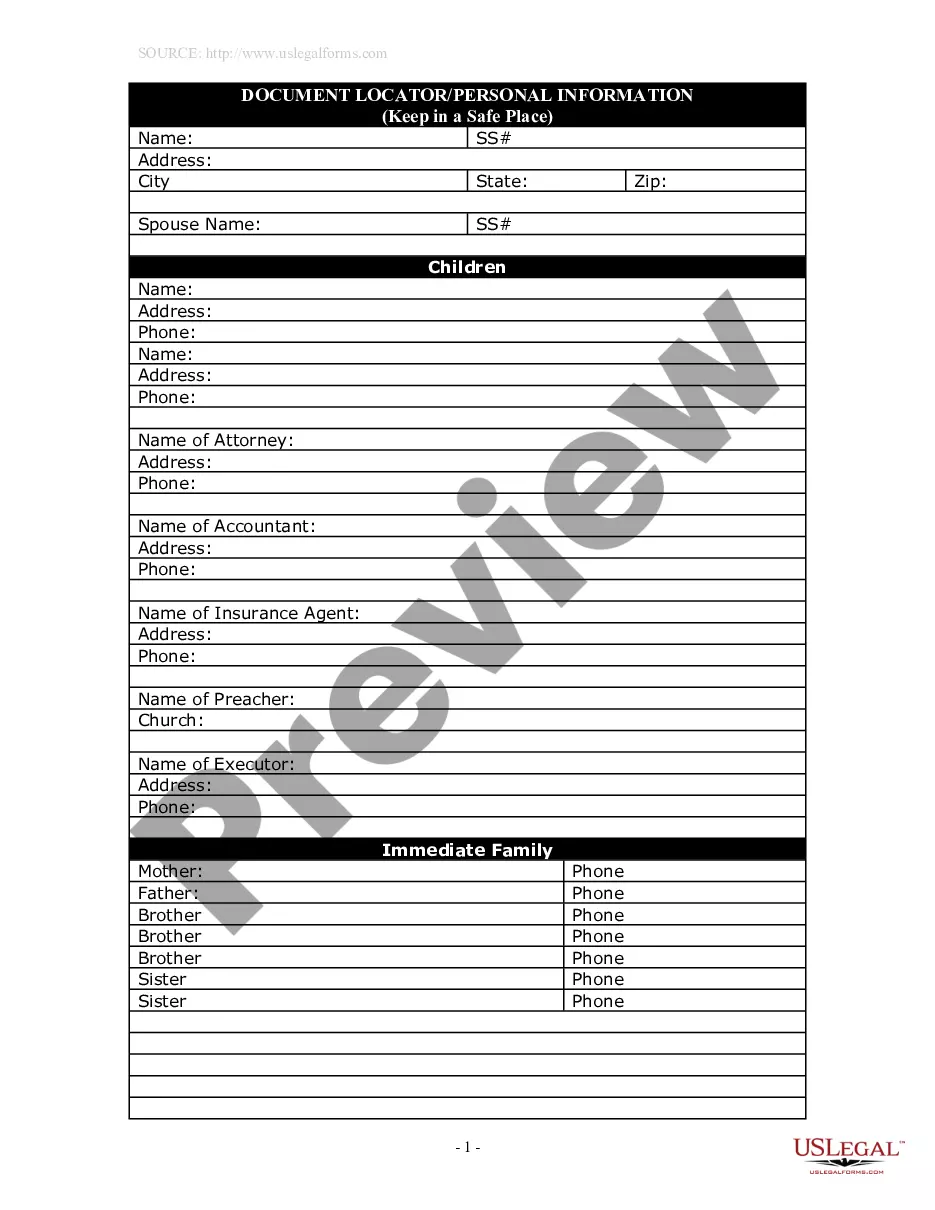

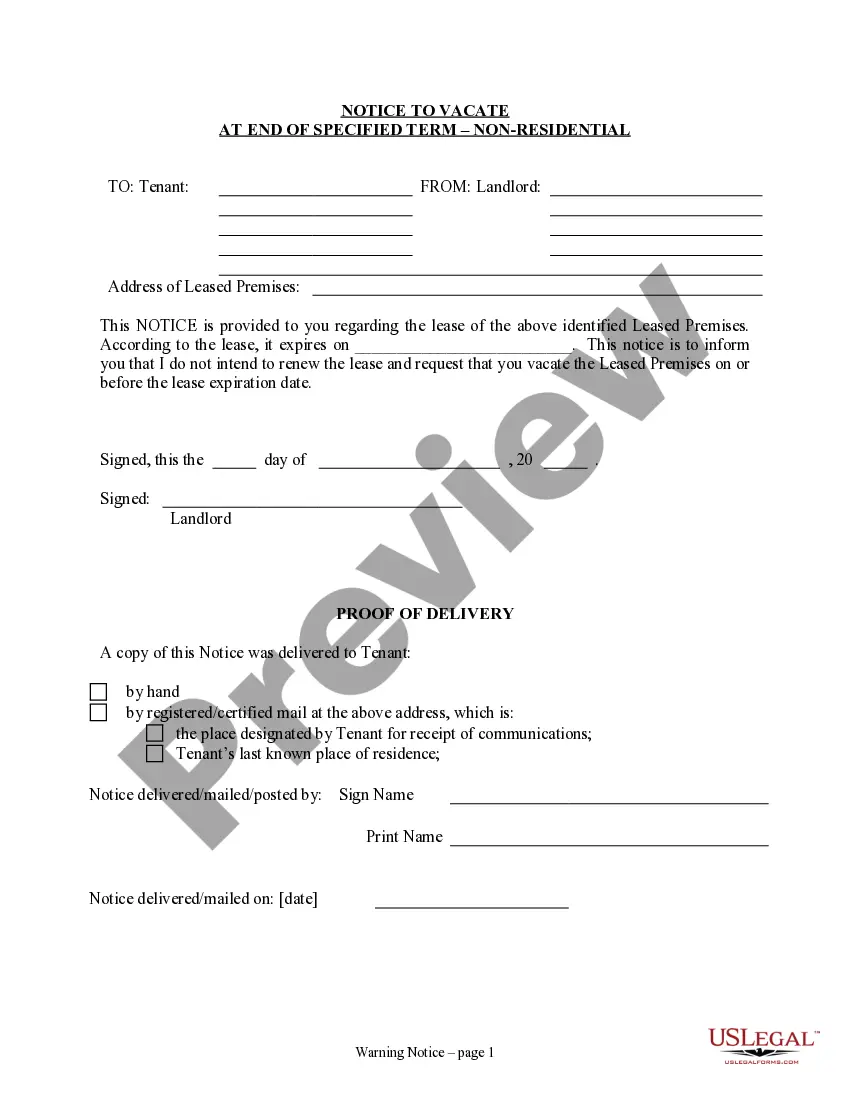

- First, ensure you have selected the correct form for your area/county. You can view the form using the Preview button and review the form description to ensure it is appropriate for you.

Form popularity

FAQ

A collateral assignment form is a legal document used to outline the terms of the collateral assignment. This form specifies the rights, obligations, and details regarding the collateral being assigned. Utilizing a Rhode Island General Form of Assignment as Collateral for Note makes it simple to create a legally binding agreement that protects both parties involved.

An assignment of deed of trust means transferring the rights and obligations of the deed to another party. This may be done for various reasons, including refinancing or securing additional loans. By applying a Rhode Island General Form of Assignment as Collateral for Note, you ensure that the terms regarding the assignment are clear and enforceable.

A collateral assignment of a note involves using a promissory note as security for another obligation. By using a Rhode Island General Form of Assignment as Collateral for Note, you enable lenders to hold your note as collateral against the borrower's debt. This practice ensures that lenders have a claim to repayment under specific circumstances.

In order to offer investors security in case you default on the loan, your original lender will assign the loan's collateral over to the investors who purchased your loan. The collateral assignment release in this instance is a document that transfers the deed on your home to the investors who purchased your loan.

Definition and Examples of Collateral Assignment Collateral is any asset that your lender can take if you default on the loan. For example, you might apply for a $25,000 loan to start a business. But your lender is unwilling to approve the loan without sufficient collateral.

If an absolute assignment was made, the company will pay the entire proceeds to the assignee. If a collateral assignment was made, the company will usually make the check payable jointly to the assignee and the beneficiary.

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

A collateral assignment refers to the transfer of ownership rights of an asset. When you borrow money, or when someone spends money on your behalf, often they will require you to pledge collateral in the form of an asset in order to protect them from loss.

Collateral Assignment of Contracts means the assignment of representations, warranties, covenants, indemnities and rights to the Agent, in respect of the Loan Parties' rights under that certain Escrow Agreement executed in connection with the Riverstone Acquisition delivered on the Original Closing Date.