Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements

Description

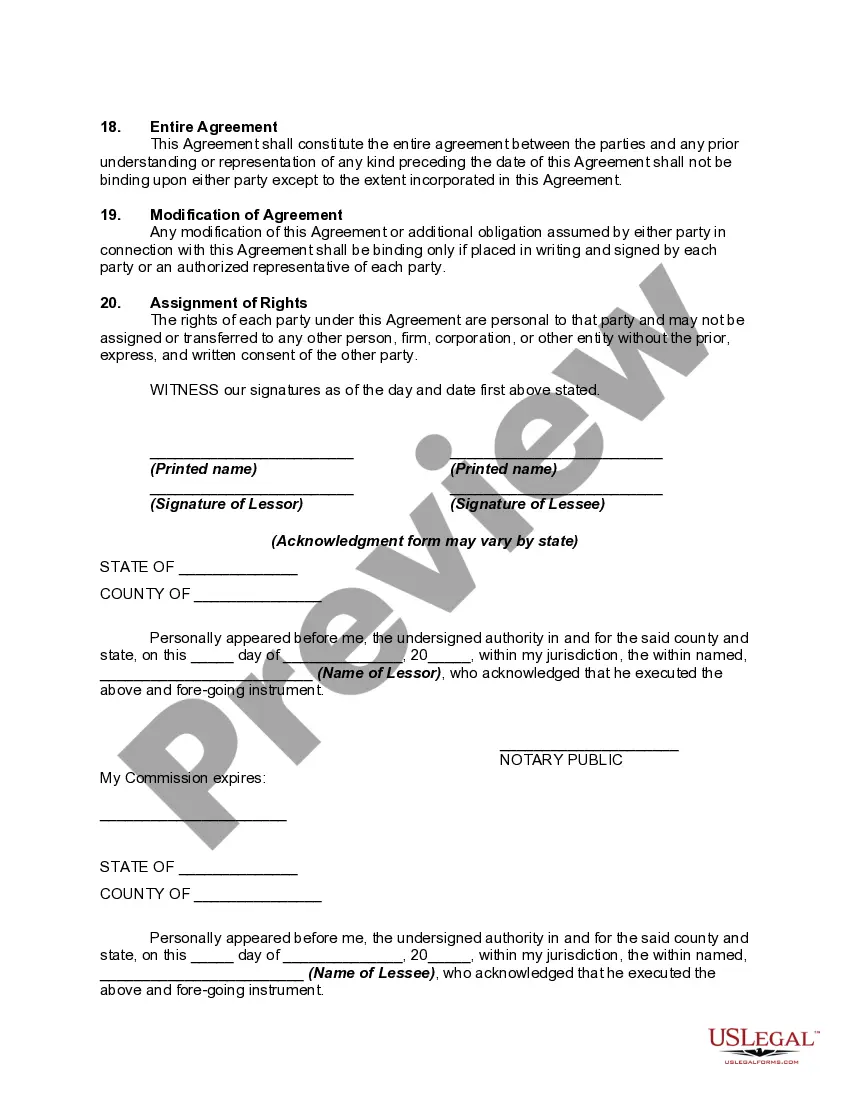

How to fill out Farm Lease Or Rental With Right To Make Improvements And Receive Reimbursements?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent editions of forms like the Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements in just minutes.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your details to register for an account.

- If you possess a membership, Log In to your account and retrieve the Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements from your US Legal Forms library.

- The Download button will appear on every document you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- For first-time users of US Legal Forms, here are some simple steps to get you started.

- Ensure that you have selected the correct form for your city/state.

- Click the Review button to check the form’s details.

Form popularity

FAQ

Form 4835 is used to report farm rental income and expenses, particularly for those who receive rent from the land they own or lease. This form helps differentiate between non-farm rental and farm rental activities for tax purposes. Understanding how to utilize a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements can streamline the process of reporting expenses on Form 4835.

There is no strict classification for acres that makes a farm, but usually, at least 10 acres qualifies for more serious farming operations. Nonetheless, smaller farms can still be productive and profitable. A Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements can support farmers in managing their operations effectively, regardless of size.

The IRS generally considers any land used for agricultural production as a farm, regardless of size. However, many look at 10 acres as a common benchmark for more established operations. Even smaller setups can benefit from a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements to maximize efficiency.

Yes, farm rent typically counts as earned income, and it should be reported on your tax return. This income can arise from leasing land or facilities for agricultural purposes. Keep in mind that a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements outlines the terms for such rentals, ensuring clarity in your earnings.

To report farm income and expenses, you need to complete Schedule F on your federal tax return. This covers all earnings from farm activities and associated costs. Using a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements can help ensure you accurately track and report your expenses.

Yes, you can have a farm on 5 acres, especially in Rhode Island where smaller parcels can be utilized effectively. Many farmers successfully manage small farms, focusing on diverse crops or livestock. With a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, you can optimize your space for better productivity.

The Farmland for Farmers Act is designed to support agricultural development among new and existing farmers in Rhode Island. This act promotes accessibility to farmland through leases and incentives. A well-structured Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements can provide farmers with the resources they need to thrive.

Land use rights define how a property can be utilized and developed. In Rhode Island, these rights can include agricultural practice, leasing arrangements, and construction of improvements. A solid understanding of land use rights is vital for anyone entering into a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements.

The Farmland Protection Act is a Rhode Island law aimed at preserving agricultural lands and preventing urban sprawl. This act encourages landowners to engage in farm leases or rentals that sustain agricultural production. Utilizing a Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements can align with the goals of this important legislation.

To rent out farmland in Rhode Island, begin by assessing the land’s condition and market value. Then, create a detailed rental agreement that includes specific terms regarding use, maintenance, and improvements. By drafting a robust Rhode Island Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, both parties can benefit from clear expectations and protection.