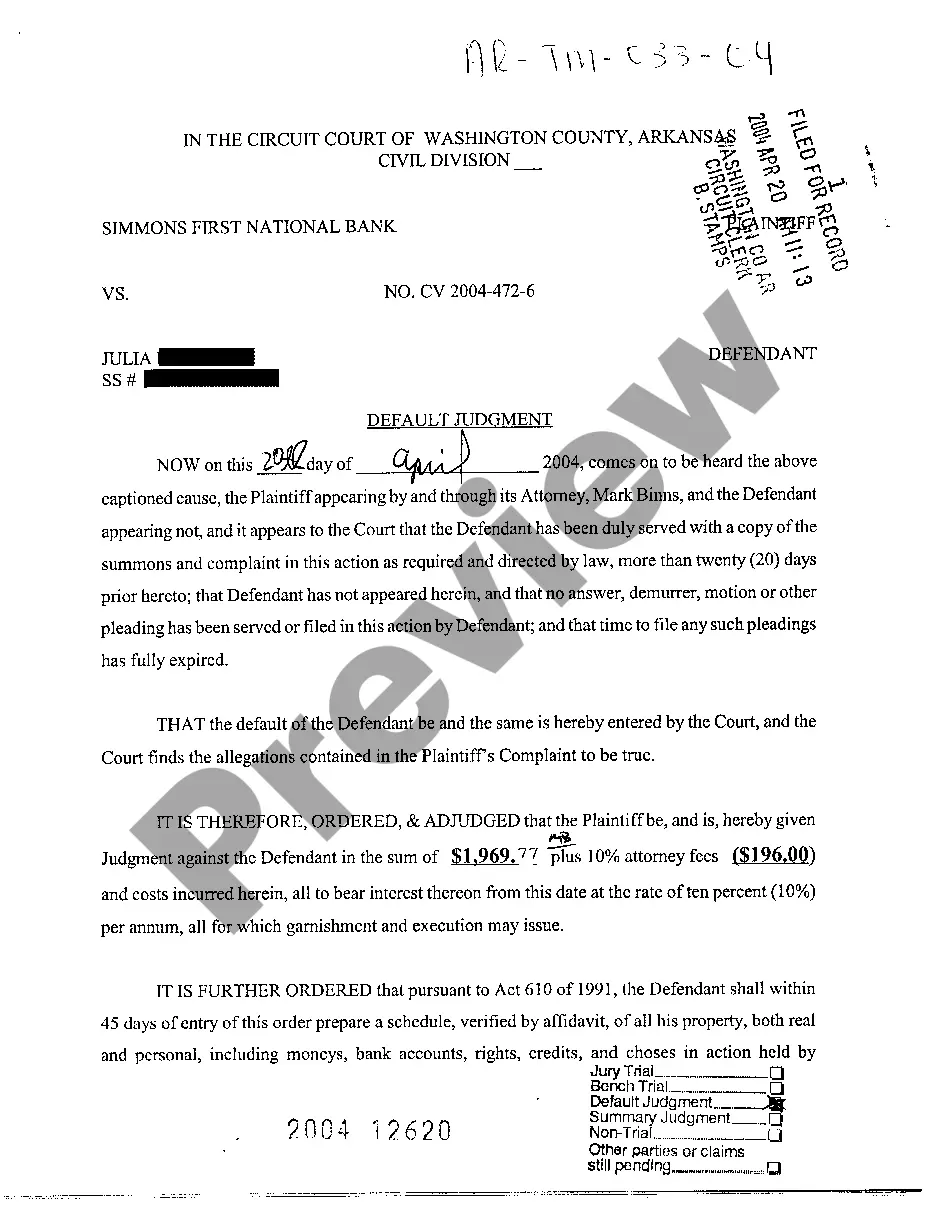

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Rhode Island Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

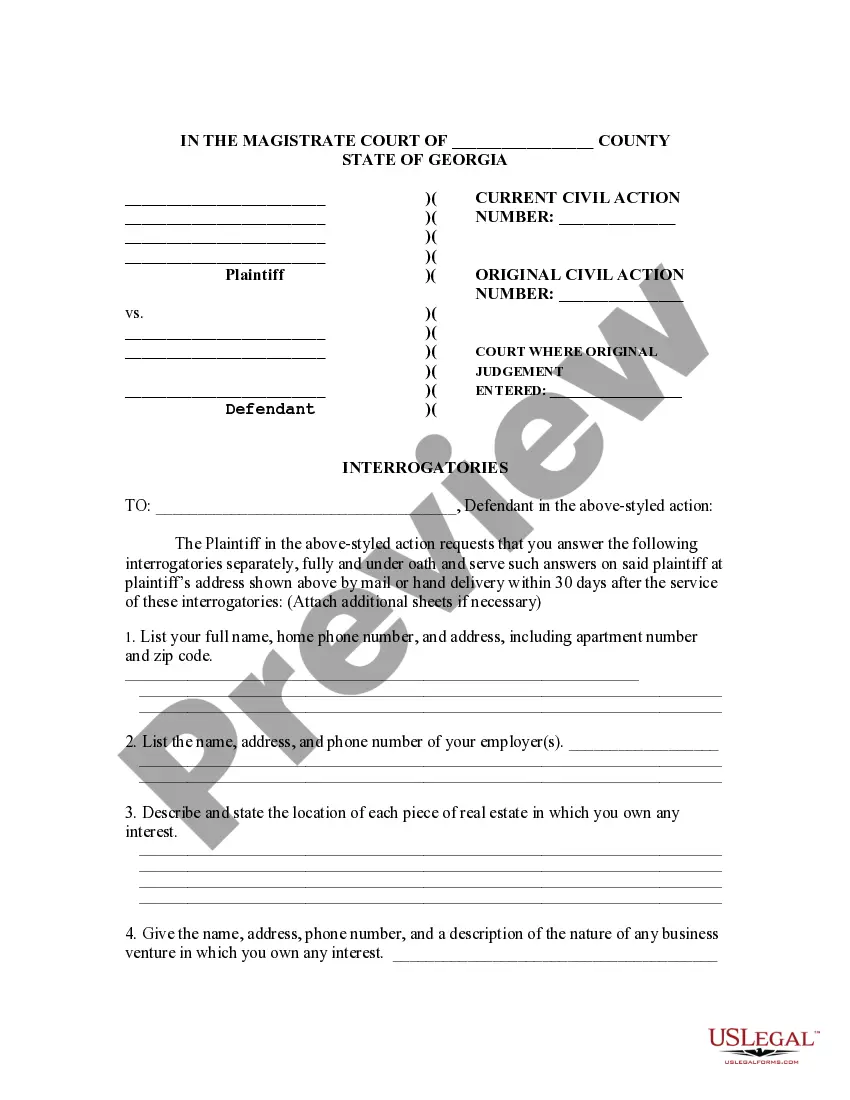

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

Choosing the best authorized file design might be a have difficulties. Naturally, there are a variety of layouts available on the net, but how would you find the authorized develop you need? Make use of the US Legal Forms internet site. The services provides 1000s of layouts, for example the Rhode Island Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, that you can use for organization and personal needs. Each of the types are checked by professionals and fulfill state and federal specifications.

Should you be previously registered, log in to your accounts and then click the Acquire key to get the Rhode Island Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. Make use of your accounts to search from the authorized types you have ordered formerly. Go to the My Forms tab of your respective accounts and acquire one more version of the file you need.

Should you be a brand new customer of US Legal Forms, listed below are simple guidelines that you should follow:

- Initial, be sure you have chosen the correct develop for your city/state. You may check out the shape using the Preview key and look at the shape description to make certain it will be the right one for you.

- In the event the develop is not going to fulfill your needs, utilize the Seach industry to get the appropriate develop.

- Once you are sure that the shape is proper, click on the Buy now key to get the develop.

- Select the prices plan you would like and enter in the essential info. Create your accounts and pay for the transaction making use of your PayPal accounts or charge card.

- Choose the data file formatting and down load the authorized file design to your gadget.

- Total, modify and print and indicator the attained Rhode Island Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

US Legal Forms may be the biggest collection of authorized types where you can find numerous file layouts. Make use of the company to down load professionally-manufactured files that follow express specifications.

Form popularity

FAQ

A conflict of interest may exist if an official or employee can reasonably expect that his or her official duties will involve or directly result in a financial benefit to the official, a member of his or her family, a business associate, his or her employer, or a business that the official represents.

Rhode Island estate tax credit and threshold set for 2023 This means that, in general, if a decedent passes away in 2023, a net taxable estate valued at $1,733,264, or less, will not be subject to Rhode Island's Estate Tax.

California's conflict of interest statutes are based on the belief that a public official cannot serve two masters simultaneously, and that the duties of public office demand the absolute loyalty and undivided, uncompromised allegiance of the individual that holds the office.

Under Rhode Island law, creditors may charge up to 12 percent interest on debt without an agreement, but up to 21 percent if there is an agreement. Exceptions include pawn brokers, licensed lenders, retail finance charges, and revolving credit (which includes all credit cards).

In Rhode Island, executor fees are not explicitly stipulated by statute. Instead, the state allows for "reasonable" compensation, which is determined on a case-by-case basis. This ambiguity can be both a benefit and a drawback, depending on the complexity of the estate and the amount of work required by the executor.

A recusal or disqualification is a method used to resolve an apparent or actual conflict of interest. A disqualified employee may be required to sign a written statement reflecting the scope of the disqualification and the precise nature of the conflicting interest or activity.

(a) A person subject to this code of ethics has an interest which is in substantial conflict with the proper discharge of his or her duties or employment in the public interest and of his or her responsibilities as prescribed in the laws of this state, if he or she has reason to believe or expect that he or she or any ...

While there is no inheritance tax in Rhode Island, a deceased person's estate may be subject to state and federal estate taxes. Unlike inheritance tax, estate taxes are paid by the estate of the person who died, not by the heirs and beneficiaries.