Rhode Island Certificate of Trust for Testamentary Trust

Description

How to fill out Certificate Of Trust For Testamentary Trust?

If you have to complete, download, or produce legitimate document web templates, use US Legal Forms, the greatest variety of legitimate kinds, which can be found online. Use the site`s easy and practical look for to discover the documents you need. Numerous web templates for organization and person reasons are sorted by classes and says, or keywords and phrases. Use US Legal Forms to discover the Rhode Island Certificate of Trust for Testamentary Trust in just a few click throughs.

In case you are presently a US Legal Forms client, log in to your account and click on the Down load key to have the Rhode Island Certificate of Trust for Testamentary Trust. Also you can gain access to kinds you earlier downloaded in the My Forms tab of your account.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for your right city/land.

- Step 2. Utilize the Review choice to check out the form`s information. Never forget about to read the outline.

- Step 3. In case you are not happy with all the type, take advantage of the Look for field near the top of the monitor to discover other variations of the legitimate type template.

- Step 4. Upon having found the shape you need, click on the Acquire now key. Opt for the rates program you like and include your qualifications to sign up to have an account.

- Step 5. Process the financial transaction. You may use your credit card or PayPal account to complete the financial transaction.

- Step 6. Choose the structure of the legitimate type and download it on your own gadget.

- Step 7. Comprehensive, change and produce or indicator the Rhode Island Certificate of Trust for Testamentary Trust.

Every legitimate document template you buy is yours forever. You might have acces to every single type you downloaded with your acccount. Click the My Forms portion and choose a type to produce or download once again.

Be competitive and download, and produce the Rhode Island Certificate of Trust for Testamentary Trust with US Legal Forms. There are many specialist and condition-certain kinds you may use to your organization or person requirements.

Form popularity

FAQ

Therefore there will be an accounting cost if you use an accountant. The trust does not need to be audited and there are no regulatory fees. There are no ongoing legal costs with operating a testamentary trust.

Once a testamentary trust has been created, it becomes a taxable entity in its own right and is thus subject to income taxes. If it has $600 or more in annual income, it must file a U.S. Income Tax Return for Estates and Trusts (Form 1041) for that year.

In limited circumstances and jurisdictions, it may be possible to terminate an irrevocable trust by agreement when all parties, including the trustee and the qualified beneficiaries, agree to do so. Modification or termination of an irrevocable trust may also occur pursuant to a judge's order.

Testamentary trusts offer a unique tax advantage that other trusts often do not have. They have a ?step up in basis? that is not available to those who receive money from a living trust. The term ?basis? is a tax term that indicates the value of an item at the time that it was acquired.

Disadvantages of a Testamentary Trust Lack of Privacy: Testamentary trusts are part of a person's will, which becomes public record upon their death. This means that the details of the trust and its beneficiaries are accessible to the public.

Bottom Line. Living trusts have to file tax returns in most cases if they have $600 or more in income for a given tax year. They may also have to file if the living trust is a grantor-controlled trust or a revocable marital trust and both spouses are still living. Trusts that file tax returns do so using Form 1041.

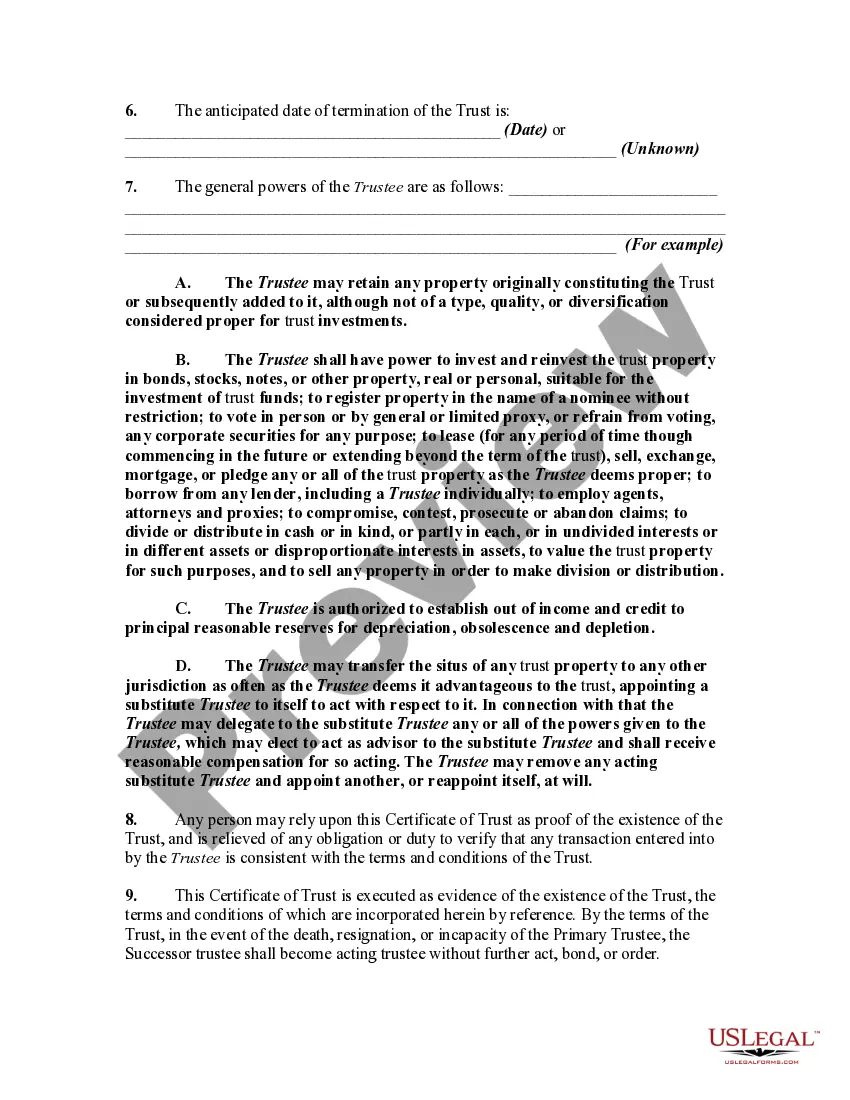

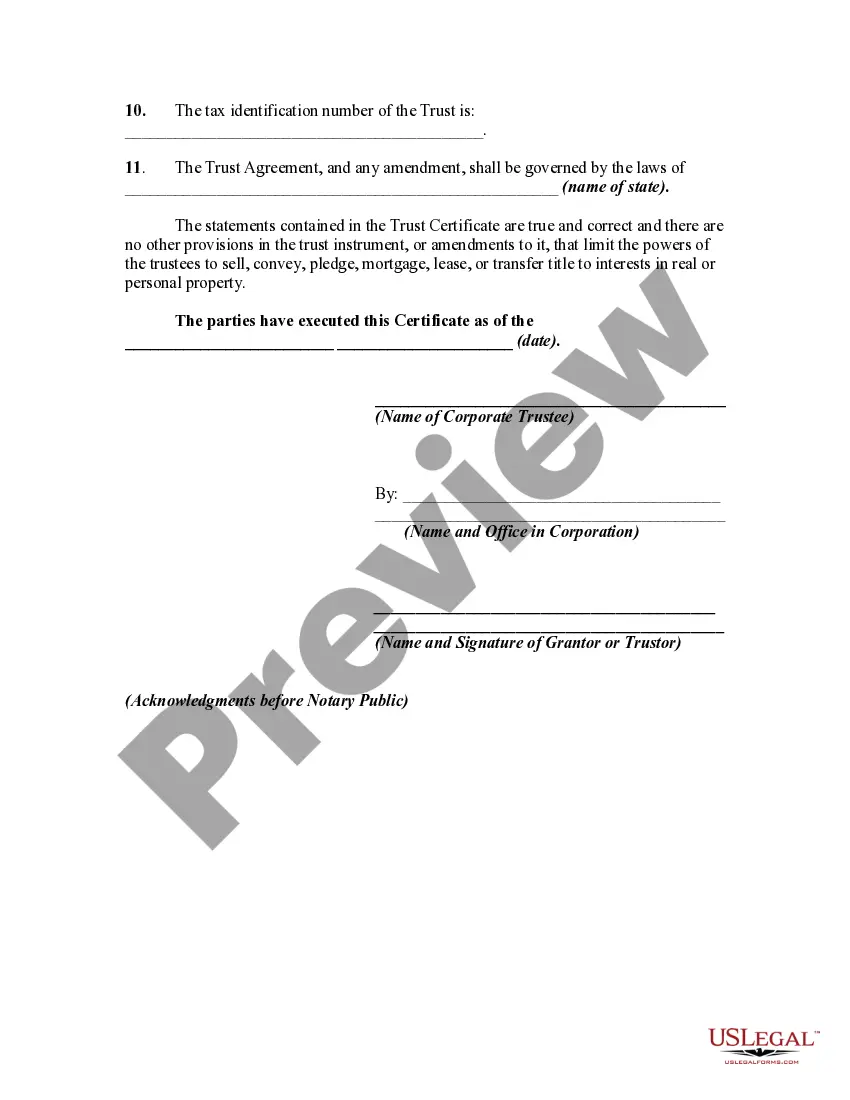

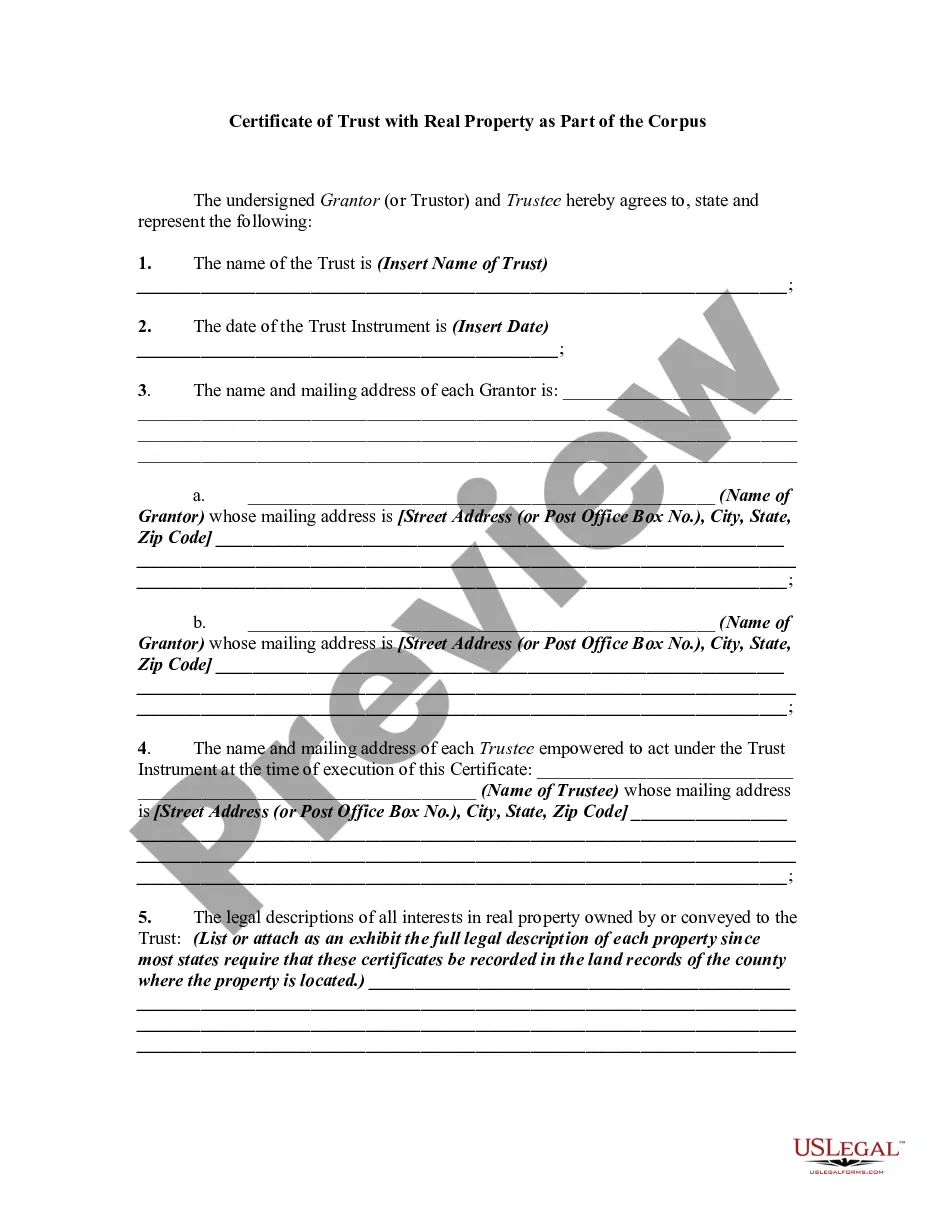

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

Sign your living trust in front of a notary public: The document will not be recognized if it is not witnessed by a notary public registered in the state of Rhode Island.