Rhode Island Pot Testamentary Trust

Description

How to fill out Pot Testamentary Trust?

Are you in a situation where you require documents for either business or personal reasons almost constantly.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of form templates, such as the Rhode Island Pot Testamentary Trust, that are designed to meet state and federal requirements.

Once you find the correct form, simply click Get now.

Choose the payment plan you want, complete the necessary details to create your account, and pay for your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Rhode Island Pot Testamentary Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

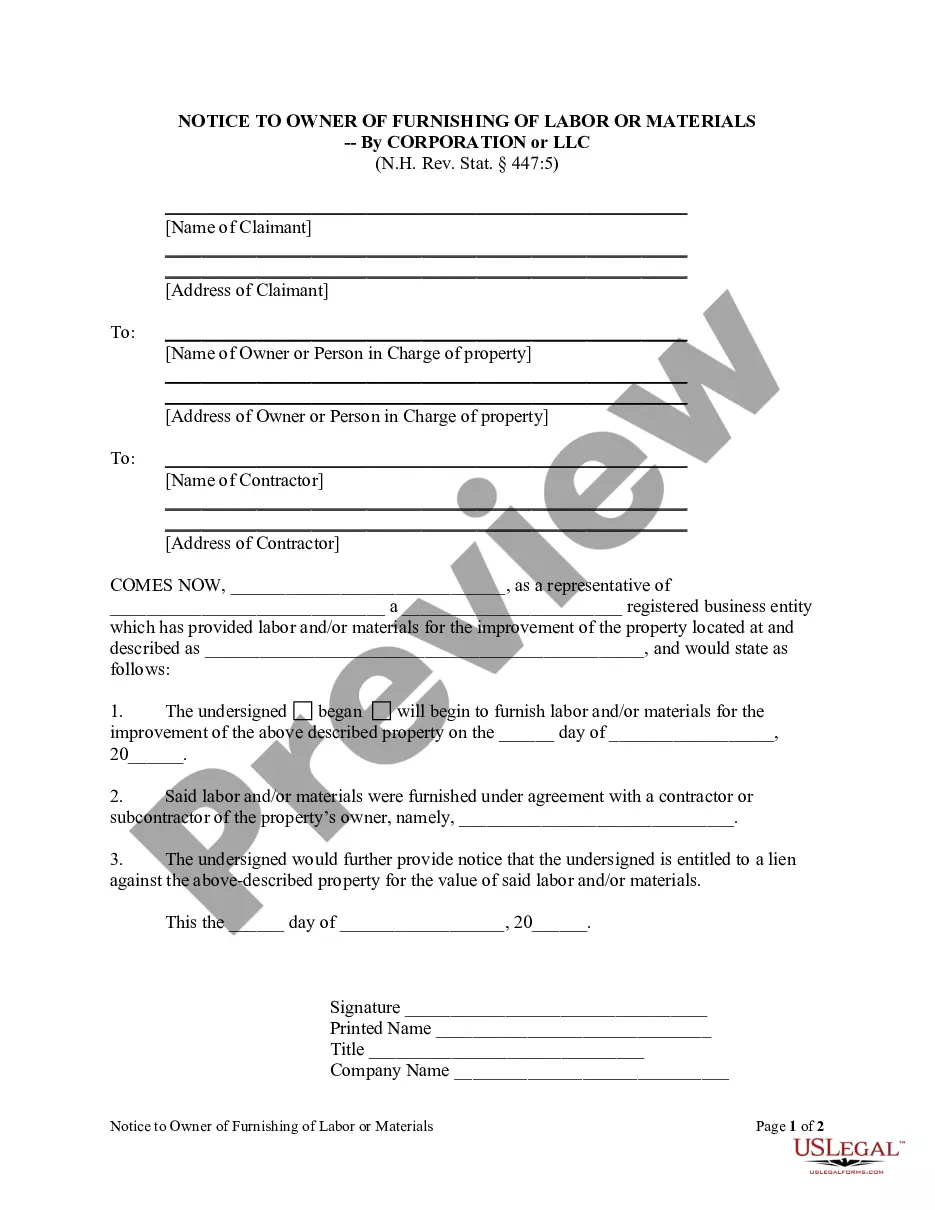

- Utilize the Review feature to examine the form.

- Check the description to verify you have selected the right form.

- If the form isn't what you're looking for, use the Search area to find the form that suits your needs.

Form popularity

FAQ

Yes, there are several strategies to avoid probate in Rhode Island. Utilizing a revocable living trust is one effective option, as it allows assets to bypass probate altogether. Additionally, setting up a Rhode Island Pot Testamentary Trust can provide clear guidance on asset distribution posthumously while minimizing probate complications. Exploring these options with a knowledgeable attorney can help you choose the best path for your estate planning needs.

A testamentary trust is set up in a person's will and starts upon their death. It holds and protects all, or some, of the person's assets such as property and investments. The trust looks after the assets for the beneficiaries. Beneficiaries are the people or organisations that will benefit from the trust.

Trust documents enhance estate planning and the effective transfer of assets to heirs. A trust created while an individual is still alive is an inter vivos trust, while one established upon the death of the individual is a testamentary trust.

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

How to Create a Living Trust in Rhode IslandDecide on a single or joint trust.Take stock of your assets and property.Pick a trustee for your living trust.Create the living trust document.Sign your living trust in front of a notary public.Add your assets and property to your living trust.

If you would like to create a living trust in Rhode Island, you must prepare a written trust document and sign it before a notary public. The trust is not functional until you take the final step of transferring ownership of assets into it. A living trust can be an important part of estate planning.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.

The main benefits of testamentary trusts are their ability to protect assets and to reduce tax paid by beneficiaries from income earned from the inheritance.