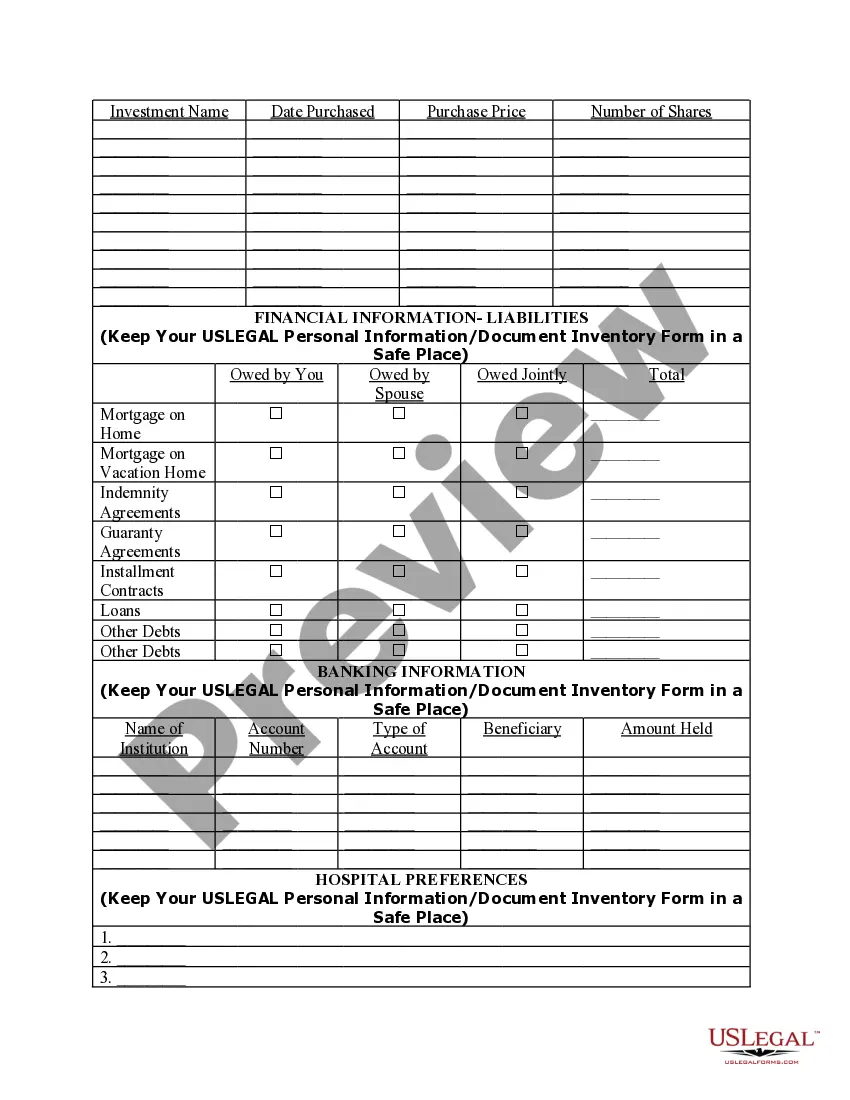

Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document

Description

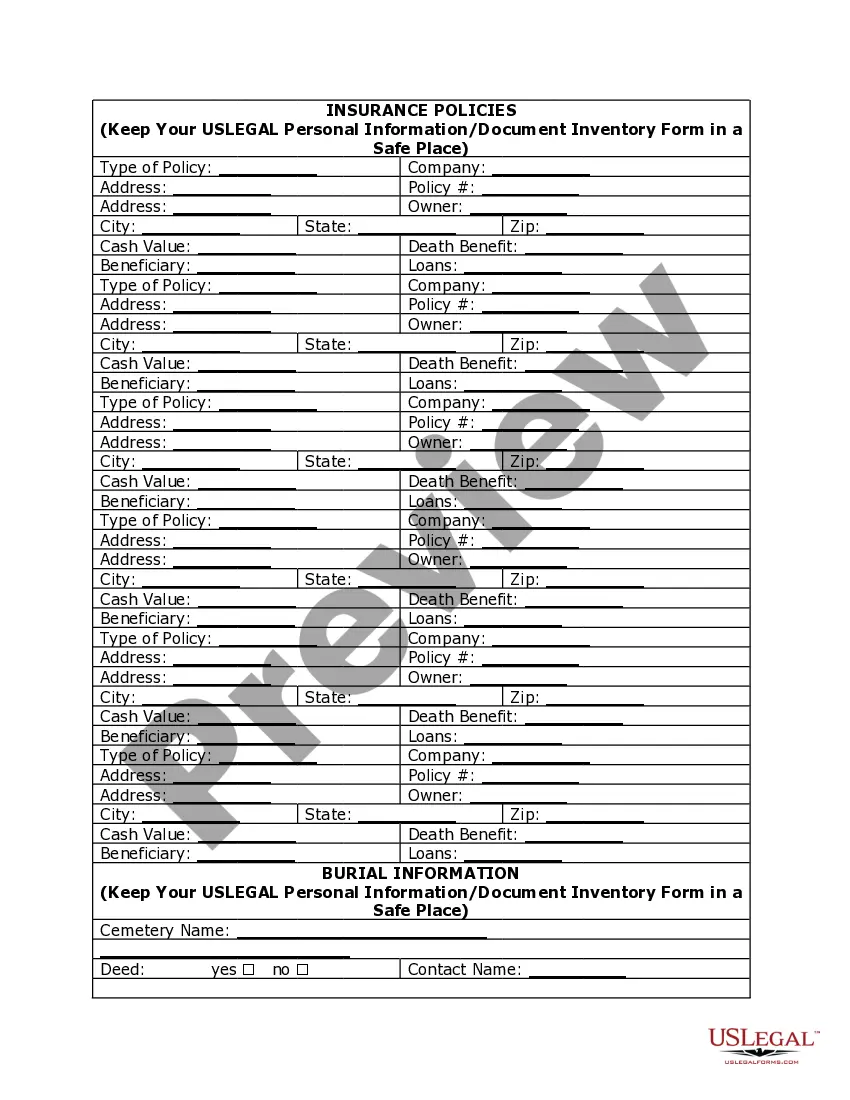

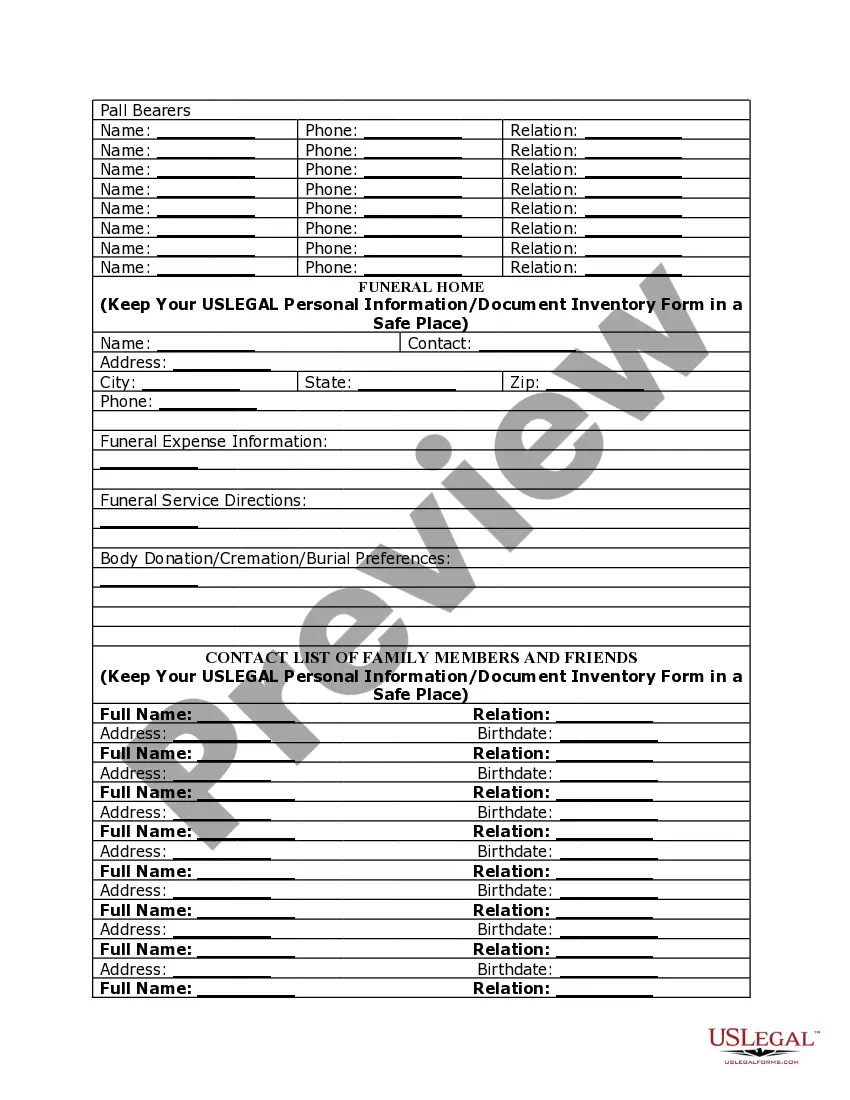

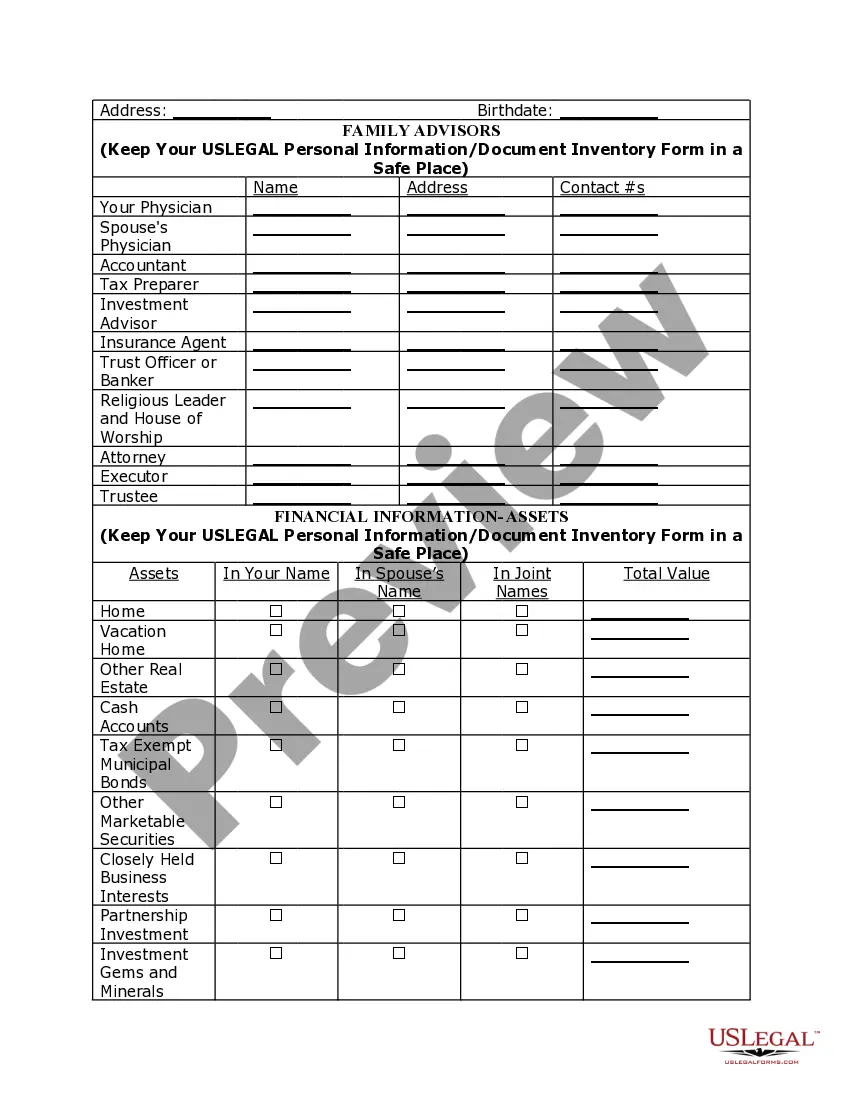

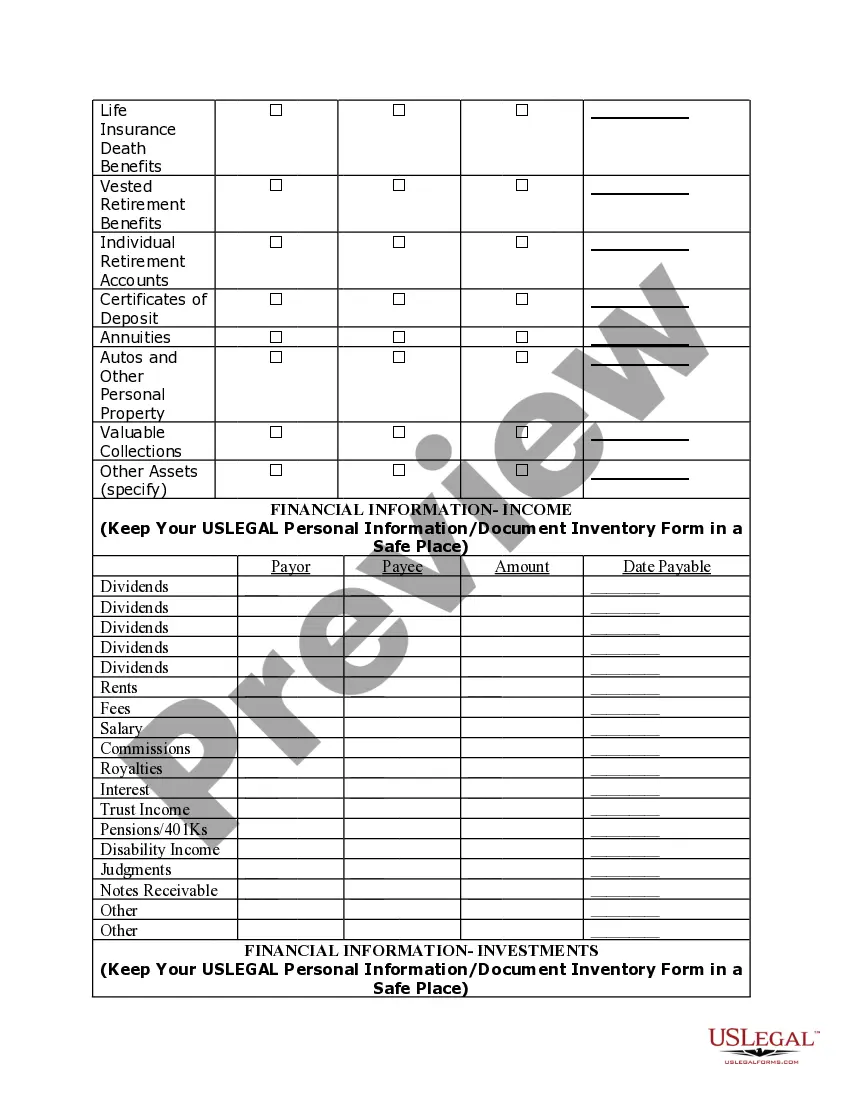

How to fill out Personal Planning Information And Document Inventory Worksheets - A Legal Life Document?

US Legal Forms - one of the most prominent libraries of legal documents in the United States - provides a selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by types, claims, or keywords.

You'll find the latest versions of forms such as the Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document in just moments.

Read the form description to confirm you have chosen the appropriate form.

If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- If you already have an account, Log In and retrieve the Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document from your US Legal Forms collection.

- The Download button will appear on every form you access.

- You have access to all previously saved forms in the My documents section of your account.

- If you are new to US Legal Forms, here are straightforward guidelines to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Whether you need to file a Rhode Island tax return depends on your specific income level and filing status. If your income surpasses a certain threshold, filing is mandatory. Otherwise, it may be beneficial to file to access refunds and credits. Utilize Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to help you keep your tax reports organized and accessible.

Filing a Rhode Island tax return is necessary if your income meets the state’s filing requirements, which depends on your filing status and total income. Even if you do not owe taxes, you may still want to file to claim potential refunds or credits. Additionally, organizing your financial records with Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can simplify the tax filing process.

A Rhode Island estate tax return must be filed for estates with a gross value exceeding the statutory threshold upon the death of a resident. Executors or administrators of the estate are responsible for filing, as they must report all assets and liabilities. To streamline this procedure, consider using Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to maintain a comprehensive inventory of your estate, making the filing process more efficient.

To file for legal separation in Rhode Island, you must complete a petition and submit it to the Family Court in your jurisdiction. This process requires you to outline your reasons for separation, along with any arrangements for child custody, support, and property division. Using Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can help you arrange your financial and legal documents more effectively as you navigate this process.

A Rhode Island partnership tax return is required for partnerships conducting business in the state, regardless of income. All partnerships with income exceeding a certain threshold or that have any income-producing property within Rhode Island must file. Utilizing Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can simplify your financial organization and preparation for filing.

To avoid the Rhode Island estate tax, you can utilize effective estate planning strategies, such as gifting assets during your lifetime to reduce your taxable estate. Engage a legal professional who can guide you through your options, including trusts or other financial tools. Additionally, using Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can help you track your assets and planning decisions effectively, ensuring compliance with tax regulations.

To submit your Rhode Island 1040 tax return, send it to the appropriate processing center based on your residency. For residents, address it to the Rhode Island Division of Taxation, PO Box 14720, Providence, RI 02914-4720. If you’re filing in a different status, ensure you check the specific address designated for your situation. For a seamless process, consider using Rhode Island Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to keep your tax documents organized.