Rhode Island Lease of Machinery for use in Manufacturing

Description

How to fill out Lease Of Machinery For Use In Manufacturing?

Are you in a situation where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides an extensive selection of form templates, including the Rhode Island Lease of Machinery for Manufacturing use, designed to comply with state and federal regulations.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes.

The service offers well-crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Rhode Island Lease of Machinery for Manufacturing template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

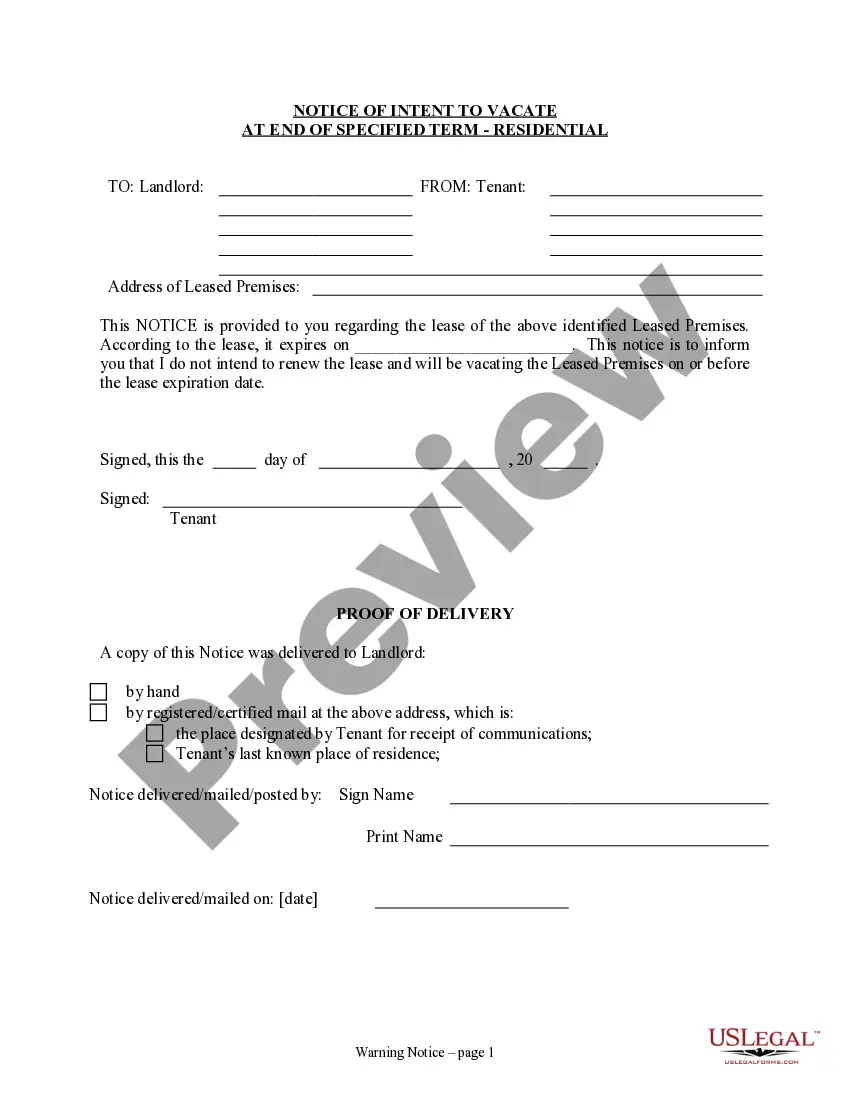

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you wish to use, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- You can locate all the form templates you have purchased in the My documents menu.

- You may retrieve an additional copy of the Rhode Island Lease of Machinery for Manufacturing whenever needed by selecting the desired form to download or print.

Form popularity

FAQ

Yes, equipment rental is taxable in Rhode Island, including machinery leased for manufacturing purposes. If you are involved in a Rhode Island Lease of Machinery for use in Manufacturing, it is important to plan for sales tax in your budget. Knowledge of tax regulations ensures a smoother leasing experience.

Certain items, like some food items and prescription medications, are exempt from sales tax in Rhode Island. However, machinery leases, particularly a Rhode Island Lease of Machinery for use in Manufacturing, typically do not qualify for these exemptions. Being aware of exemptions can help you make better financial decisions.

Yes, Rhode Island does have a personal property tax that affects business equipment, including machinery. This tax can impact your costs if you lease machinery for manufacturing operations. Understanding how this tax works can be beneficial for budgeting and financial planning.

In Massachusetts, equipment rentals are also subject to sales tax. As with Rhode Island, different types of rentals may have varying tax implications. For those looking to rent machinery for manufacturing, it is advisable to review the specific tax rules or consult a tax professional.

Rhode Island imposes sales tax on a variety of goods and services, including rental of machinery. Understanding what is taxable ensures compliance with state regulations. If you are considering a Rhode Island Lease of Machinery for use in Manufacturing, being informed about tax obligations is crucial.

Yes, equipment rental is taxable in Rhode Island. When you engage in a Rhode Island Lease of Machinery for use in Manufacturing, you must account for sales tax on the rental fees. Staying informed about state tax laws can help avoid unexpected expenses.

In New York, equipment rentals are generally subject to sales tax. However, the taxability might vary based on specific circumstances and the type of equipment. It is essential to consult local tax regulations or a tax professional to ensure compliance if you lease machinery for use in manufacturing in Rhode Island.

Yes, Rhode Island does accept out of state resale certificates as long as they comply with certain requirements. If you are engaged in a Rhode Island Lease of Machinery for use in Manufacturing, you can present an out of state resale certificate during your transactions. This helps in reducing your tax liability when leasing equipment. Always ensure that the certificate is properly filled out to avoid any complications.

In Rhode Island, certain services related to the Rhode Island Lease of Machinery for use in Manufacturing may be subject to sales tax. For example, services that are directly involved in the production process, such as repair and maintenance services for machinery, can often incur tax liabilities. It's essential to consult the specific guidelines set by the Rhode Island Division of Taxation to ensure compliance. Using US Legal Forms can help you navigate these complexities effectively.

The key difference between equipment leasing and rental lies in the duration and commitment involved. Leasing usually involves long-term agreements—sometimes spanning multiple years—whereas rentals are typically short-term arrangements. If you're considering a Rhode Island Lease of Machinery for use in Manufacturing, understanding these distinctions can help you make an informed decision about your equipment needs.