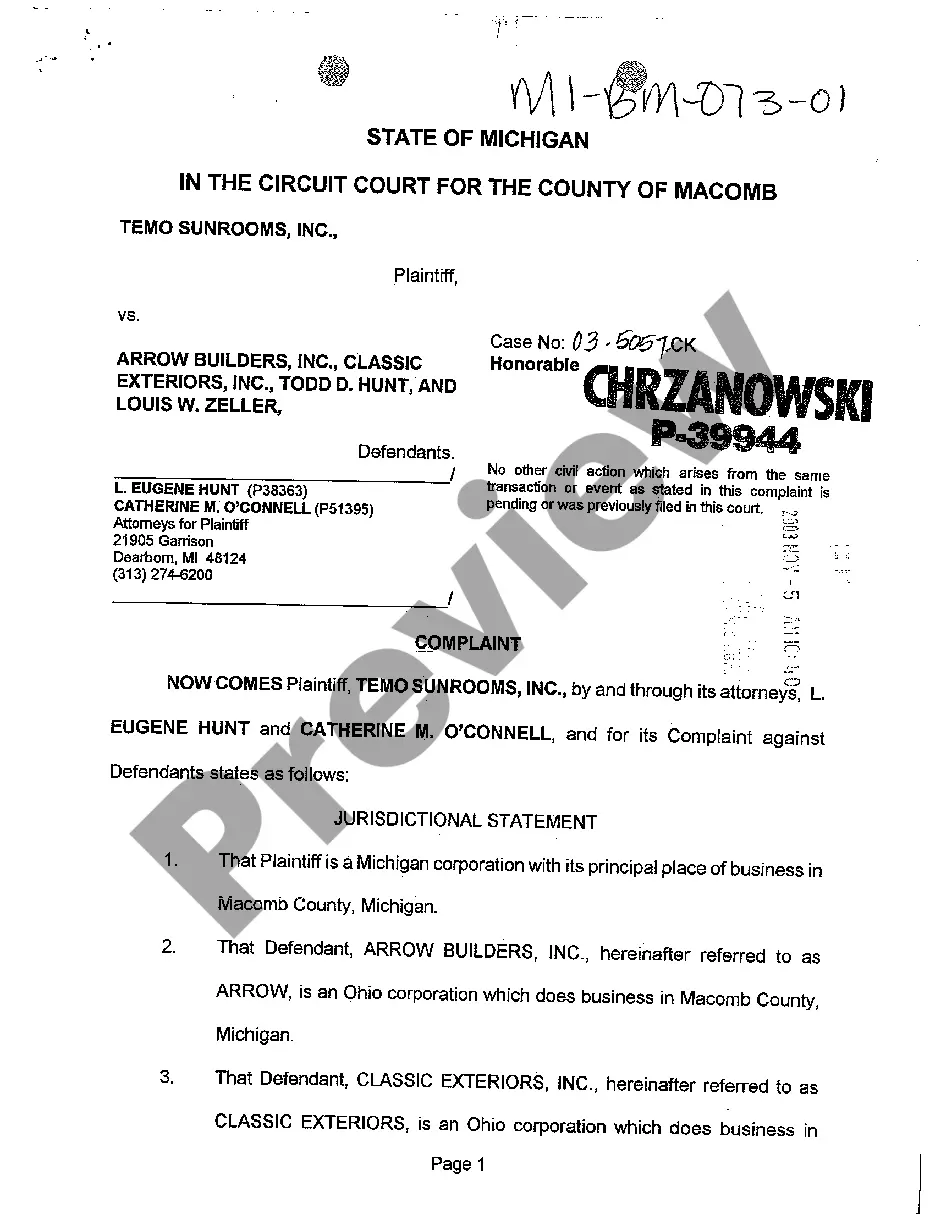

This form is a Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums

Description

How to fill out Complaint For Declaratory Judgment For Return Of Improperly Waived Insurance Premiums?

If you need to total, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site's straightforward and efficient search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to access the Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. You can also access forms you've previously acquired from the My documents section of your account.

Every legal document template you purchase is yours permanently. You have access to every form you've acquired within your account. Navigate to the My documents section and choose a form to print or download again.

Complete and download, then print the Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Lookup section at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Select your preferred pricing plan and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums.

Form popularity

FAQ

The False Claims Act in Rhode Island is a law that allows individuals to file claims against entities that defraud the government, particularly in the context of government contracts and programs. It aims to protect public funds and encourage reporting of fraud. If you are facing issues related to insurance claims and suspect fraudulent activities, exploring a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums might be a necessary step to address the situation.

Bringing a declaratory judgment action is appropriate when there is a genuine dispute regarding the interpretation of a contract or statute. This legal action can provide clarity and prevent further disputes by establishing rights before they escalate. If you are dealing with improperly waived insurance premiums, a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums could be an effective way to resolve your concerns.

Rule 7 in Rhode Island pertains to the motions and pleadings in civil litigation. It outlines the procedures for filing motions, including those related to declaratory judgments. If you are considering a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, you may utilize Rule 7 to ensure your motions are properly structured and submitted to the court.

A declaratory judgment in insurance is a court ruling that defines the rights and obligations of the parties under an insurance policy. This judgment helps resolve disputes by providing a legal interpretation of the policy terms. For those interested in filing a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, understanding this process is crucial as it can clarify the situation regarding improperly waived premiums.

An insurance company may seek a declaratory judgment when it faces uncertainty about its obligations under a policy. This situation often arises in disputes over coverage or claims that may not fall clearly within the policy terms. By filing a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, the insurer seeks clarity from the court, ensuring it acts within legal bounds and avoids potential liability.

To file a complaint about insurance in Rhode Island, you should first review your insurance policy to understand your rights. Next, gather any relevant documentation, including communication with your insurance company. You can then submit a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums to the Rhode Island Department of Business Regulation. Additionally, using a platform like USLegalForms can simplify the process by providing the necessary templates and guidance to help you effectively present your case.

To successfully file a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, you need to meet certain requirements. First, there must be an actual controversy between parties regarding a legal issue. Second, the relief sought must be specific and capable of being granted by the court, ensuring that the judge can provide a clear ruling on the matter at hand.

The burden of proof for a declaratory judgment in Rhode Island typically falls on the party seeking the judgment. In a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, you must provide sufficient evidence to establish your claims. This involves presenting clear and convincing evidence that demonstrates the need for the court's intervention in resolving the legal uncertainty.

Rule 7 of the Rhode Island Superior Court Rules pertains to the form and content of pleadings. It requires that a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums must clearly state the grounds for the court's jurisdiction, the facts that support the claims, and the specific relief sought. This rule aims to ensure that all parties involved understand the basis of the action being taken.

In the context of a Rhode Island Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, the three burdens of proof include the burden of production, the burden of persuasion, and the burden of going forward. The burden of production involves the obligation to present evidence to support your claims. The burden of persuasion is the responsibility to convince the court with sufficient evidence, while the burden of going forward refers to the need to maintain evidence throughout the trial.