Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

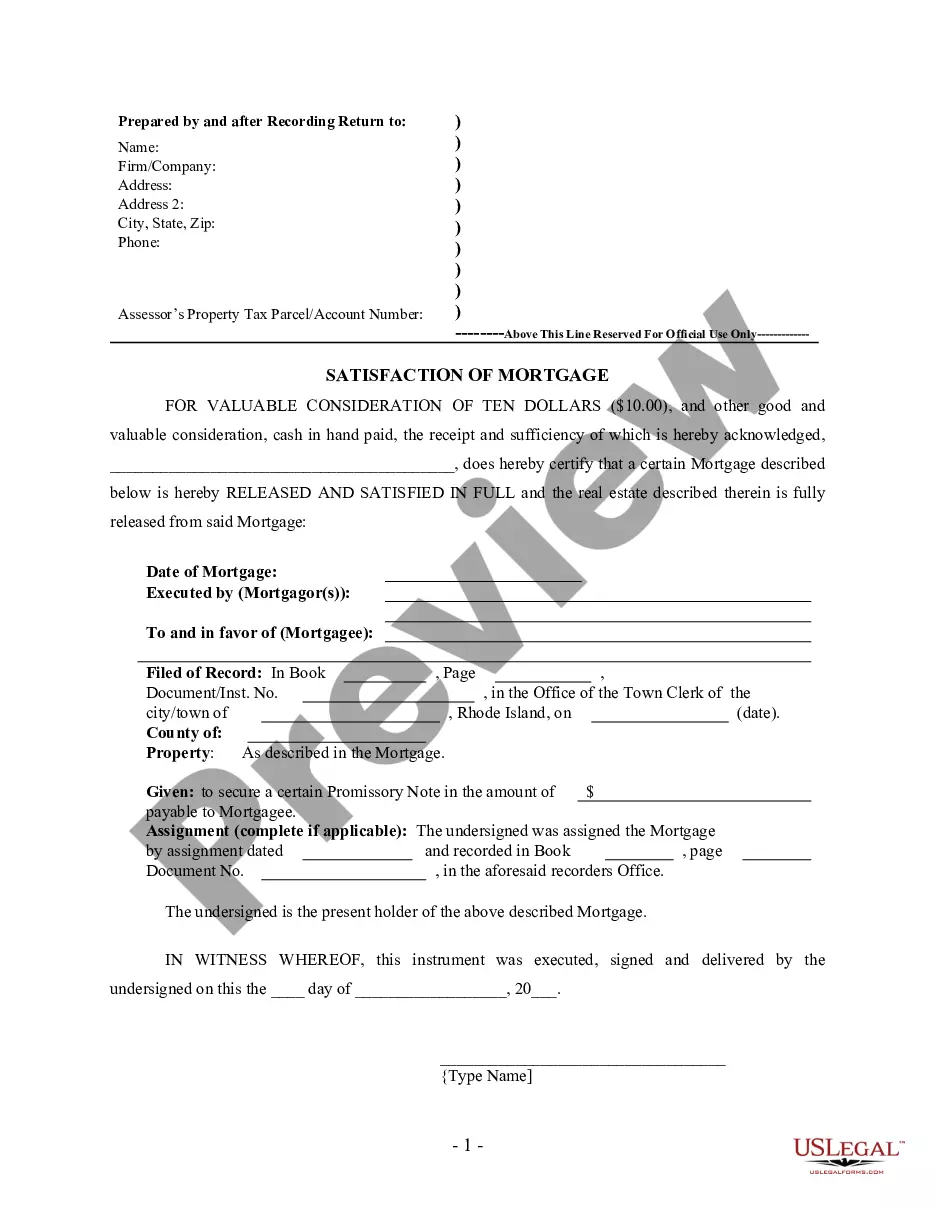

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Rhode Island Law

Assignment: Assignee may not enforce rights until assignment is recorded.

Demand to Satisfy: A request must be made and reasonable charges for the satisfaction tendered to the mortgagee, who, within ten days after receipt, must discharge the mortgage of record.

Recording Satisfaction: Satisfaction (discharge) may be recorded by the mortgagee indicating upon the recorded mortgage document that same is cancelled and satisfied, and signing the document. Satisfaction may also be achieved by a separate document (a deed of release) duly acknowledged and recorded.

Marginal Satisfaction: Satisfaction (discharge) may be recorded by the mortgagee indicating upon the recorded mortgage document that same is cancelled and satisfied, and signing the document.

Penalty: If mortgagee fails to discharge the mortgage within 10 days of request and receipt of fee, the mortgagee shall pay a penalty to the mortgagor for noncompliance in the amount of fifty dollars ($50.00) for a first day of noncompliance and five dollars ($5.00) for each day thereafter that the party remains in noncompliance. The mortgagor shall also be entitled to a reimbursement of reasonable attorney's fees. (See below, 34-26-5, for details).

Acknowledgment: An assignment or satisfaction must contain a proper Rhode Island acknowledgment, or other acknowledgment approved by Statute.

Rhode Island Statutes

34-26-2 Right to discharge on satisfaction of mortgage - Escrow accounts.

(a) Every mortgagee of real estate, his, her or its heirs, executors, administrators, successors, or assigns, having received full satisfaction for the money due on the mortgage, shall, within thirty (30) days after final payment, discharge the mortgage as provided in 34-26-3 or by separate instrument of release of the mortgage, and shall send the discharge to be recorded in the proper record book with suitable references to the original record, including the mortgagor's name and address, which shall forever afterwards discharge, defeat and release the mortgage and perpetually bar all actions to be brought thereon in any court. Upon forwarding the discharge for recording the mortgagee shall notify the mortgagor. Any mortgagor or his agent upon tendering final payment to the mortgagee in full satisfaction of the mortgage may in writing require the mortgagee to issue the discharge by separate instrument of release, directly to a designated person or real estate closing officer within the thirty (30) day period.

(b) Every mortgagee of real estate, his, her or its heirs, executors, administrators or successors or assigns, having received full satisfaction for the money due on the mortgage, shall, within thirty (30) days after final payment, disburse to the mortgagor any and all funds held in escrow under the terms of the mortgage.

History of Section.

(G.L. 1896, ch. 207, 5; G.L. 1909, ch. 258, 5; G.L. 1923, ch. 302, 5; G.L. 1938, ch. 442, 5; G.L. 1956, 34-26-2; P.L. 1960, ch. 147, 3; P.L. 1980, ch. 240, 1; P.L. 1987, ch. 216, 1; P.L. 1993, ch. 53, 1; P.L. 1993, ch. 143, 1; P.L. 2000, ch. 482, 1.)

34-26-3 Methods of discharge.

A mortgage may be discharged in whole or in part by an entry acknowledging the satisfaction thereof or the payment thereon, as the case may be, made on the face or back of the mortgage, or upon the face or margin of the record of the mortgage, in the records of land evidence, and signed by the mortgagee or by his or her executor, administrator, successor, or, if the mortgage be assigned, by the assignee or his or her executor or administrator; and such entry shall have the same effect as a deed of release duly acknowledged and recorded.

History of Section.

(G.L. 1896, ch. 207, 6; G.L. 1909, ch. 258, 6; G.L. 1923, ch. 302, 6; G.L. 1938, ch. 442, 6; G.L. 1956, 34-26-3.)

34-26-4 Requiring assignment of mortgage in lieu of discharge; Enforcement by incumbrancers.

Where a mortgagor is entitled to redeem, he or she shall by virtue of this section have power to require the mortgagee, instead of discharging or reconveying, and on the terms on which he or she would be bound to discharge or reconvey, to assign the mortgage debt and convey the mortgaged property to such third person as the mortgagor directs; provided, that the mortgagor assumes the expense of making the assignment and conveyance, and obligates himself or herself to have the same recorded, and the fact of the transfer being made shall be prima facie evidence that the assumption of expense and the obligation have been made; and the mortgagee shall, by virtue of this section, be bound, on being relieved of all expense and having the obligation made to him or her, to assign and convey accordingly; and the right shall belong to and be capable of being enforced by each incumbrancer, or by the mortgagor, notwithstanding any intermediate incumbrance, but a requisition of an incumbrancer shall prevail over a requisition of the mortgagor and, as between incumbrancers, a requisition of a prior incumbrancer shall prevail over a requisition of the mortgagor and, as between incumbrancers, a requisition of a prior incumbrancer shall prevail over a requisition of a subsequent incumbrancer. This section does not apply in the case of a mortgagee being or having been in possession.

History of Section.

(G.L. 1896, ch. 207, § 7; G.L. 1909, ch. 258, § 7; G.L. 1923, ch. 302, § 7; G.L. 1938, ch. 442, § 7; G.L. 1956, § 34-26-4.)

34-26-5 Liability of mortgagee for failure to discharge, release, or transfer mortgage.

(a) If any mortgagee, his, her or its heirs, executors, administrators, agents, successors, or assigns, shall not, within ten (10) days after a request made in that behalf and a tender of all reasonable charges therefor, discharge the mortgage in one of the modes aforesaid, or otherwise make and execute a release and quitclaim of the estate so mortgaged, and acknowledge it before some proper officer, or transfer the mortgage if required under the provisions of 34-26-4, he, she, or they so refusing shall be liable to make good all damages that shall accrue for want of the discharge, release, or transfer, to be recovered in a civil action; and in case judgment shall pass against the party sued, the mortgagee shall pay the plaintiff reasonable attorney's fees and triple costs upon the suit.

(b) In the event of noncompliance with the provisions of either this section and 34-26-2, the mortgagee shall pay a penalty to the mortgagor for noncompliance in the amount of fifty dollars ($50.00) for a first day of noncompliance and five dollars ($5.00) for each day thereafter that the party remains in noncompliance. The mortgagor shall also be entitled to a reimbursement of reasonable attorney's fees, if applicable, for the costs incurred by the mortgagor andr his, her or its attorneys in attempting to obtain a discharge to which the mortgage was lawfully entitled pursuant to the provisions of this section and 34-26-2. Demand for penalties and, if applicable, attorney's fees and costs pursuant to this section may be made to the department of business regulation, in those instances in which the mortgagee is a regulated institution as defined in Title 19, and the department shall direct such regulated institutions to pay applicable penalties and reimburse effected mortgagors for attorneys fees and costs incurred, on confirmed instances of noncompliance. The department may promulgate rules and regulations governing the processing of such reimbursement. In those instances in which the mortgagee is not a regulated institution as defined in Title 19, the Department shall provide the mortgagor with the name, address and telephone number of the regulatory agency having jurisdiction over the actions of such mortgagees.

(c) As used herein, the term first day of noncompliance shall mean the first day following the last day for a mortgagee or similar party to discharge the mortgage.

History of Section.

(G.L. 1896, ch. 207, § 8; G.L. 1909, ch. 258, § 8; G.L. 1923, ch. 302, § 8; G.L. 1938, ch. 442, § 8; G.L. 1956, § 34-26-5; P.L. 1986, ch. 216, § 1; P.L. 1999, ch. 476, § 1.)

34-26-6 Other forms of discharge or release preserved.

Nothing contained in this chapter shall be so construed as to defeat, invalidate, annul, or render ineffectual any other legal or equitable discharge, payment, satisfaction, or release of any mortgage.