Rhode Island Letter to Lienholder to Notify of Trust

Description

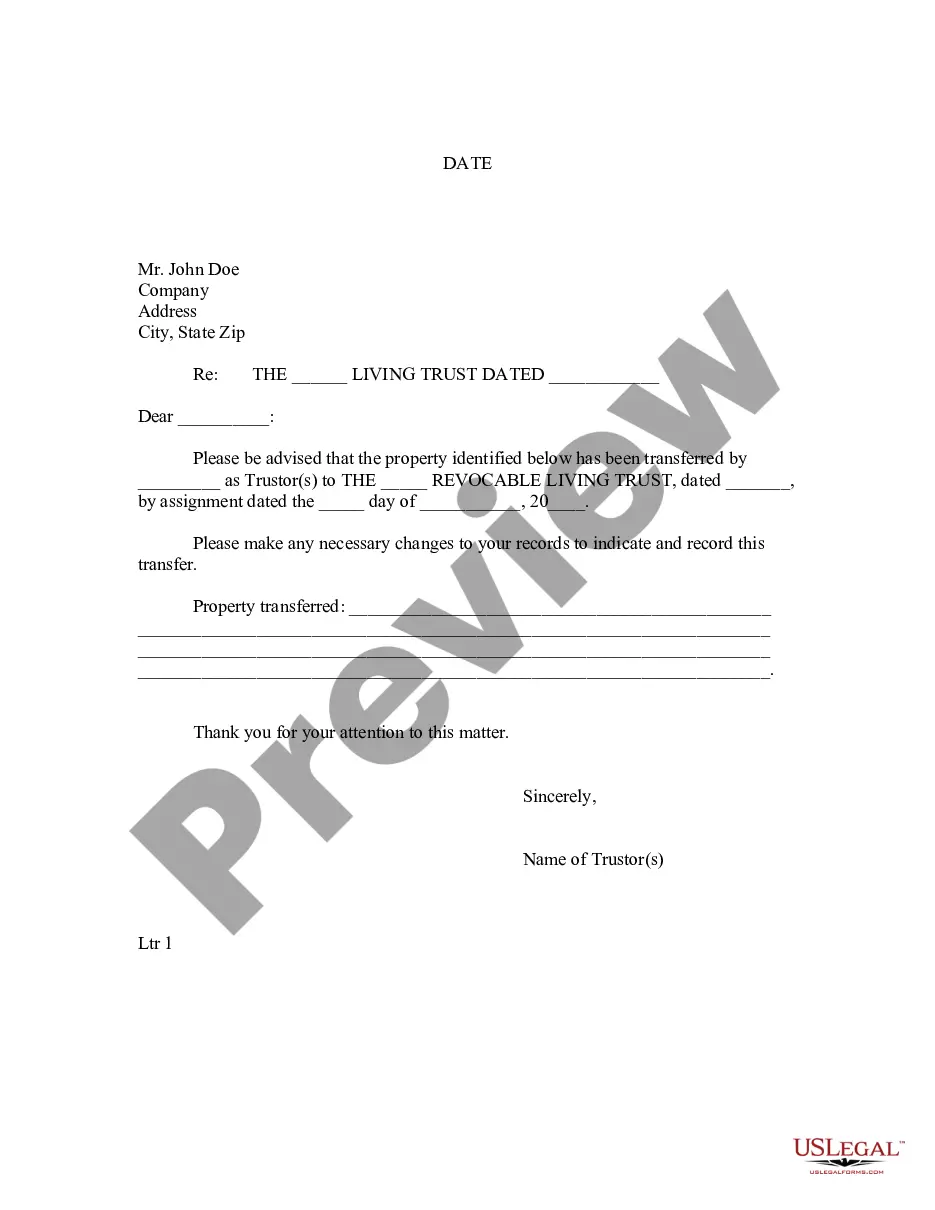

How to fill out Rhode Island Letter To Lienholder To Notify Of Trust?

Creating papers isn't the most simple task, especially for people who rarely deal with legal papers. That's why we recommend using correct Rhode Island Letter to Lienholder to Notify of Trust templates made by skilled lawyers. It allows you to stay away from difficulties when in court or handling formal institutions. Find the documents you want on our website for top-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the template webpage. Right after accessing the sample, it will be stored in the My Forms menu.

Customers with no an activated subscription can quickly create an account. Follow this brief step-by-step guide to get your Rhode Island Letter to Lienholder to Notify of Trust:

- Ensure that the document you found is eligible for use in the state it is required in.

- Confirm the document. Make use of the Preview feature or read its description (if available).

- Buy Now if this template is what you need or return to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After completing these simple steps, you can complete the sample in a preferred editor. Recheck filled in data and consider asking a legal professional to examine your Rhode Island Letter to Lienholder to Notify of Trust for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

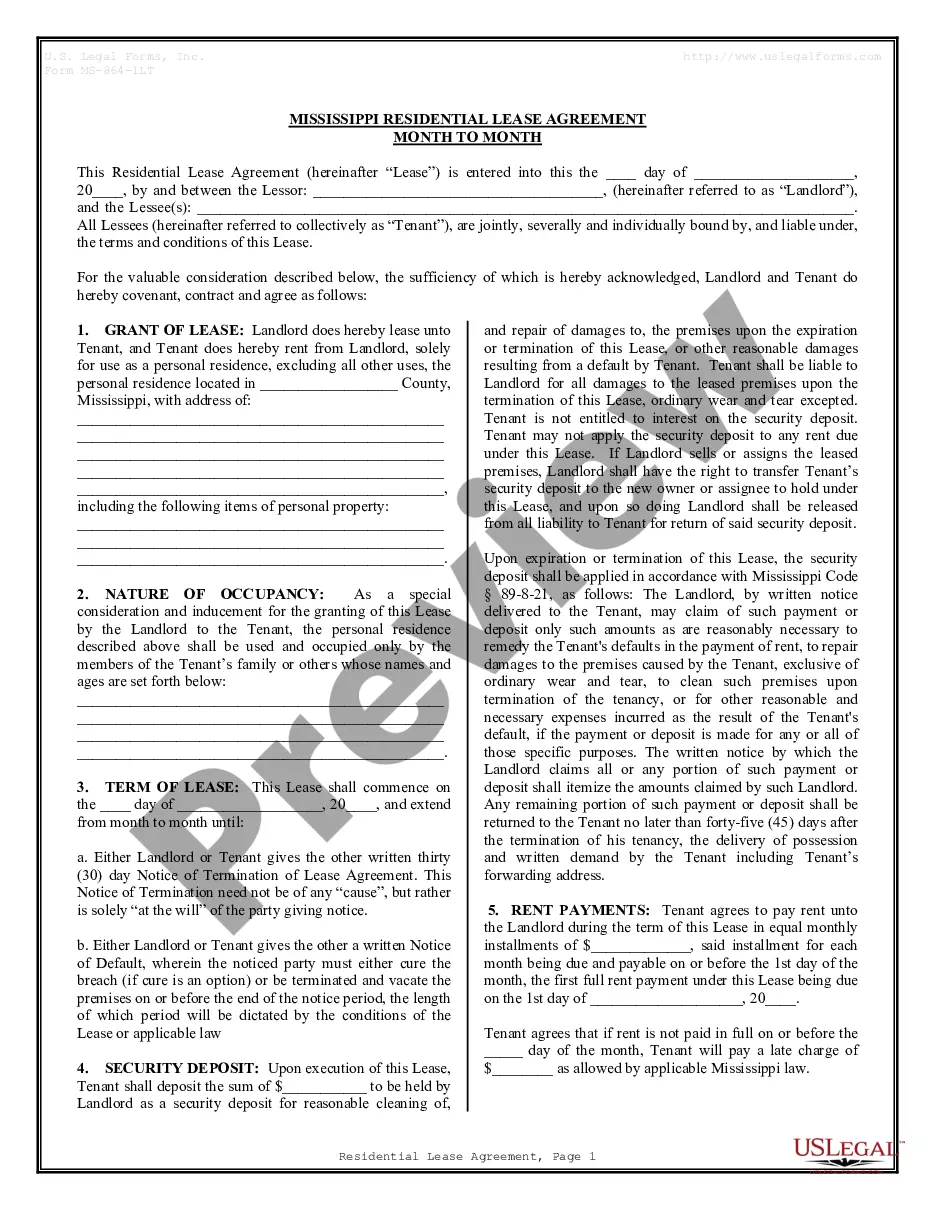

A lienholder is a lender that legally has an interest in your property until you pay it off in full. The lender which can be a bank, financial institution or private party holds a lien, or legal claim, on the property because they lent you the money to purchase it.

How does a creditor go about getting a judgment lien in Rhode Island? To attach the lien, the creditor must request execution of attachment within 48 hours after entry of the judgment, then file the execution with the town clerk or recorder of deeds in the Rhode Island town where the debtor's property is located.

In simple situations where you own the vehicle outright and wish to transfer ownership to someone else, all you must do is complete a title certificate. Once you have filled out and signed the certificate, the buyer or recipient can take the title to a local DMV office and officially transfer ownership.

On the title where it says Signature(s) of all purchaser(s), all persons who are buying the car should sign their names. Next to that, the seller should sign their name. On the next line, all buyers and sellers should print their names.

Release ownership by signing on line one on the front of the title. If the vehicle is, or was financed, the lienholder's name appears in the legal owner section and their release with counter signature is required on line two. For step-by-step instructions see the California DMV instructional video here.

Provide the buyer with the title, with all of the seller's information completed. You must complete the Application for Title (the seller's section). You must complete the Use Tax Return (the seller's section). Give the buyer a bill of sale. Give the buyer a lien release.

When you purchase a vehicle in Rhode Island, you are required to pay sales tax on the vehicle and obtain a title in your own name, even if you do not register the vehicle. You will need to complete both a Sales Tax form and a Application for Title (TR-2/TR-9) form.

Prepare your Rhode Island Notice of Intention form. Serve the Rhode Island Notice of Intention as a preliminary notice. Record the Rhode Island Notice of Intention as a mechanics lien. File Notice of Lis Pendens and enforce the mechanics lien.

Both are on the FRONT of the title. The first is in the center of the title and is labeled "Signature of Registered Owner." A second signature is required for the odometer statement. The field is labeled "Transferor/Seller Signature" and is located on the lower left.