This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

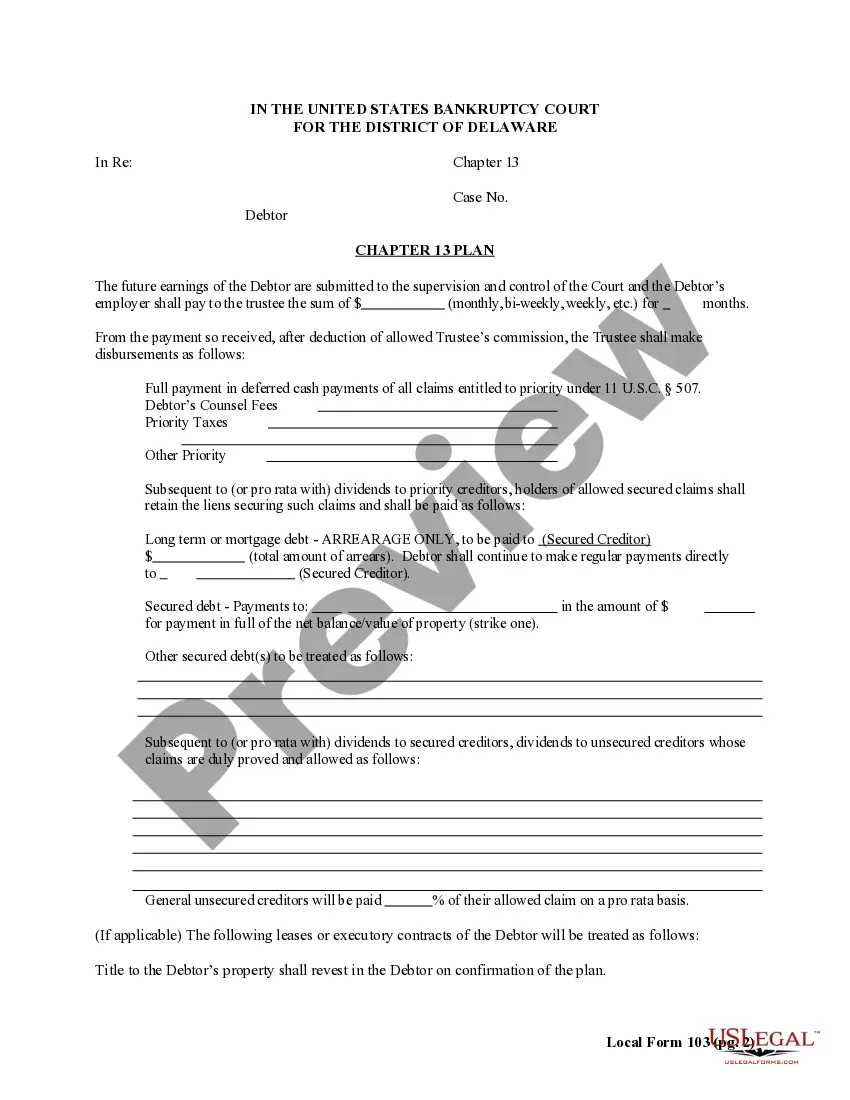

Puerto Rico Financing

Description

How to fill out Financing?

Discovering the right lawful papers template could be a have difficulties. Naturally, there are a variety of web templates available on the net, but how can you get the lawful kind you require? Utilize the US Legal Forms site. The service delivers thousands of web templates, like the Puerto Rico Financing, that you can use for organization and personal requirements. All of the varieties are checked by experts and satisfy federal and state requirements.

If you are presently registered, log in for your profile and then click the Download key to get the Puerto Rico Financing. Use your profile to search with the lawful varieties you may have purchased in the past. Check out the My Forms tab of your profile and have an additional backup of the papers you require.

If you are a fresh user of US Legal Forms, allow me to share easy recommendations for you to stick to:

- Very first, ensure you have chosen the appropriate kind for your personal town/area. It is possible to examine the form making use of the Review key and read the form outline to make sure it will be the right one for you.

- In case the kind does not satisfy your requirements, take advantage of the Seach area to find the correct kind.

- Once you are sure that the form is proper, go through the Buy now key to get the kind.

- Opt for the rates program you desire and enter in the needed information and facts. Design your profile and pay money for an order making use of your PayPal profile or bank card.

- Select the data file format and download the lawful papers template for your product.

- Comprehensive, modify and printing and sign the acquired Puerto Rico Financing.

US Legal Forms will be the greatest library of lawful varieties where you can discover a variety of papers web templates. Utilize the service to download skillfully-created documents that stick to status requirements.

Form popularity

FAQ

Being preapproved for a loan is a requirement to buy a house in Puerto Rico, unless you plan to pay cash, in which case you're required to demonstrate evidence of sufficient funds. To procure a mortgage, you'll need a good credit score and enough liquid funds to make a 20% down payment.

Mortgage balances average $70,000 in Puerto Rico compared with $122,000 on the mainland, credit cards average $4,300 compared with $5,100 on the mainland, and student loans equate to $20,000 per borrower, compared with $27,000 on the mainland.

Primary Lenders These lenders can originate, process, approve, and close their own loans. Examples in Puerto Rico include Banco Popular de Puerto Rico, First Mortgage, and Scotiabank. These lenders have many locations throughout Puerto Rico and offer a wide array of mortgage products, making them very convenient.

As in the mainland United States, in order to get the best interest rate on your mortgage in Puerto Rico, it is important to maintain a credit score as high as possible, with a debt-to-income ratio as low as possible.

Get the best land loan rates from 86 land loan Puerto Rico lenders ready to fund loans for land purchases, lot loans, and other kinds of land financing. The actual value of any land depends on its location, size, topography, zoning, and any entitlement that was done about the land in the past or ongoing.

Popular Mortgage is a division of Banco Popular de Puerto Rico. These offers require the borrower to obtain a minimum credit score of 740 as defined by the Government-Sponsored Enterprises.

Puerto Rican households experience a number of financial hardships: The annual household median income in Puerto Rico was just below $22,000 in 2021. 1.4 million people in Puerto Rico are reported as living below the federal poverty line.

One of the biggest advantages of buying a house in Puerto Rico is the tax benefits. The island is a U.S. territory, which means that Puerto Rican residents are subject to U.S. federal income tax. However, there are several tax incentives available to people who move to Puerto Rico, including Act 20, Act 22 and Act 60.