This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Puerto Rico Related Entity

Description

How to fill out Related Entity?

Have you been within a situation the place you will need files for sometimes business or personal purposes just about every time? There are plenty of legal papers layouts available on the net, but getting versions you can rely isn`t simple. US Legal Forms offers thousands of form layouts, just like the Puerto Rico Related Entity, that happen to be composed to satisfy federal and state requirements.

If you are already informed about US Legal Forms web site and have a free account, merely log in. After that, you may obtain the Puerto Rico Related Entity design.

Should you not provide an profile and wish to begin using US Legal Forms, adopt these measures:

- Get the form you want and ensure it is to the correct area/region.

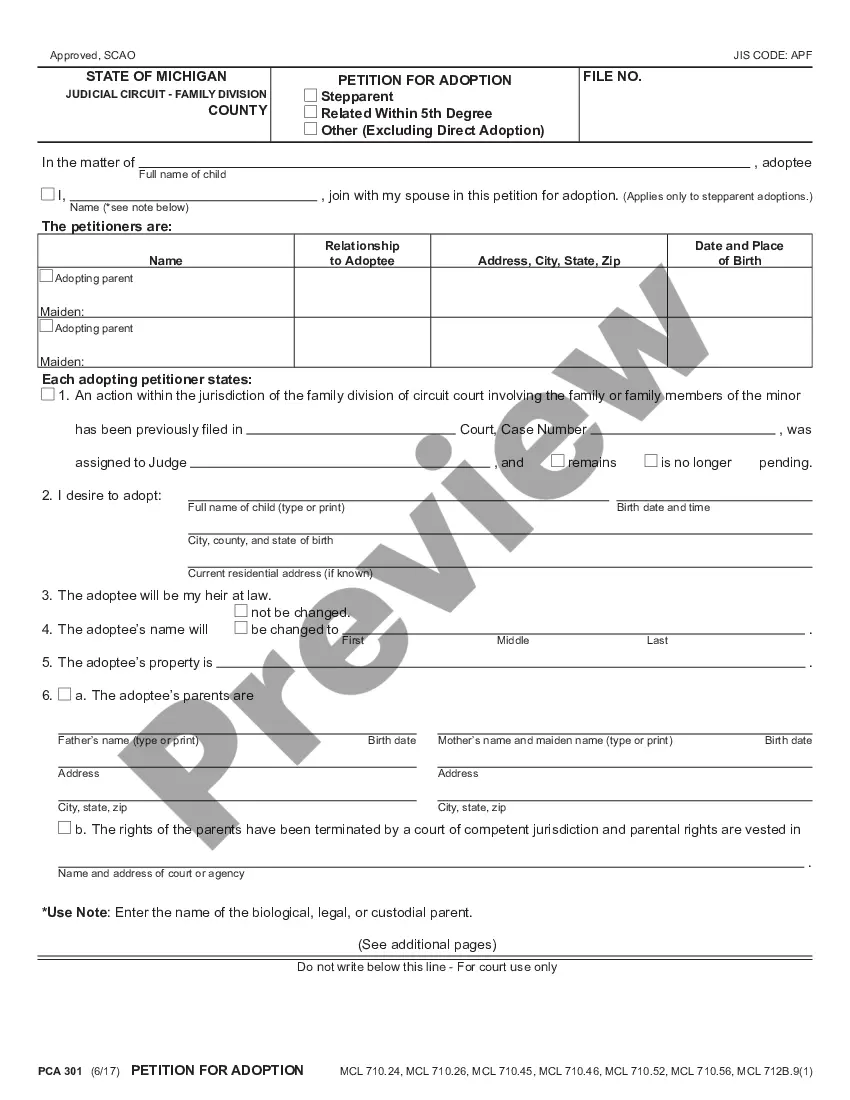

- Take advantage of the Review switch to check the form.

- Read the explanation to ensure that you have selected the appropriate form.

- In case the form isn`t what you`re looking for, take advantage of the Search industry to get the form that meets your requirements and requirements.

- Once you obtain the correct form, just click Purchase now.

- Pick the pricing strategy you want, fill in the desired information to create your money, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a handy file format and obtain your duplicate.

Get all of the papers layouts you have purchased in the My Forms food list. You may get a extra duplicate of Puerto Rico Related Entity anytime, if necessary. Just click the essential form to obtain or produce the papers design.

Use US Legal Forms, the most considerable assortment of legal types, to conserve some time and stay away from mistakes. The services offers appropriately manufactured legal papers layouts which can be used for a range of purposes. Make a free account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

A Puerto Rico LLC is a foreign eligible entity for U.S. federal income taxes. LLCs may elect to be taxed as partnerships even if they have a single member.

As a U.S. Commonwealth, Puerto Rico is considered domestic travel from the continental Unites States, just as long as you don't touch down in a foreign place or port before arriving. You will, however, be required to show a state-issued photo I.D. card, such as a driver's license or a non-driving photo I.D.

Limited Liability Companies Although a Puerto Rico LLC is automatically treated as a corporation for US federal income tax purposes, it may elect to be treated as a partnership or disregarded entity, as applicable. This election is accomplished through the filing of Form 8832 with the IRS.

A Puerto Rico LLC taxed as a Corporation of Individuals is taxed as a pass-through entity and doesn't pay corporate income tax, making it similar to a partnership. However, unlike a partnership, a corporation of individuals can make distributions to its members that aren't subject to US self-employment taxes.

'Free Associated State of Puerto Rico'), is a Caribbean island and unincorporated territory of the United States with official Commonwealth status.

The political status of Puerto Rico is that of an unincorporated territory of the United States officially known as the Commonwealth of Puerto Rico (Spanish: Estado Libre Asociado de Puerto Rico, lit. 'Free Associated State of Puerto Rico').

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail.

For foreign tax credit purposes, all qualified taxes paid to U.S. possessions are considered foreign taxes. For this purpose, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands and American Samoa.