This form is a weekly expense report listing name, period, position, client, project number, project code, the expense items and the daily totals.

Puerto Rico Weekly Expense Report

Description

How to fill out Weekly Expense Report?

Are you presently in a situation where you require documents for either organizational or personal purposes almost every time.

There are numerous legitimate document templates accessible online, but locating ones you can trust isn't simple.

US Legal Forms offers a vast collection of document templates, such as the Puerto Rico Weekly Expense Report, that are designed to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Puerto Rico Weekly Expense Report anytime you need it. Just select the necessary document to download or print the template.

- If you are currently acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Puerto Rico Weekly Expense Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

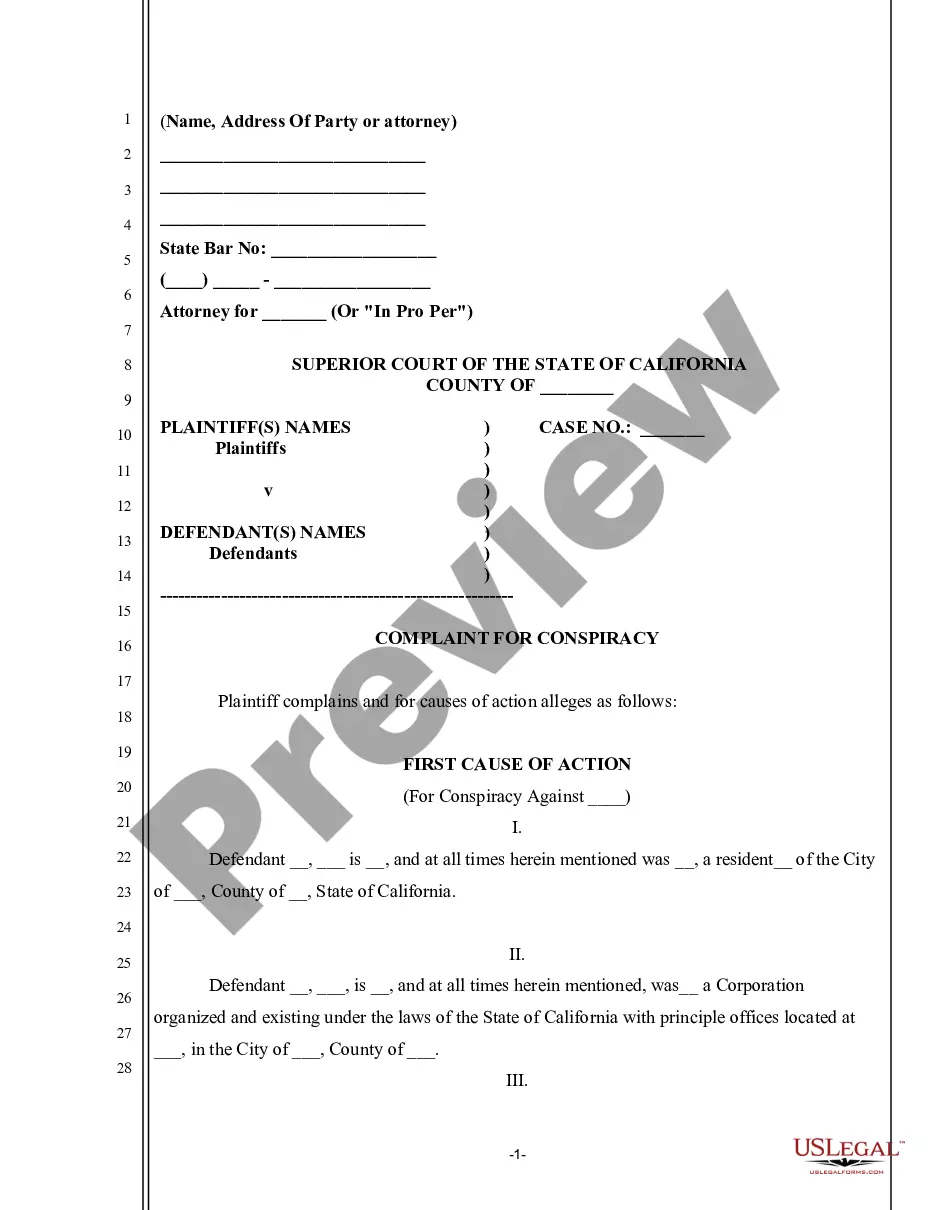

- Use the Preview button to review the document.

- Read the description to ensure you have selected the right document.

- If the document isn't what you are looking for, utilize the Search field to find the document that meets your needs.

- Once you find the appropriate document, click Buy now.

Form popularity

FAQ

Creating a daily expense report involves tracking your expenses on a day-to-day basis. Start by logging each expense as it occurs, noting the date, amount, and purpose. The Puerto Rico Weekly Expense Report can help you compile these daily entries into a cohesive report, saving you time and ensuring accuracy in your financial tracking.

To fill out an expense claim form, begin by entering your personal details, such as name and employee ID. Next, list each expense with the corresponding date, amount, and category. By using the Puerto Rico Weekly Expense Report feature, you can easily track and manage your claims, ensuring all necessary information is included for quick processing.

Filling out an expense report involves a few simple steps. First, collect all your receipts, and then categorize your expenses. The Puerto Rico Weekly Expense Report tool offers predefined categories, making it straightforward to allocate your expenses correctly and efficiently, ensuring you do not miss any critical details.

An expense report usually includes the date of the expense, the amount spent, a description of the expense, and the category it falls under, such as travel or meals. Additionally, it may require receipts as proof of expenditure. By using the Puerto Rico Weekly Expense Report, you can ensure that all necessary information is captured and presented clearly, making it easier for approvals and reimbursements.

To fill out an expense report, start by gathering all relevant receipts and documentation for your expenses. Next, categorize each expense and input the required details, such as date and amount. Utilizing the Puerto Rico Weekly Expense Report can simplify this task, as it provides a user-friendly interface to help you manage and organize your expenses effectively.

A monthly expense report typically includes a summary of all expenses incurred during the month, categorized by type, such as travel, meals, and supplies. You'll often find a detailed breakdown of each expense, including date, amount, and purpose. With the Puerto Rico Weekly Expense Report feature, you can streamline this process, ensuring accuracy and compliance with local regulations.

A T&E document is any paperwork that supports the recording of travel and entertainment expenses. This can include receipts, invoices, and the T&E report itself. By leveraging a Puerto Rico Weekly Expense Report on the US Legal Forms platform, you can ensure that all your T&E documents are accurately compiled and easily accessible for future reference.

A T&E report is a formal record of expenses related to business travel and entertainment activities. This report typically includes receipts, dates, and descriptions of each expense. By using a Puerto Rico Weekly Expense Report, you can organize and submit your T&E expenses more efficiently, helping your business maintain clear financial records.

T&E reports are detailed documents that outline travel and entertainment expenses incurred by employees. These reports are essential for reimbursement and financial tracking purposes. When you utilize a Puerto Rico Weekly Expense Report, you simplify the process of documenting these expenses, ensuring accuracy and compliance with company policies.

T&E stands for Travel and Entertainment. This term encompasses all expenses related to business travel and entertainment activities. For companies operating in Puerto Rico, managing these expenses effectively can streamline financial reporting. Using a Puerto Rico Weekly Expense Report can help you keep track of these costs efficiently.