Puerto Rico Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

Are you presently in a situation where you require files for either organization or particular purposes nearly every working day.

There are numerous reliable document templates accessible online, but finding ones that you can depend on is not easy.

US Legal Forms offers thousands of document templates, such as the Puerto Rico Department Time Report for Payroll, designed to comply with federal and state regulations.

Find all the document templates you have purchased in the My documents list.

You can download an additional copy of the Puerto Rico Department Time Report for Payroll anytime, if needed. Just go through the necessary form to download or print the document template.

- If you are already acquainted with the US Legal Forms site and have an account, just Log In.

- Then, you can download the Puerto Rico Department Time Report for Payroll template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct area/state.

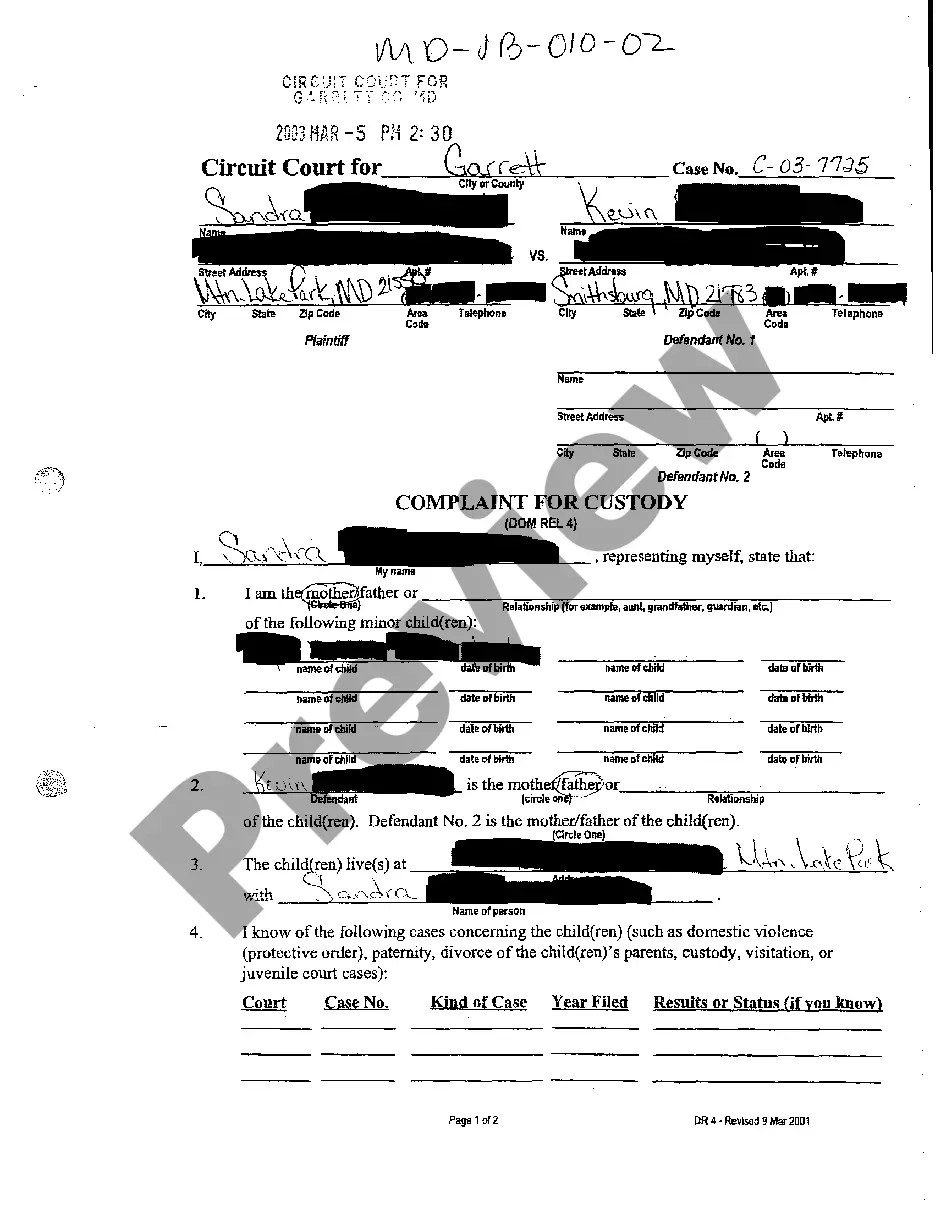

- Utilize the Review option to examine the form.

- Check the outline to confirm you have selected the proper template.

- If the form isn’t what you were looking for, use the Lookup field to find the document that fulfills your needs.

- Once you discover the correct template, click Get now.

- Choose the pricing plan you want, provide the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient paper format and download your copy.

Form popularity

FAQ

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Puerto RicoRegister your business name and file articles of incorporation.File for local bank accounts.Learn and keep track of the local employment laws.Set up local payroll.Hire local accounting, legal, and HR people.

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.