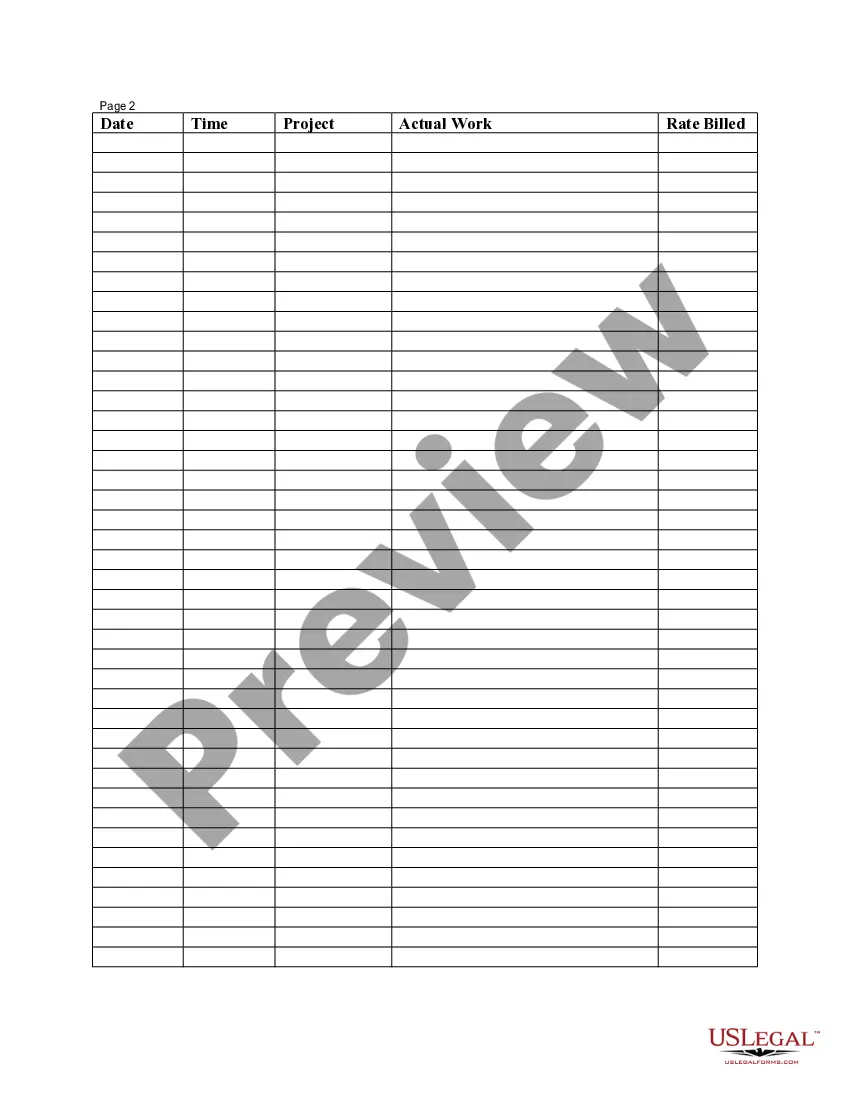

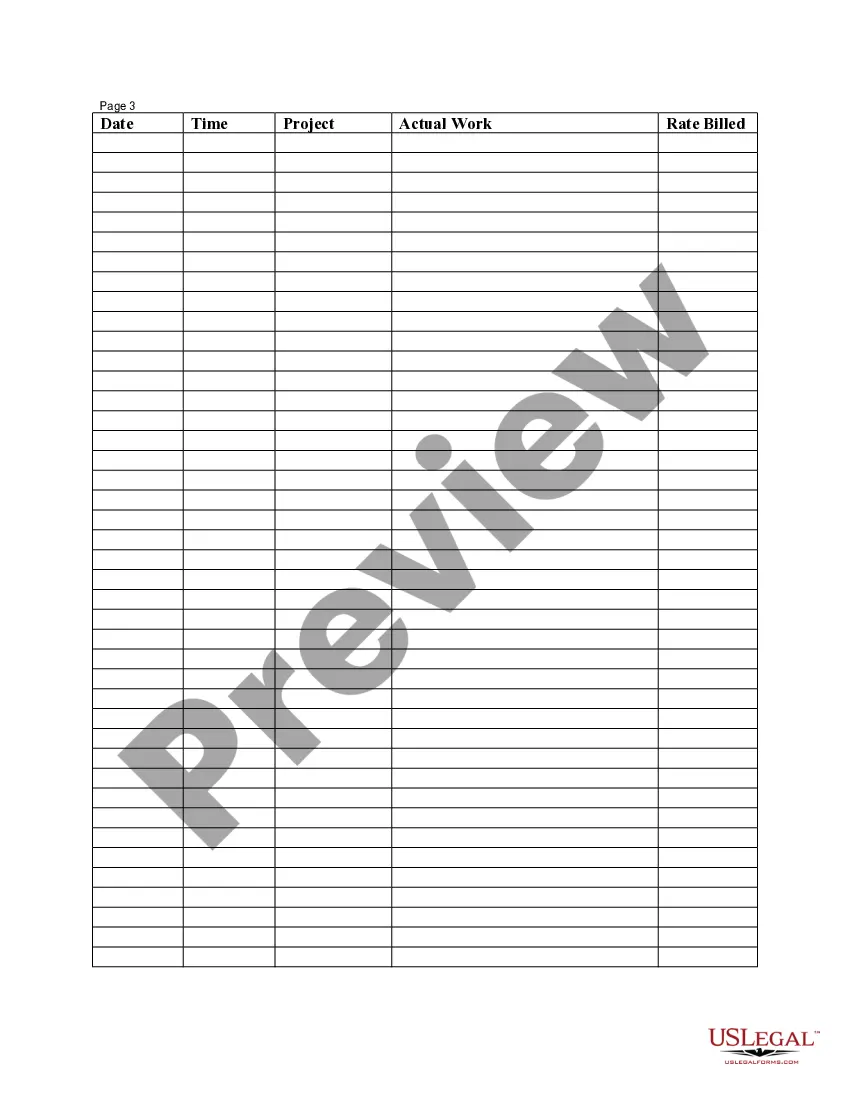

Puerto Rico Employee Time Sheet

Description

How to fill out Employee Time Sheet?

Are you in a situation where you require documentation for both business or personal matters nearly every day.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms offers a vast selection of templates, such as the Puerto Rico Employee Time Sheet, designed to comply with state and federal standards.

Once you find the appropriate form, click Get now.

Choose the pricing plan you want, fill in the necessary details to create your account, and place your order using your PayPal or credit card. Select a suitable document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Puerto Rico Employee Time Sheet anytime if necessary. Just choose the required form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Employee Time Sheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/area.

- Use the Review option to examine the form.

- Check the details to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Hours & Pay Regulations. The regular work shift for non-exempt employees is 8 hours per day and a regular workweek of 40 hours per week.

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.

According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.

Normal Working Hours The regular work shift for non-exempt employees is 8 hours per day and a regular workweek of 40 hours per week. The workweek will begin on the day and time that the employer determines and so the employer will notify the employee in writing.

Senate Bill 1524 also would revert the minimum vacation leave accrual for all eligible employees to 1.25 days per month, for a total of 15 days per year (currently, depending on years of service, an employee can accrue from five to 15 days a year).

Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Puerto Rico establishes a special overtime rate of double an employee's normal hourly rate for any hours worked over 8 in a single day, or over 40 in a week. This is higher then the standard overtime rate of time-and-a-half, or one and a half times an employee's normal pay rate.