Puerto Rico Annual Expense Report

Description

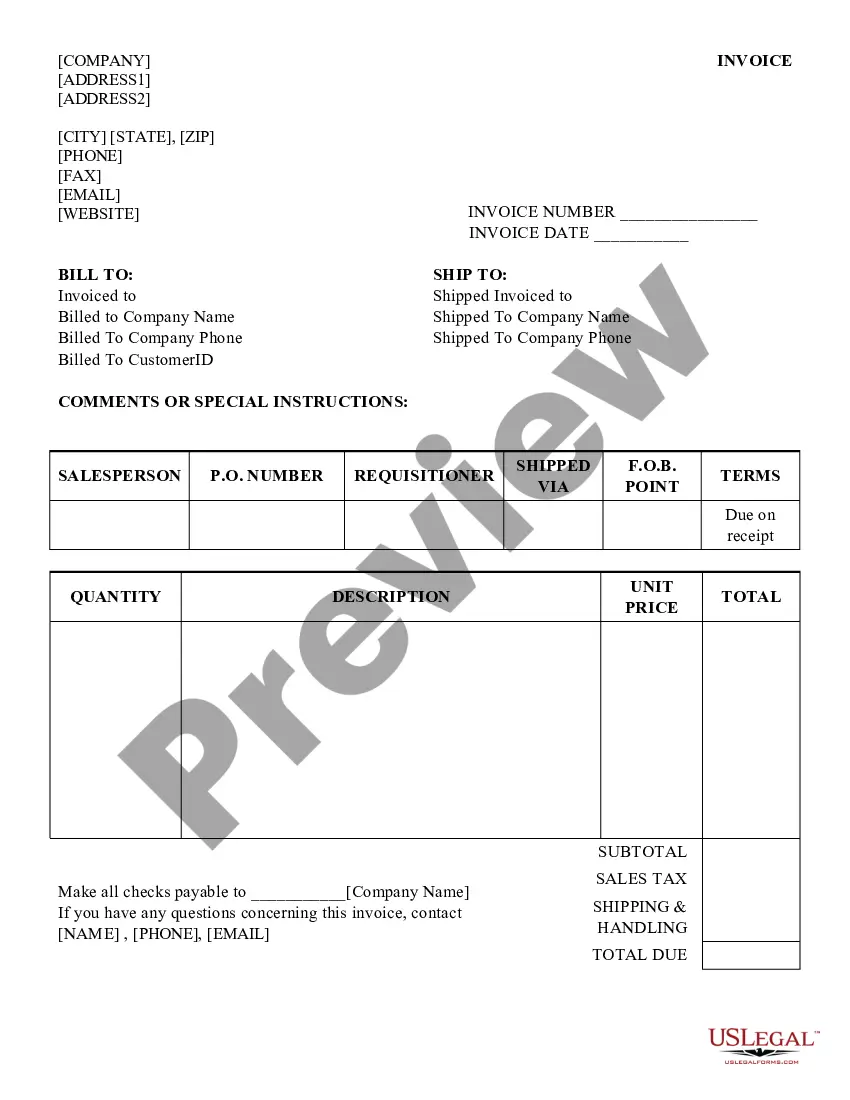

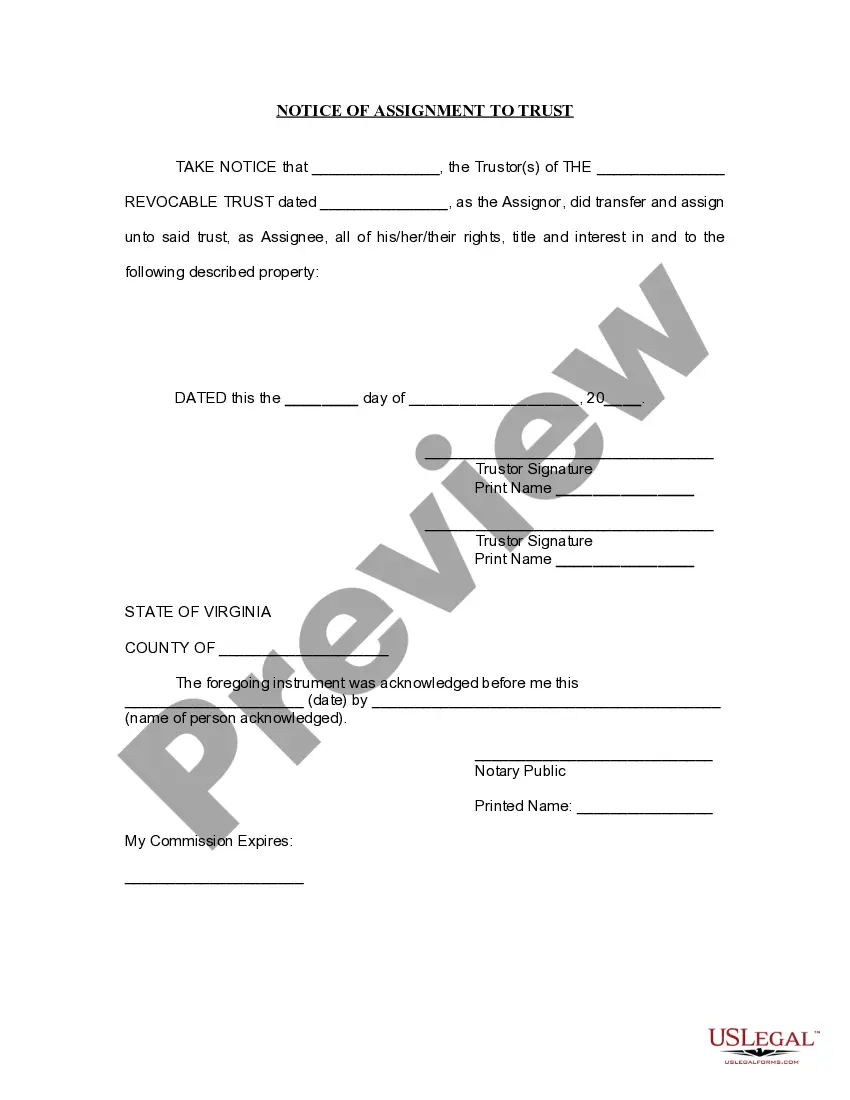

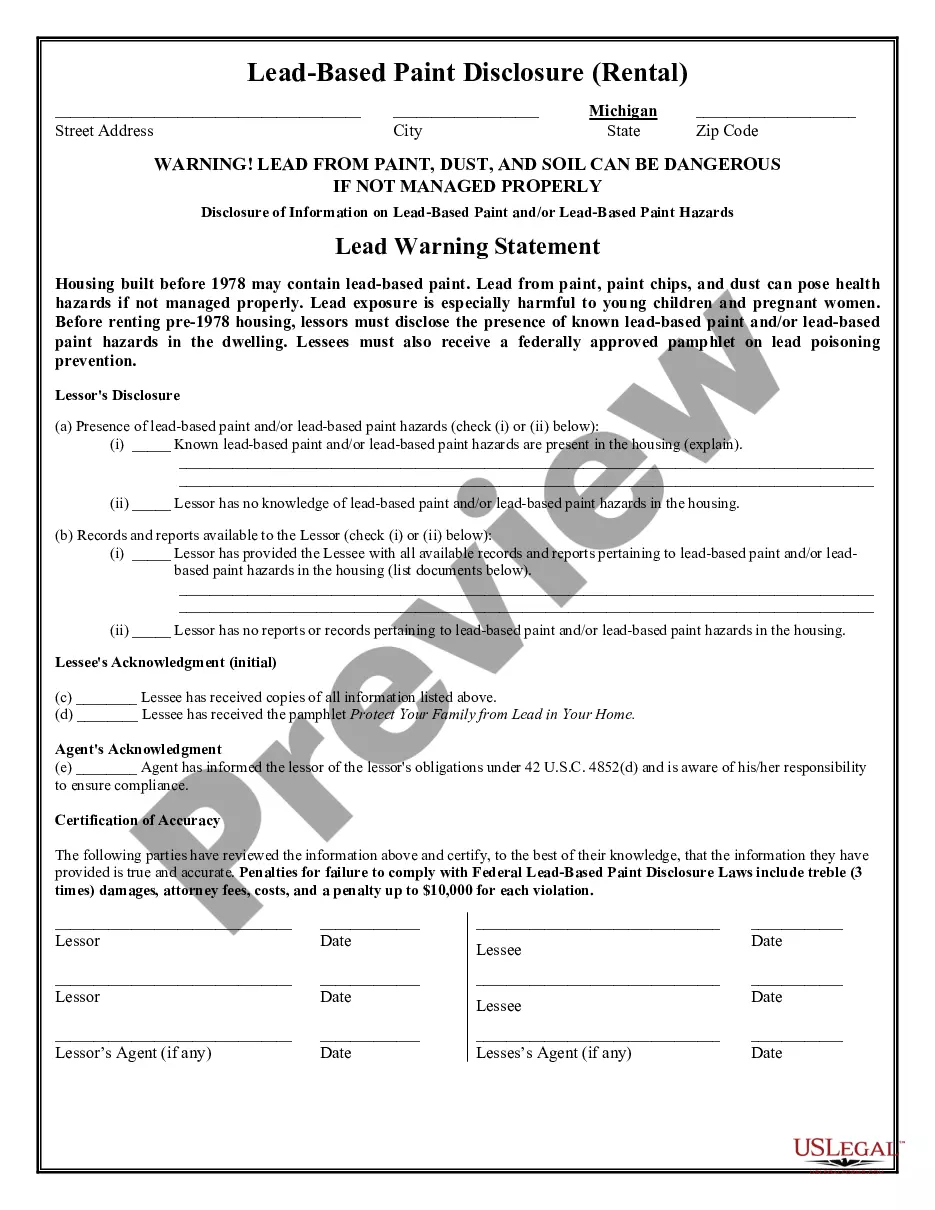

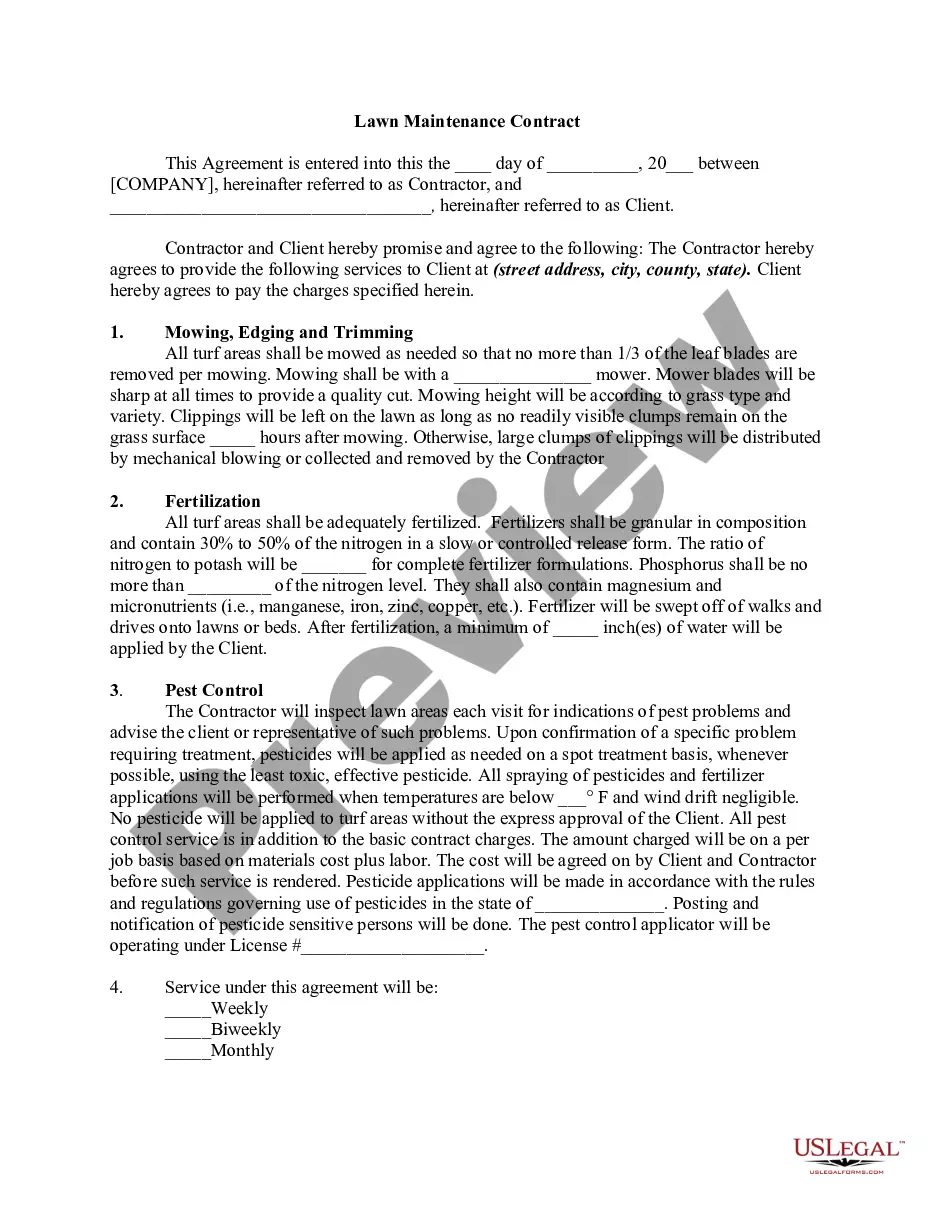

How to fill out Annual Expense Report?

If you wish to complete, acquire, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states or keywords. Use US Legal Forms to locate the Puerto Rico Annual Expense Report in just a few clicks.

Every legal document format you purchase is yours indefinitely. You have access to every document you have downloaded within your account.

Select the My documents section and choose a document to print or download again. Complete and download, and print the Puerto Rico Annual Expense Report with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click on the Purchase button to acquire the Puerto Rico Annual Expense Report.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- For first-time users of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the appropriate city/region.

- Step 2. Use the Preview option to examine the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have located the form you desire, click on the Purchase now button. Select your preferred pricing plan and provide your information to register for an account.

- Step 5. Process the payment. You can use a credit card or a PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Annual Expense Report.

Form popularity

FAQ

Yes, you can fill out a DBA online in Puerto Rico. The online system simplifies the filing process, making it convenient for you. Remember to keep a copy for your records, as it will support your Puerto Rico Annual Expense Report.

Filing your Puerto Rico annual report online involves accessing the Department of State's website. Here, you'll find the necessary forms and instructions to guide you. Be sure to prepare your Puerto Rico Annual Expense Report in advance, as accurate information is crucial for a smooth filing process.

Yes, a US citizen can easily start a business in Puerto Rico. The process is straightforward, allowing you to enjoy numerous benefits, such as favorable tax incentives. As part of your setup, you'll also need to consider filing your Puerto Rico Annual Expense Report, ensuring your business remains compliant.

Incorporating in Puerto Rico involves several steps, including selecting a business structure, filing necessary documents, and registering with the Department of State. You will gather required documentation, such as articles of incorporation, and create an operating agreement if you choose an LLC. Once established, your Puerto Rico Annual Expense Report will help track your financials effectively. Consider using USLegalForms to streamline the incorporation process and ensure compliance with local regulations.

Puerto Rico follows various US federal laws and regulations, although it has its own local legal framework. This dual system can sometimes lead to complexities, particularly in taxation and compliance issues. When you are compiling your Puerto Rico Annual Expense Report, incorporating both US and local laws becomes essential for accurate representation. It's advisable to stay informed about changes that may affect your business operations in this unique jurisdiction.

Yes, Puerto Rico is a territory of the United States, making it US-based in many respects. Businesses operating in Puerto Rico typically enjoy certain federal benefits, although some local regulations differ. When preparing financial documents, such as the Puerto Rico Annual Expense Report, it's crucial to understand both federal and local laws to ensure compliance. This relationship with the US offers additional opportunities for Puerto Rican businesses.

Establishing a Limited Liability Company (LLC) in Puerto Rico offers several advantages, such as personal liability protection and pass-through taxation. An LLC structure also provides flexibility in management and profitability distributions among owners. Furthermore, when you prepare your Puerto Rico Annual Expense Report, having an LLC makes tracking your business finances straightforward. Overall, forming an LLC can enhance your business's financial strategy in Puerto Rico.

Puerto Rico follows US GAAP for its financial reporting, making it comparable to the practices used across the mainland United States. Adhering to these standards ensures that financial documents, including the Puerto Rico Annual Expense Report, maintain reliability and accuracy. This alignment is particularly beneficial for businesses that need to report consistently to stakeholders. Understanding these principles is vital for accurate financial management in Puerto Rico.

Yes, Puerto Rico utilizes the US banking system, which provides access to national banking institutions. This connection allows residents and businesses in Puerto Rico to engage seamlessly in financial services offered across the United States. As you handle a Puerto Rico Annual Expense Report, the integration with US banking helps facilitate smoother transactions and financial operations. The familiarity with the US banking framework also supports local business growth.

The United States is the primary user of US Generally Accepted Accounting Principles (GAAP). However, some territories and regions, like Puerto Rico, also adopt US GAAP for their financial reporting. This alignment helps ensure consistency and transparency in financial statements, which is crucial for businesses operating under these regulations. If you're dealing with a Puerto Rico Annual Expense Report, understanding US GAAP is essential.