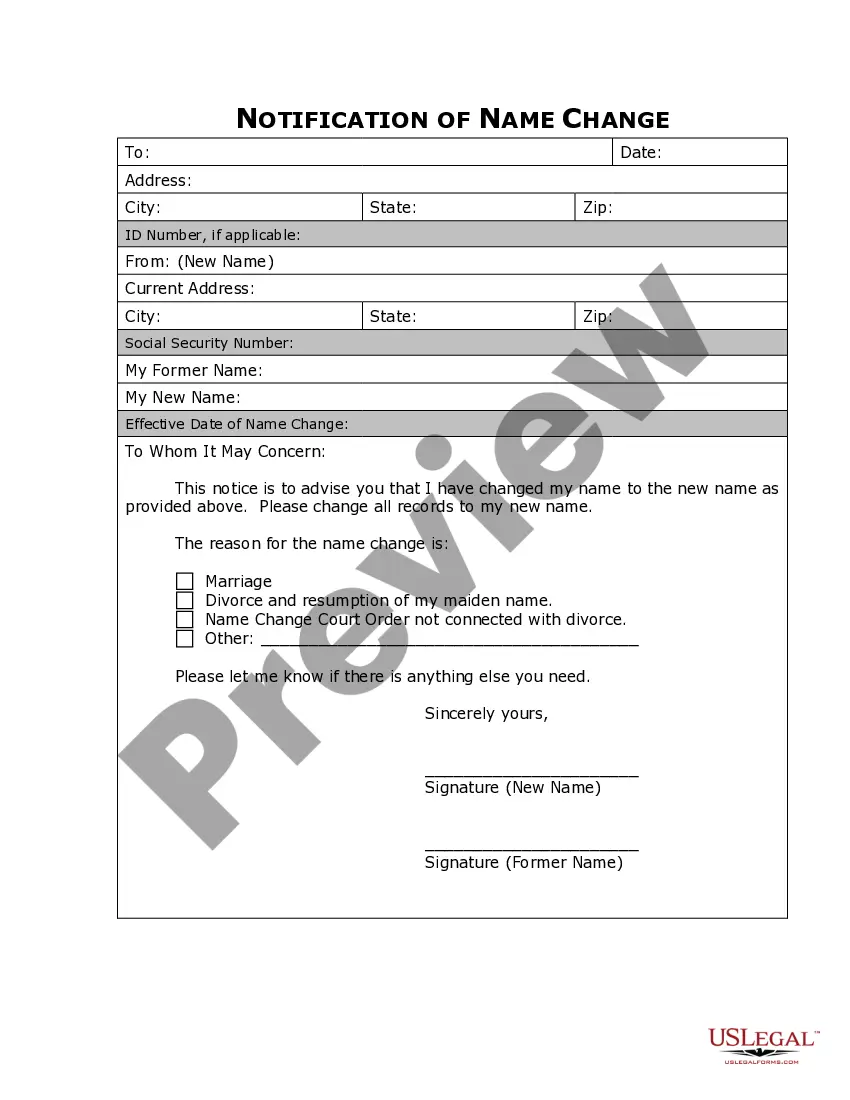

Puerto Rico Exploration Agreement

Description

How to fill out Exploration Agreement?

If you want to full, obtain, or printing lawful papers themes, use US Legal Forms, the biggest variety of lawful types, which can be found online. Make use of the site`s basic and practical research to obtain the documents you will need. Different themes for business and person functions are categorized by categories and suggests, or search phrases. Use US Legal Forms to obtain the Puerto Rico Exploration Agreement in a handful of mouse clicks.

When you are presently a US Legal Forms customer, log in to your bank account and click the Obtain button to obtain the Puerto Rico Exploration Agreement. You can even gain access to types you earlier delivered electronically within the My Forms tab of your own bank account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for that right metropolis/land.

- Step 2. Make use of the Preview method to check out the form`s articles. Do not forget to learn the outline.

- Step 3. When you are not satisfied with the develop, utilize the Look for discipline at the top of the display to discover other variations from the lawful develop format.

- Step 4. Upon having identified the shape you will need, click on the Get now button. Pick the prices plan you prefer and put your credentials to register for an bank account.

- Step 5. Procedure the transaction. You should use your bank card or PayPal bank account to complete the transaction.

- Step 6. Find the format from the lawful develop and obtain it in your device.

- Step 7. Complete, revise and printing or indication the Puerto Rico Exploration Agreement.

Every lawful papers format you purchase is yours eternally. You possess acces to every develop you delivered electronically within your acccount. Go through the My Forms area and choose a develop to printing or obtain yet again.

Contend and obtain, and printing the Puerto Rico Exploration Agreement with US Legal Forms. There are many skilled and status-particular types you may use for the business or person needs.

Form popularity

FAQ

A shipment to Puerto Rico doesn't need to go through customs because it is a domestic package. However, you will need a commercial invoice, and if the value of the shipment exceeds $2,500 US you will also need Electronic Export Information.

Puerto Rico is part of the U.S. customs territory - therefore, U.S. customs laws apply. Imported goods must be reported to the U.S. Customs Service (Customs and Border Protection-CBP), where they are inspected to ensure compliance with U.S. law.

Not any different than the USA. Number of house Name of Street. City, puerto Rico. Zip code. One thing that is added is the name of the barrio or urbanization (subdivision) So a typucal address may be: 1645 Asomante St. Urb Altamesa. Carolina, Puerto Rico. 00934.

Puerto Rico is part of the U.S. Customs territory and therefore no customs duties are assessed on products coming from the mainland United States. There is, however, a 11.5 percent excise tax (sales tax) applied on products imported into the island, as well as on those produced locally.

In addition to being in Puerto Rico for 183 days, you must also pass two additional tests: You must not have a ?tax home? outside of Puerto Rico at any point in that taxable year, and.

Currently, Puerto Rico is considered an unincorporated territory of the US. This means that the USPS considers Puerto Rico to be domestic shipping, but some private carriers (like FedEx or UPS) consider Puerto Rico to be international.

As a U.S. territory, shipments to Puerto Rico are not considered exports so duties are not applied.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.