Puerto Rico Dissolution of Pooled Unit

Description

How to fill out Dissolution Of Pooled Unit?

It is possible to invest hours on the Internet trying to find the authorized papers template that meets the state and federal demands you need. US Legal Forms supplies a huge number of authorized kinds that are analyzed by experts. It is simple to download or print the Puerto Rico Dissolution of Pooled Unit from our assistance.

If you already possess a US Legal Forms account, you may log in and then click the Download key. After that, you may full, revise, print, or indicator the Puerto Rico Dissolution of Pooled Unit. Each and every authorized papers template you acquire is your own permanently. To obtain an additional version of the acquired form, go to the My Forms tab and then click the related key.

If you work with the US Legal Forms website the first time, adhere to the basic recommendations below:

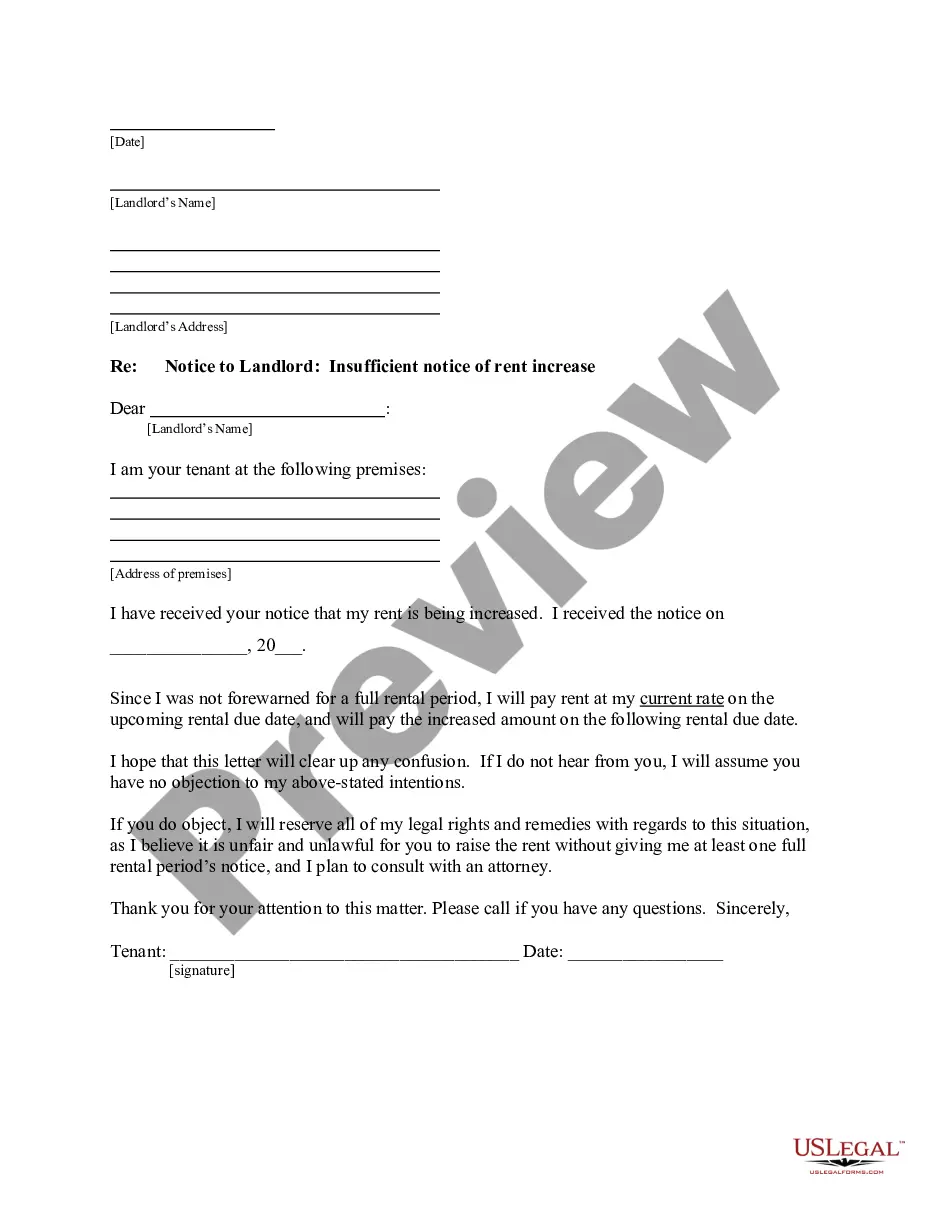

- Initially, ensure that you have chosen the correct papers template to the area/town of your choice. Look at the form description to ensure you have picked out the proper form. If available, make use of the Review key to check from the papers template also.

- In order to locate an additional version in the form, make use of the Lookup field to discover the template that suits you and demands.

- Once you have found the template you want, click Purchase now to move forward.

- Pick the rates program you want, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal account to purchase the authorized form.

- Pick the formatting in the papers and download it to the gadget.

- Make alterations to the papers if needed. It is possible to full, revise and indicator and print Puerto Rico Dissolution of Pooled Unit.

Download and print a huge number of papers templates utilizing the US Legal Forms website, that offers the greatest variety of authorized kinds. Use specialist and express-certain templates to deal with your company or individual requirements.