This form provides boilerplate contract clauses that make provision for how transaction costs, both initially and in the event of a dispute or litigation, will be handled under the contract agreement. Several different language options are included to suit individual needs and circumstances.

Puerto Rico Negotiating and Drafting Transaction Cost Provisions

Description

How to fill out Negotiating And Drafting Transaction Cost Provisions?

If you need to comprehensive, acquire, or print lawful file web templates, use US Legal Forms, the greatest collection of lawful types, that can be found on-line. Utilize the site`s simple and easy hassle-free look for to discover the papers you will need. A variety of web templates for company and specific reasons are categorized by groups and says, or search phrases. Use US Legal Forms to discover the Puerto Rico Negotiating and Drafting Transaction Cost Provisions with a couple of click throughs.

Should you be previously a US Legal Forms consumer, log in in your accounts and click on the Obtain switch to obtain the Puerto Rico Negotiating and Drafting Transaction Cost Provisions. You may also accessibility types you in the past acquired inside the My Forms tab of your accounts.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate town/nation.

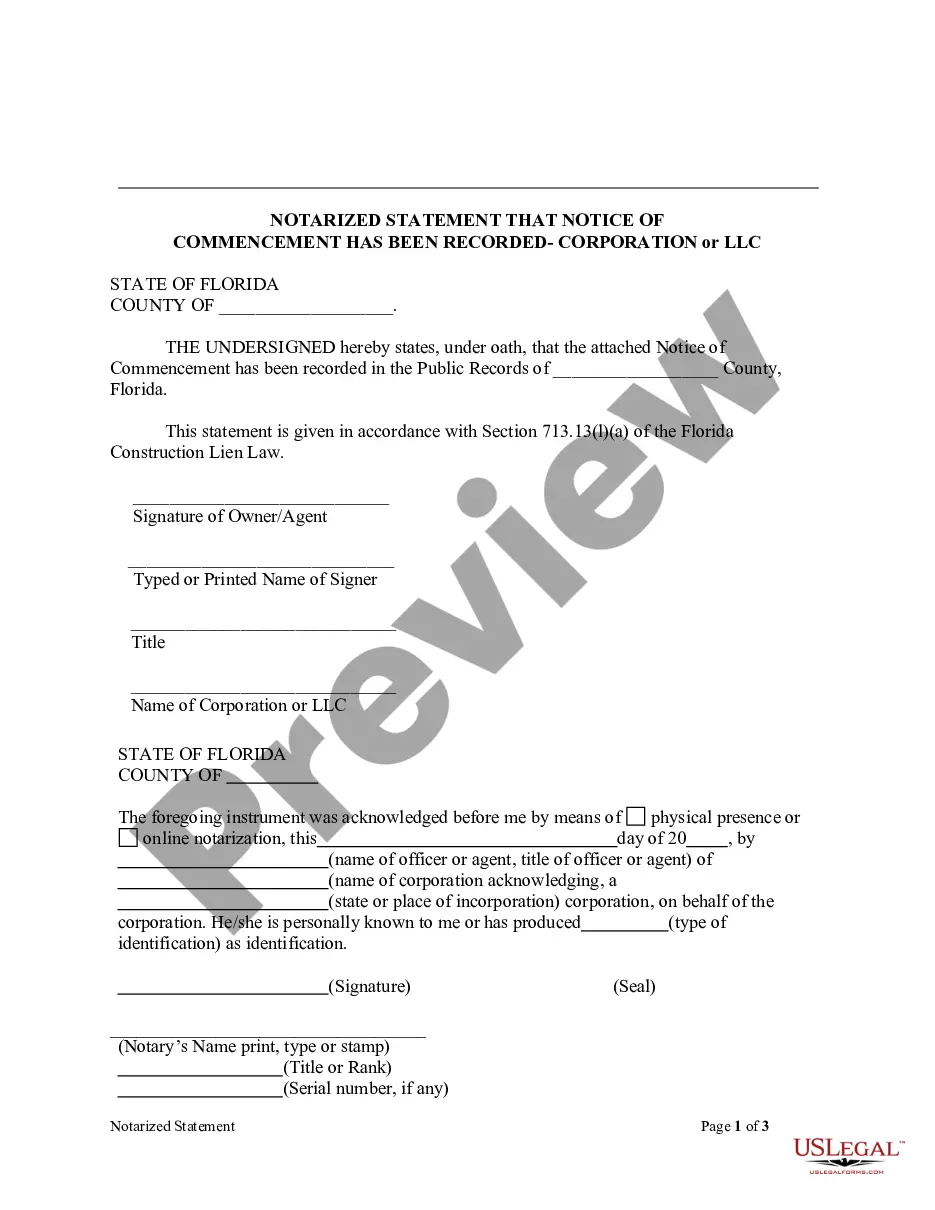

- Step 2. Take advantage of the Review option to examine the form`s information. Never neglect to read the outline.

- Step 3. Should you be unhappy together with the type, take advantage of the Look for field towards the top of the monitor to discover other versions from the lawful type web template.

- Step 4. When you have identified the shape you will need, click the Acquire now switch. Select the costs prepare you prefer and include your accreditations to register for the accounts.

- Step 5. Process the deal. You can use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Pick the format from the lawful type and acquire it on your own gadget.

- Step 7. Comprehensive, edit and print or signal the Puerto Rico Negotiating and Drafting Transaction Cost Provisions.

Every lawful file web template you acquire is the one you have permanently. You might have acces to each type you acquired in your acccount. Select the My Forms portion and select a type to print or acquire yet again.

Contend and acquire, and print the Puerto Rico Negotiating and Drafting Transaction Cost Provisions with US Legal Forms. There are thousands of specialist and state-particular types you may use for your personal company or specific needs.

Form popularity

FAQ

Puerto Rico's residents say flooding, erosion, and loss of wetlands and other coastal habitats are among the most important threats the island's government should prioritize in coastal resource planning, ing to a survey by the island's Department of Natural and Environmental Resources (DNER).

Systemic barriers and challenges limit many Puerto Ricans' access to fair and affordable financial services and products. What's more, people encounter problems because of limited ability to speak and read English (the language of most financial transactions and disclosures) and they face rapidly rising housing costs.

Hear this out loud PauseAct 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

It has also struggled under a large public debt in recent years, totaling about $70 billion?or 68 percent of gross domestic product (GDP)?in 2020. Puerto Rico's downward spiral has been compounded by natural disasters, government mismanagement and corruption, and the COVID-19 pandemic.

Hear this out loud PauseIf the volume of business is under three million dollars, the statement must be prepared in ance with GAAP. If the corporation's volume of business is over three million dollars, then the statement must be audited by a certified public accountant licensed to practice in Puerto Rico.

Hear this out loud PauseThe following pages detail the main causes of the island's financial troubles, focusing on labor force decline, the health care crisis, and debt and debt service costs.

Puerto Rico's short-term economic performance is overshadowed by a large cloud of uncertainty, as the island's government concurrently addresses the impacts of three systemic shocks: the COVID-19 pandemic, Hurricane Maria, and the bankruptcy of the central government.

Hear this out loud PauseA foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.