Puerto Rico Self-Employed Precast Concrete Contract

Description

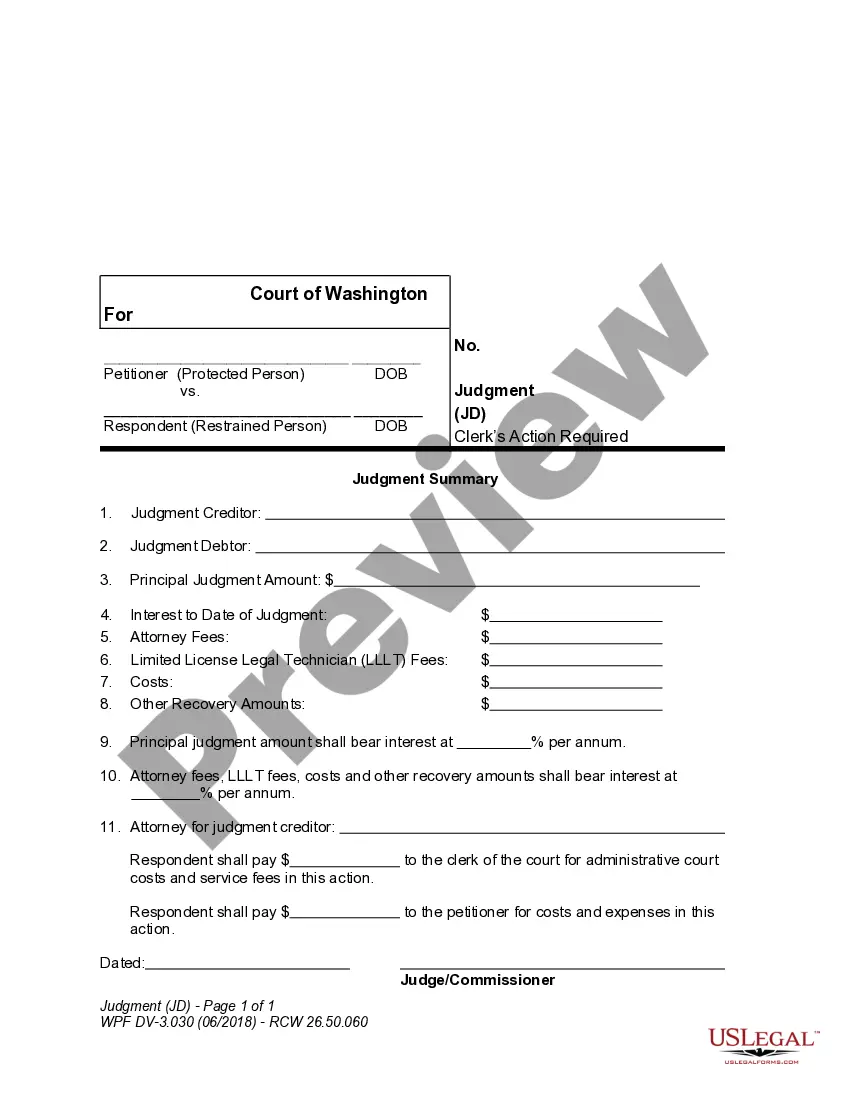

How to fill out Self-Employed Precast Concrete Contract?

You can spend time online searching for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been vetted by professionals.

You can download or print the Puerto Rico Self-Employed Precast Concrete Contract from their service.

If available, utilize the Review option to inspect the document template as well. If you wish to find another version of the form, use the Search section to locate the template that meets your criteria. Once you find the template you need, click Get now to proceed. Choose the pricing plan you desire, enter your credentials, and create an account on US Legal Forms. Complete the payment. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make changes to the document if necessary. You can complete, edit, sign, and print the Puerto Rico Self-Employed Precast Concrete Contract. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can sign in and select the Download option.

- Then, you can complete, edit, print, or sign the Puerto Rico Self-Employed Precast Concrete Contract.

- Every legal document template you obtain is yours indefinitely.

- To acquire another copy of a purchased form, navigate to the My documents section and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, confirm that you have chosen the correct document template for the state/city of your choice.

- Review the form details to ensure you have selected the right form.

Form popularity

FAQ

An independent contractor needs to complete various forms, including the IRS Form W-9 and potentially the Puerto Rico tax forms associated with their Puerto Rico Self-Employed Precast Concrete Contract. These forms provide essential information for tax reporting and ensure proper classification. Additionally, keeping detailed records of expenses related to the contract is vital. You can find templates and guidance on USLegalForms to help streamline this process and ensure accuracy in your submissions.

Section 1062.03 of the Puerto Rico Internal Revenue Code outlines the tax obligations for self-employed individuals, including those involved in a Puerto Rico Self-Employed Precast Concrete Contract. This section explains how independent contractors must report their income and the deductions they can claim. Understanding this section is crucial for compliance and to maximize potential tax benefits. Utilizing resources like USLegalForms can help simplify the paperwork and ensure you meet all legal requirements.

One key disadvantage of precast concrete is its heavy weight, which can complicate transportation and installation. Furthermore, it often requires specialized equipment and trained personnel for proper handling. Understanding these challenges is essential when entering a Puerto Rico Self-Employed Precast Concrete Contract, as it can affect your overall project timeline and budget.

One common issue with precast concrete is that it may not always adapt well to changes in design once production begins. Additionally, if there are quality control issues during manufacturing, it can lead to significant structural problems. When considering a Puerto Rico Self-Employed Precast Concrete Contract, it’s vital to work with reputable suppliers to mitigate these risks.

The life expectancy of precast concrete typically ranges from 50 to 100 years, depending on environmental conditions and maintenance practices. This longevity makes it a popular choice for many construction projects. When you choose a Puerto Rico Self-Employed Precast Concrete Contract, you invest in a material that can last for decades with proper care.

While precast concrete has many benefits, it also comes with some disadvantages. The initial setup costs can be high, and it requires specialized equipment for installation and transportation. Additionally, any repairs may be more complex compared to traditional concrete methods. Understanding these aspects is crucial when entering a Puerto Rico Self-Employed Precast Concrete Contract.

Rule 60 in Puerto Rico relates to the legal framework governing contracts, including those for self-employed individuals. This rule is particularly important for anyone entering into a Puerto Rico Self-Employed Precast Concrete Contract, as it defines the requirements for contract enforcement and compliance. To fully understand your rights and responsibilities under Rule 60, reviewing the rule in detail or consulting with a legal professional is recommended.

Puerto Rico has specific exemptions that can apply to certain types of income and businesses. For example, many businesses, including those operating under a Puerto Rico Self-Employed Precast Concrete Contract, may be exempt from certain federal taxes but still have obligations under local law. It is critical to stay informed about these exemptions, as they can significantly impact your overall tax burden and financial planning.

The self-employment tax in Puerto Rico is assessed at a rate similar to the federal level, which is approximately 15.3%. This tax applies to net earnings from self-employment, including income from a Puerto Rico Self-Employed Precast Concrete Contract. To accurately calculate your tax liability, keeping detailed records of your earnings and expenses is essential, and utilizing resources like uslegalforms can guide you through the process.

Rule 22 in Puerto Rico pertains to the regulations governing the operation of self-employed individuals and their businesses. It outlines specific compliance measures that need to be followed, especially for those involved in contracting, such as those with a Puerto Rico Self-Employed Precast Concrete Contract. Understanding Rule 22 is crucial for maintaining legal and operational standards, so consider reviewing it thoroughly or consulting a legal expert.