Puerto Rico Self-Employed Seasonal Picker Services Contract

Description

How to fill out Self-Employed Seasonal Picker Services Contract?

Are you presently in a situation where you need to obtain documents for either organizational or personal reasons nearly every day.

There are numerous trustworthy document templates accessible online, but finding ones you can rely on isn't straightforward.

US Legal Forms offers a vast array of document templates, including the Puerto Rico Self-Employed Seasonal Picker Services Agreement, designed to meet state and federal requirements.

When you find the right form, simply click Get now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, just Log In.

- Then, you can download the Puerto Rico Self-Employed Seasonal Picker Services Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

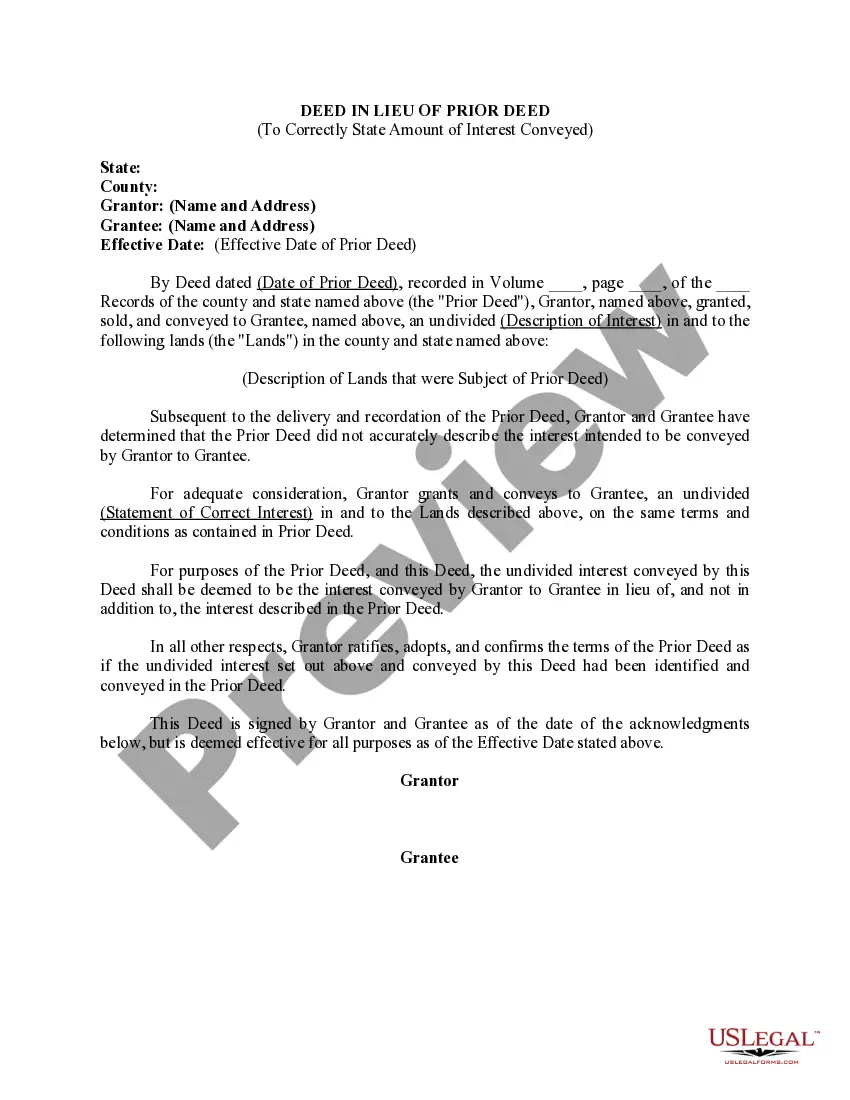

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search section to find a form that meets your requirements.

Form popularity

FAQ

Hiring in Puerto Rico involves understanding local labor laws and regulations. Begin by defining the role you need to fill and then create a clear job description. For independent contractors, using a Puerto Rico Self-Employed Seasonal Picker Services Contract can help set the right expectations and protect both parties.

To obtain a general contractor's license in Puerto Rico, you need to meet specific eligibility requirements, including proving your experience and passing relevant examinations. The application process can be detailed, so consider using resources like uslegalforms to help you navigate the necessary paperwork and ensure compliance with local regulations.

In essence, you can hire someone as a 1099 independent contractor, but it's important to follow the proper guidelines. The worker must meet specific criteria set by the IRS to qualify as an independent contractor rather than an employee. When drafting a Puerto Rico Self-Employed Seasonal Picker Services Contract, ensure you include all necessary terms to clearly define the relationship.

Yes, Puerto Rico follows many US employment laws, but there are also unique regulations that apply specifically to the territory. It's crucial to understand these differences, especially when creating contracts like the Puerto Rico Self-Employed Seasonal Picker Services Contract. Be sure to consult legal resources or platforms like uslegalforms to navigate these laws effectively.

The IRS uses a series of criteria to determine if a person qualifies as an independent contractor. Key factors include the level of control you have over the worker, the relationship's nature, and how the work is performed. When engaging services under a Puerto Rico Self-Employed Seasonal Picker Services Contract, ensure you clearly define these elements to avoid misclassification.

Hiring independent contractors as a sole proprietor involves a few key steps. First, identify the specific tasks you need help with and the skills required. Once you find suitable candidates, ensure that you have clear agreements, such as a Puerto Rico Self-Employed Seasonal Picker Services Contract, to outline expectations and responsibilities.

To be authorized as an independent contractor in the US, you'll typically need to register your business, obtain any required licenses, and comply with tax obligations. Additionally, having a solid understanding of contracts, like the Puerto Rico Self-Employed Seasonal Picker Services Contract, will help you navigate your responsibilities effectively.

Yes, you generally need work authorization to operate as an independent contractor in the US. This ensures that you can legally perform your services and receive payment. If you're considering a Puerto Rico Self-Employed Seasonal Picker Services Contract, ensure you have the necessary work authorization before starting.

In Puerto Rico, whether you need a business license depends on the type of services you offer. Many independent contractors are required to obtain a license to operate legally. If you plan to enter a Puerto Rico Self-Employed Seasonal Picker Services Contract, checking local regulations is crucial for compliance.

To be authorized as an independent contractor in the US, you need to understand the legal requirements in your specific state. Typically, this involves obtaining the necessary permits or licenses and ensuring you comply with tax regulations. For those entering into a Puerto Rico Self-Employed Seasonal Picker Services Contract, following these steps will help you operate legally and efficiently.