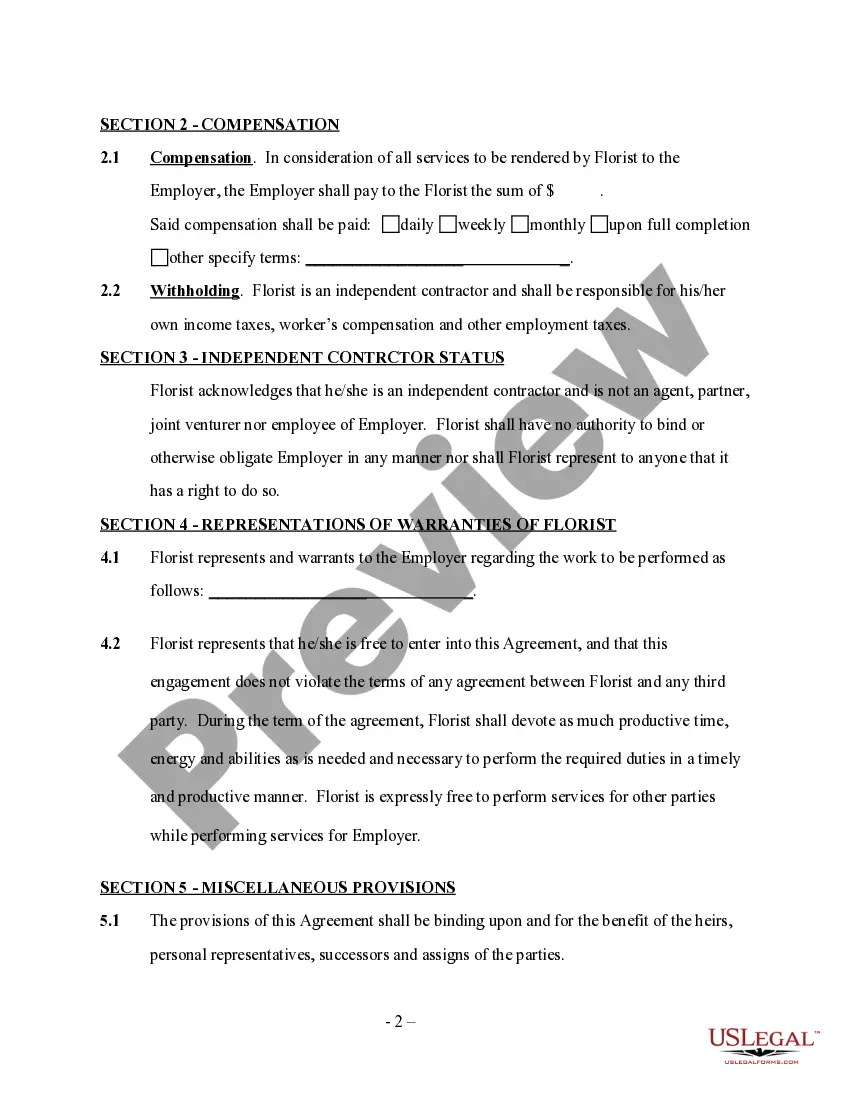

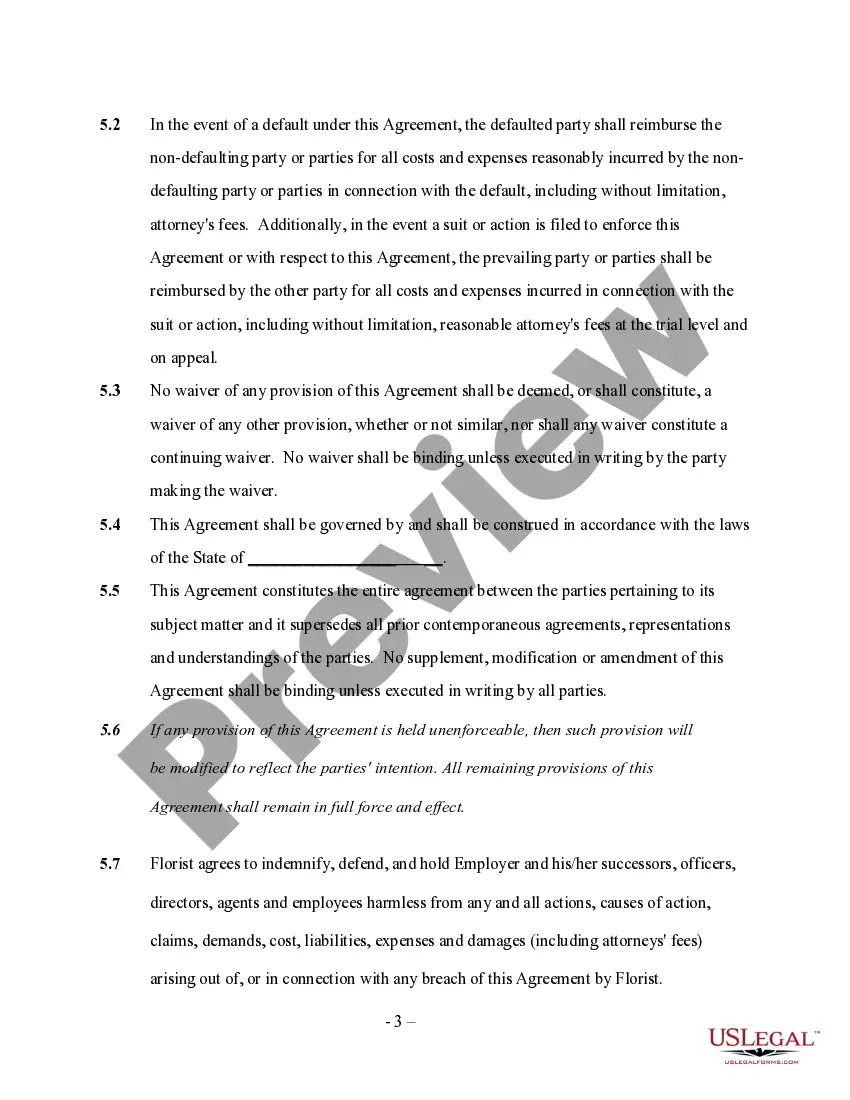

Puerto Rico Florist Services Contract - Self-Employed

Description

How to fill out Florist Services Contract - Self-Employed?

You might spend time online searching for the approved document format that adheres to the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can easily download or print the Puerto Rico Florist Services Contract - Self-Employed from their service.

If available, use the Preview option to look at the document format at the same time. To get another version of your form, use the Lookup field to find the template that meets your needs and specifications. Once you have found the template you want, click Acquire now to proceed. Choose the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your system. Make adjustments to the document if necessary. You can complete, modify, sign, and print the Puerto Rico Florist Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click the Download option.

- Next, you can complete, modify, print, or sign the Puerto Rico Florist Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the downloaded form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the area/region of your choice.

- Check the form description to ensure you have chosen the appropriate template.

Form popularity

FAQ

The equivalent of a 1099 in Puerto Rico is the Form 480. This form is used to report payments made to independent contractors, including those working under a Puerto Rico Florist Services Contract - Self-Employed. It is crucial to understand the requirements for filing this form to avoid penalties. Utilizing resources like USLegalForms can enhance your understanding and compliance.

Form 480 is a tax form used in Puerto Rico to report income earned, particularly relevant for self-employed individuals under a Puerto Rico Florist Services Contract - Self-Employed. This form is essential for accurately reporting taxes owed to the Puerto Rican government. Understanding the details of this form can greatly benefit your operations, and assistance from USLegalForms can provide clarity.

Yes, Puerto Ricans can receive 1099 forms if they are independent contractors or self-employed, including those operating under a Puerto Rico Florist Services Contract - Self-Employed. The 1099 form reflects the income earned and must be filed for tax purposes. Ensuring proper filing and compliance is essential, and services from USLegalForms can be beneficial.

Individuals who have net earnings from self-employment typically need to file Schedule SE, including those under a Puerto Rico Florist Services Contract - Self-Employed. This includes business owners and freelancers earning above a certain threshold. Filing accurately is crucial to maintain compliance with tax laws. Using professional guidance can make this process more manageable.

Yes, Puerto Rico imposes a self-employment tax on individuals earning income, including those under a Puerto Rico Florist Services Contract - Self-Employed. This tax is calculated similarly to the federal self-employment tax. It's essential to understand these tax obligations to avoid penalties and ensure compliance. USLegalForms can provide resources for understanding self-employment tax specifics.

Yes, Puerto Rico requires certain businesses, including florists, to obtain a business license. Depending on the scope of your operations under the Puerto Rico Florist Services Contract - Self-Employed, additional permits may also be necessary. To navigate these requirements smoothly, consider using platforms like USLegalForms for detailed guidance and services.

No, an I-9 and a 1099 serve different purposes. The I-9 is used to verify an employee's eligibility to work in the United States, while the 1099 reports income earned by independent contractors, including those under a Puerto Rico Florist Services Contract - Self-Employed. Understanding these differences is vital for compliance. Seeking guidance from professional services can ensure accurate handling of these documents.

Yes, a US company can do business in Puerto Rico under the Puerto Rico Florist Services Contract - Self-Employed framework. Puerto Rico is a US territory, and businesses can operate there similarly to any other state. However, companies must register and comply with local laws and regulations. Utilizing resources like USLegalForms can simplify this process.

A merchant registration certificate in Puerto Rico is an official document that allows individuals to conduct business legally within the territory. It verifies that your business is registered with the local government and compliant with tax obligations. For self-employed florists, this certificate is vital for building trust with clients and suppliers. UsLegalForms can help you navigate this registration smoothly.

To obtain a merchant certificate in Puerto Rico, you must complete the registration process through the Department of Treasury. This includes submitting necessary paperwork and paying fees associated with the registration. As a self-employed florist, having this certificate legitimizes your business operations. Using platforms like UsLegalForms simplifies this process by providing clear guidance and templates.