Puerto Rico Farm Hand Services Contract - Self-Employed

Description

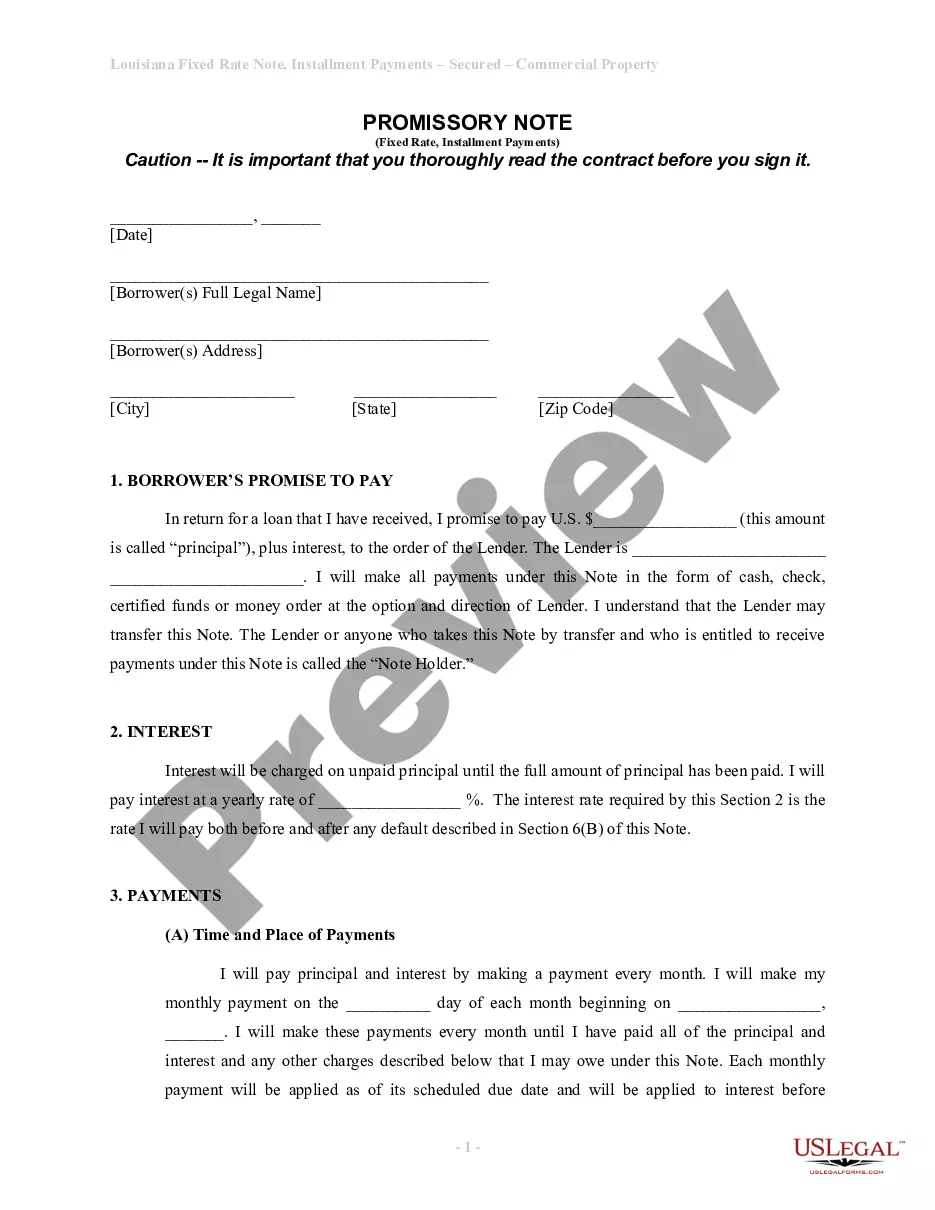

How to fill out Farm Hand Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms such as the Puerto Rico Farm Hand Services Contract - Self-Employed in a matter of minutes.

If you already have a subscription, Log In and download the Puerto Rico Farm Hand Services Contract - Self-Employed from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some easy steps to get started: Make sure you have selected the correct form for your city/county. Click the Preview button to review the form's details. Check the form information to ensure that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you wish and provide your credentials to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Puerto Rico Farm Hand Services Contract - Self-Employed. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

- Access the Puerto Rico Farm Hand Services Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

The farm optional method allows farmers to compute their self-employment tax based on gross farm income rather than net income. This calculation can be particularly beneficial for those operating under a Puerto Rico Farm Hand Services Contract - Self-Employed. By using this method, you can simplify your tax reporting and potentially reduce your tax liability. Accessing reliable resources like uslegalforms can help you understand this method better and apply it effectively.

Yes, Puerto Rico does impose a self-employment tax. This tax is applicable to individuals who earn income through self-employment, including those who operate under a Puerto Rico Farm Hand Services Contract - Self-Employed. It’s important to prepare for this tax when planning your finances, as it directly impacts your net income. Using platforms like uslegalforms can help ensure your contracts align with tax regulations.

Yes, professional services are generally taxable in Puerto Rico. This includes various services performed by individuals, such as the ones outlined in a Puerto Rico Farm Hand Services Contract - Self-Employed. Understanding your tax obligations is vital to remain compliant and optimize your earnings. Consider consulting resources like uslegalforms to manage your professional services contracts appropriately.

The new rules for self-employed individuals focus on various aspects, including tax obligations and reporting requirements. These regulations emphasize accurate record-keeping and compliance with local laws. Utilizing a Puerto Rico Farm Hand Services Contract - Self-Employed can help you stay informed and compliant, ensuring that you understand your responsibilities as a self-employed farmer.

Yes, farming can be classified as a self-employed activity. If you operate your own farm and manage the business independently, you are considered self-employed. This classification allows you to take advantage of the Puerto Rico Farm Hand Services Contract - Self-Employed, which provides important legal protections and outlines expectations for work arrangements.

Puerto Rico Act 80 addresses wrongful termination and outlines the rights of employees regarding job stability. It mandates that employers provide justifications for dismissing workers. When creating a Puerto Rico Farm Hand Services Contract - Self-Employed, it is crucial to adhere to this law to ensure compliance and protect both your rights and your workers' rights.

Law 75 in Puerto Rico governs the relationship between distributors and suppliers, particularly in the context of commercial dealings. It provides protections to distributors to prevent unjust termination of contracts. If you are self-employed, incorporating elements of Law 75 into a Puerto Rico Farm Hand Services Contract - Self-Employed can enhance business relationships and secure your interests.

In Puerto Rico, employees are entitled to meal breaks during their work shifts, and not providing these breaks can lead to penalties for employers. Specifically, employers may face compensation claims for missed breaks. For those self-employed in agriculture, including clear meal break provisions in your Puerto Rico Farm Hand Services Contract - Self-Employed is essential to avoid legal issues.

The new inheritance law in Puerto Rico simplifies the process of passing on assets after death. This law allows for a more efficient distribution of property and ensures that heirs receive their rightful shares. If you are involved in agricultural operations, considering a Puerto Rico Farm Hand Services Contract - Self-Employed may help clarify terms related to inheritance in the context of your business.

Law 80 is about employment termination in Puerto Rico. It protects employees against unjust dismissal by requiring employers to have a just cause for termination. As a self-employed individual, you might find yourself drafting a Puerto Rico Farm Hand Services Contract - Self-Employed that reflects these rights and ensures fairness in employment agreements.