Puerto Rico Housecleaning Services Contract - Self-Employed

Description

How to fill out Housecleaning Services Contract - Self-Employed?

If you wish to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to access the Puerto Rico Housecleaning Services Contract - Self-Employed in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Select the My documents section and choose a form to print or download again.

Act promptly and download, and print the Puerto Rico Housecleaning Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Puerto Rico Housecleaning Services Contract - Self-Employed.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

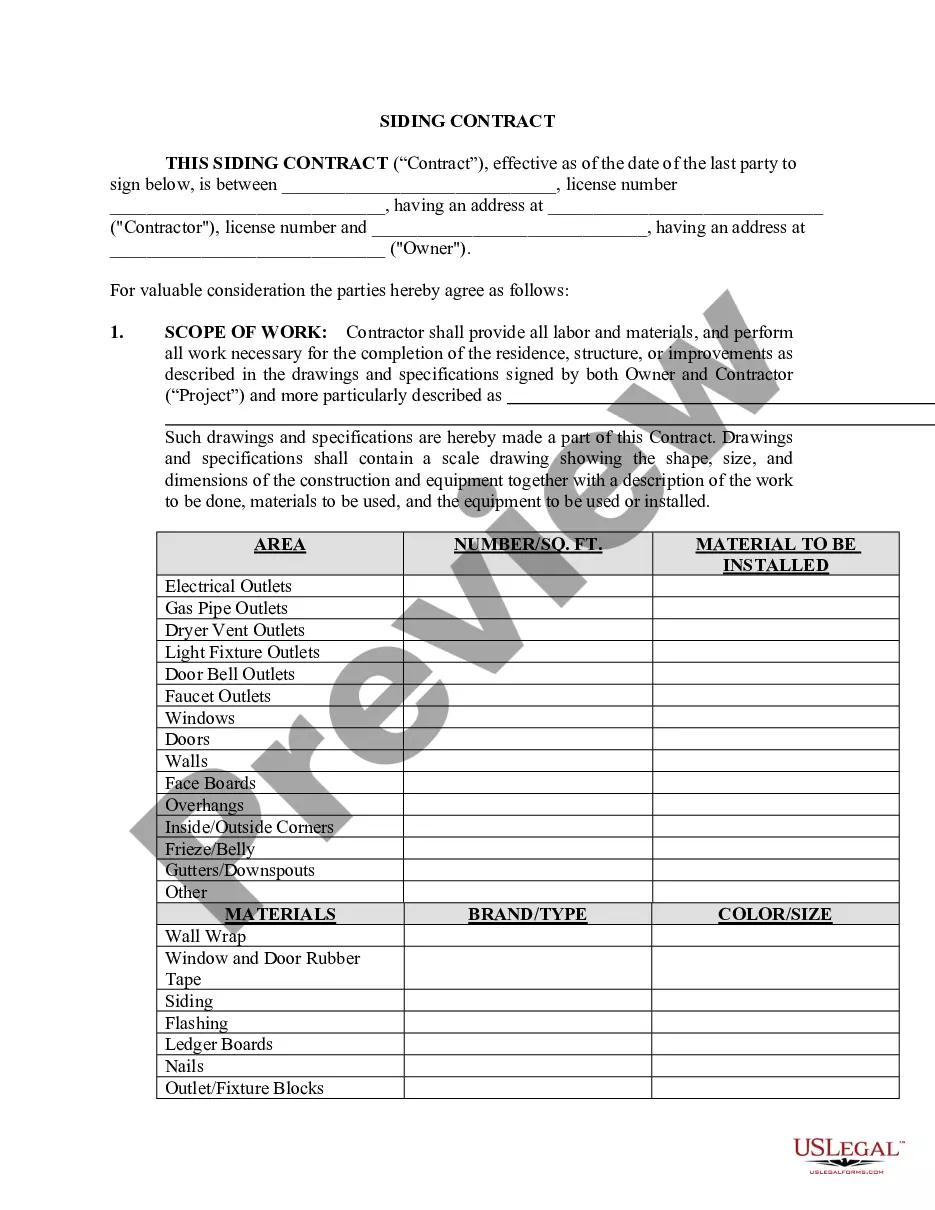

- Step 2. Utilize the Preview feature to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Housecleaning Services Contract - Self-Employed.

Form popularity

FAQ

Common rates for cleaning services can vary based on factors like location, the level of service, and frequency of cleaning. Typically, hourly rates can range significantly, so understanding your market is crucial. The Puerto Rico Housecleaning Services Contract - Self-Employed can aid you in setting competitive rates while ensuring your client agreements are clear and fair.

Absolutely, anyone can become a self-employed house cleaner if they have the necessary skills and drive. This career allows individuals to work at their own pace while earning a decent income. Utilizing a Puerto Rico Housecleaning Services Contract - Self-Employed helps set the groundwork for your business, creating clarity for both you and your clients.

The earnings of self-employed cleaners can vary significantly based on the services offered and client base. On average, self-employed cleaners can make a comfortable income, particularly in well-serviced areas. By establishing a reliable Puerto Rico Housecleaning Services Contract - Self-Employed, you can outline your rates clearly, making it easier for clients to understand your value.

Going self-employed as a cleaner requires dedication and planning. Start by legalizing your business, understanding tax obligations, and creating a marketing strategy. A Puerto Rico Housecleaning Services Contract - Self-Employed can streamline your operations and give your clients confidence in your services.

Yes, house cleaning can be considered self-employment if you work independently and set your own hours. This type of work allows for flexibility and control over your income. It’s essential to have a solid Puerto Rico Housecleaning Services Contract - Self-Employed to protect yourself and clarify your business relationship with clients.

Becoming a subcontractor in the cleaning industry involves networking with established cleaning companies. Offer your services and demonstrate your reliability. By using a Puerto Rico Housecleaning Services Contract - Self-Employed, you can ensure that your partnership is formalized and beneficial to both parties.

To transition to self-employment as a house cleaner, focus on building a portfolio of your work. You may also want to advertise your services through social media or local listings. Utilizing a Puerto Rico Housecleaning Services Contract - Self-Employed can help you maintain professionalism and set the expectations with your clients.

To write a contract agreement for cleaning services, start by identifying the parties involved, and specify that it pertains to the Puerto Rico Housecleaning Services Contract - Self-Employed. Clearly outline the services included, such as specific cleaning tasks and schedules. Also, mention payment terms and any provisions for damages or cancellations. Finally, both parties should sign the agreement to confirm their acceptance of the terms.

Writing a simple contract agreement involves a few clear steps. First, state the name of the parties involved, followed by a description of the services to be provided, which, in this case, would be relevant to a Puerto Rico Housecleaning Services Contract - Self-Employed. Next, include the terms of payment, the timeline for service, and any other important stipulations, like confidentiality. End with a space for signatures to finalize the contract and make it official.

To write a cleaning contract agreement, start by outlining the services you will provide under the Puerto Rico Housecleaning Services Contract - Self-Employed. Clearly specify the duration of the agreement, the payment terms, and any cancellation policies. Include details about the expectations for both parties, such as cleaning frequencies and responsibilities. Finally, ensure both you and the client sign the document to make it legally binding.