Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor

Description

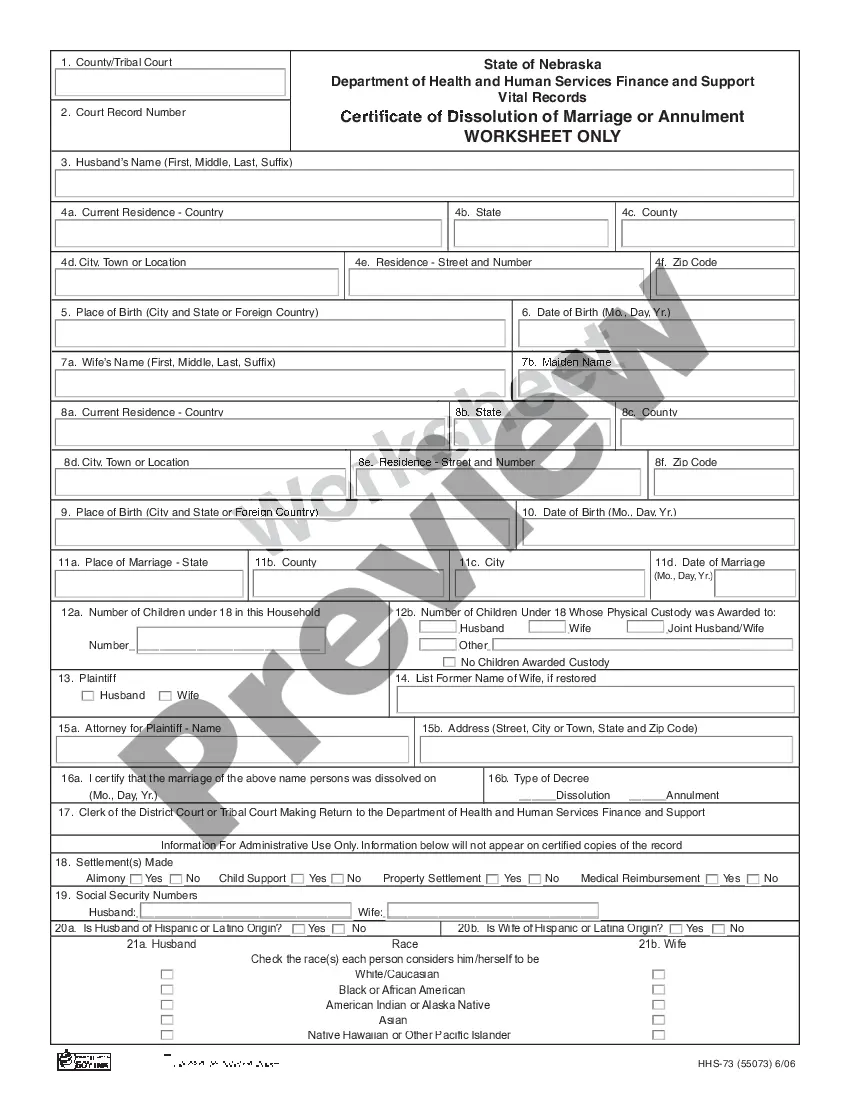

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

If you want to be thorough, download, or create official document templates, utilize US Legal Forms, the largest assortment of official forms that are available online.

Employ the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the official form and download it to your device. Step 7. Fill out, edit, and print or sign the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. Every official document template you obtain is yours permanently. You have access to each form you saved in your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal or business needs.

- Use US Legal Forms to acquire the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor with a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents tab of your account.

- If it is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/country.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

Creating an independent contractor agreement is a straightforward process. First, outline the essential terms, such as the services to be provided, payment structure, and deadlines. Next, clarify the relationship between the parties, ensuring it reflects the nature of a Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. To simplify this task, consider using a reliable platform like US Legal Forms, which offers templates tailored for various needs, ensuring your agreement is both professional and compliant.

A temporary employee is not the same as an independent contractor. With a Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor, you operate under a different set of guidelines. Temporary employees usually work under the supervision of an employer, while independent contractors manage their own tasks. Understanding this distinction is crucial for legal and tax purposes.

To fill out an independent contractor agreement effectively, start by entering the basic details about both parties, ensuring you reference the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. Include service descriptions, payment terms, and timelines. Make sure to clearly state any additional obligations or conditions that apply to the partnership. Using USLegalForms can streamline this process, offering templates that guide you through each necessary section.

Writing an independent contractor agreement begins with outlining the roles and responsibilities you and the client will have. Ensure you include essential elements related to the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor, such as compensation, duration of the agreement, and any other specific terms of service. Clearly define confidentiality and termination clauses as well. To create a solid agreement, consider using platforms like USLegalForms, which provide tailored templates and tips to ensure compliance.

Filling out a declaration of independent contractor status form involves clearly stating your role as a self-employed individual under the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. Include your personal details, such as your name and address, along with the nature of your services. Be precise about your working conditions, such as whether you work independently or under specific instructions from a client. Utilizing services like USLegalForms can simplify this process by offering ready-to-use templates specifically for this purpose.

To fill out an independent contractor form, begin by reviewing the details regarding the services you plan to provide under the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. Clearly state your business name, contact information, and the specifics of the services you will offer. It is essential to include payment terms, timelines, and any other relevant conditions. If you're unsure, consider using platforms like USLegalForms, which provide templates and guidance tailored for independent contractors.

Yes, independent contractors are required to have a work permit in Puerto Rico. This requirement helps ensure all self-employed individuals operate within the law, adhering to the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor guidelines. By obtaining this permit, you protect yourself and your business from potential legal issues.

To work as an independent contractor in Puerto Rico, you need to meet specific requirements, including obtaining a work permit and registering your business. Understanding the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor will help you navigate these requirements effectively. Using platforms like uslegalforms can simplify the process of securing the necessary documentation.

Generally, you cannot be self-employed without a work permit in Puerto Rico. Operating without proper documentation can lead to penalties under the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. To ensure your business is compliant and successful, it's best to secure the necessary permits.

Yes, independent contractors typically need a work permit to operate legally in Puerto Rico. This permit ensures that you comply with local laws under the Puerto Rico Temporary Worker Agreement - Self-Employed Independent Contractor. However, obtaining a work permit can be a straightforward process if you follow the correct channels.