Puerto Rico Moving Services Contract - Self-Employed

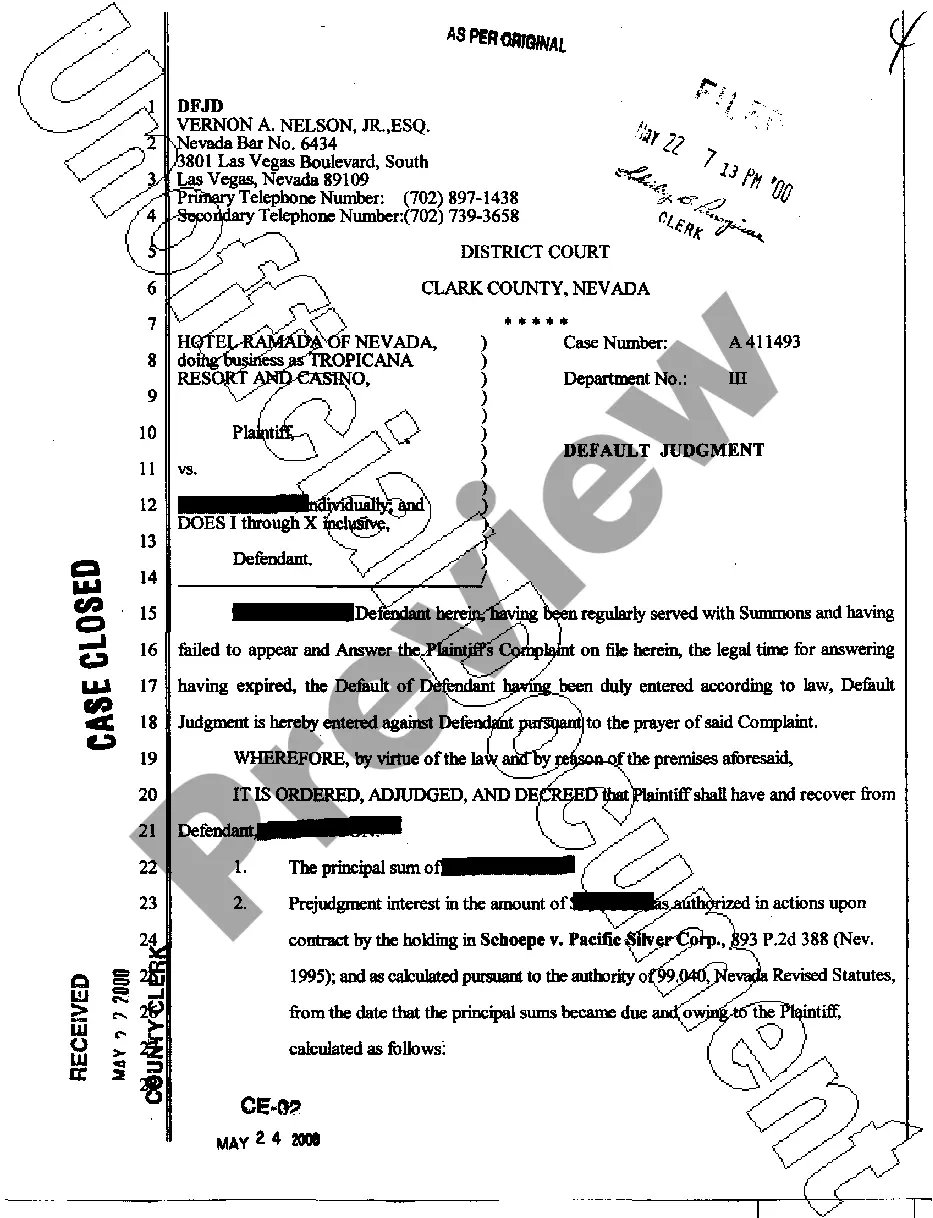

Description

How to fill out Moving Services Contract - Self-Employed?

You might spend hours online searching for the legal document template that satisfies both federal and state stipulations that you require.

US Legal Forms offers numerous legal templates that are evaluated by experts.

You can easily acquire or print the Puerto Rico Moving Services Contract - Self-Employed from our service.

If available, use the Review option to preview the document template as well.

- If you already have a US Legal Forms account, you can sign in and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Puerto Rico Moving Services Contract - Self-Employed.

- Every legal document template you download is yours indefinitely.

- To access another version of the acquired document, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the area/city you designate.

- Review the document description to confirm you have chosen the right one.

Form popularity

FAQ

The self-employment tax in Puerto Rico generally mirrors the federal self-employment tax structure, comprising Social Security and Medicare taxes. For self-employed individuals, this tax is assessed on net earnings over a certain threshold. If you are considering a Puerto Rico Moving Services Contract - Self-Employed, understanding this tax can help you budget effectively. Consulting resources like uslegalforms can streamline your tax preparation and planning process.

While there are no states in the U.S. that completely exempt self-employed individuals from certain taxes, some states, such as Florida and Nevada, do not impose a state income tax. This might be appealing for self-employed professionals considering relocation or expansion. However, if you are looking at a Puerto Rico Moving Services Contract - Self-Employed, you will encounter specific local regulations. Researching these alternatives can help determine what option suits your needs best.

Rule 22 in Puerto Rico governs how self-employed individuals must deal with their income taxes. Specifically, it outlines the requirements for appraising business income and expenses. This rule is significant for those entering into a Puerto Rico Moving Services Contract - Self-Employed, as it helps clarify their financial responsibilities. Understanding these regulations can ensure compliance and proper tax management.

While Act 60 offers numerous benefits, there are potential risks, such as changes in tax regulations that could affect self-employed individuals. Compliance with local laws is crucial to avoid penalties. It's essential to remain informed and consult with professionals to mitigate these risks effectively. Engaging with a Puerto Rico Moving Services Contract - Self-Employed can provide necessary insights into navigating these complexities.

The beneficiaries of Act 60 primarily include self-employed individuals and businesses that enhance Puerto Rico's economy. By taking advantage of the tax incentives, these individuals can retain more earnings. However, anyone considering relocating should closely assess their specific situation to fully benefit. Therefore, a Puerto Rico Moving Services Contract - Self-Employed can facilitate this process.

The 183-day rule states that individuals who spend 183 days or more in Puerto Rico during the tax year may be considered residents for tax purposes. This can impact your tax status significantly, especially under Act 60. Understanding this rule is crucial for self-employed individuals who want to maximize their benefits. Thus, considering a Puerto Rico Moving Services Contract - Self-Employed becomes increasingly important.

Yes, obtaining a merchant registration is necessary for self-employed individuals wishing to work freelance in Puerto Rico. This registration allows you to operate legally, ensuring compliance with local regulations. Utilizing a Puerto Rico Moving Services Contract - Self-Employed can help you navigate the registration process while establishing your business seamlessly.

To qualify for Act 60 in Puerto Rico, you typically need to establish your business on the island and engage in eligible activities. This includes self-employed individuals and businesses that support the economic development of Puerto Rico. It's essential to review the specific criteria to ensure compliance, especially if you're considering a Puerto Rico Moving Services Contract - Self-Employed.

Rule 60 pertains to the tax incentives established under the Act 60 in Puerto Rico. It allows self-employed individuals to reduce their tax burden significantly while conducting business on the island. This rule encourages entrepreneurship, making it an attractive aspect of moving to Puerto Rico. Engaging with a Puerto Rico Moving Services Contract - Self-Employed can help streamline your transition.

Entrepreneurs are moving to Puerto Rico due to the favorable tax incentives provided by the Act 60. The appeal lies in the low tax rates, which significantly enhance profit margins for self-employed individuals. Additionally, the vibrant culture and business-friendly environment offer a unique opportunity for growth. Therefore, if you consider the Puerto Rico Moving Services Contract - Self-Employed, you may find numerous benefits.