Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor

Description

How to fill out Dietitian Agreement - Self-Employed Independent Contractor?

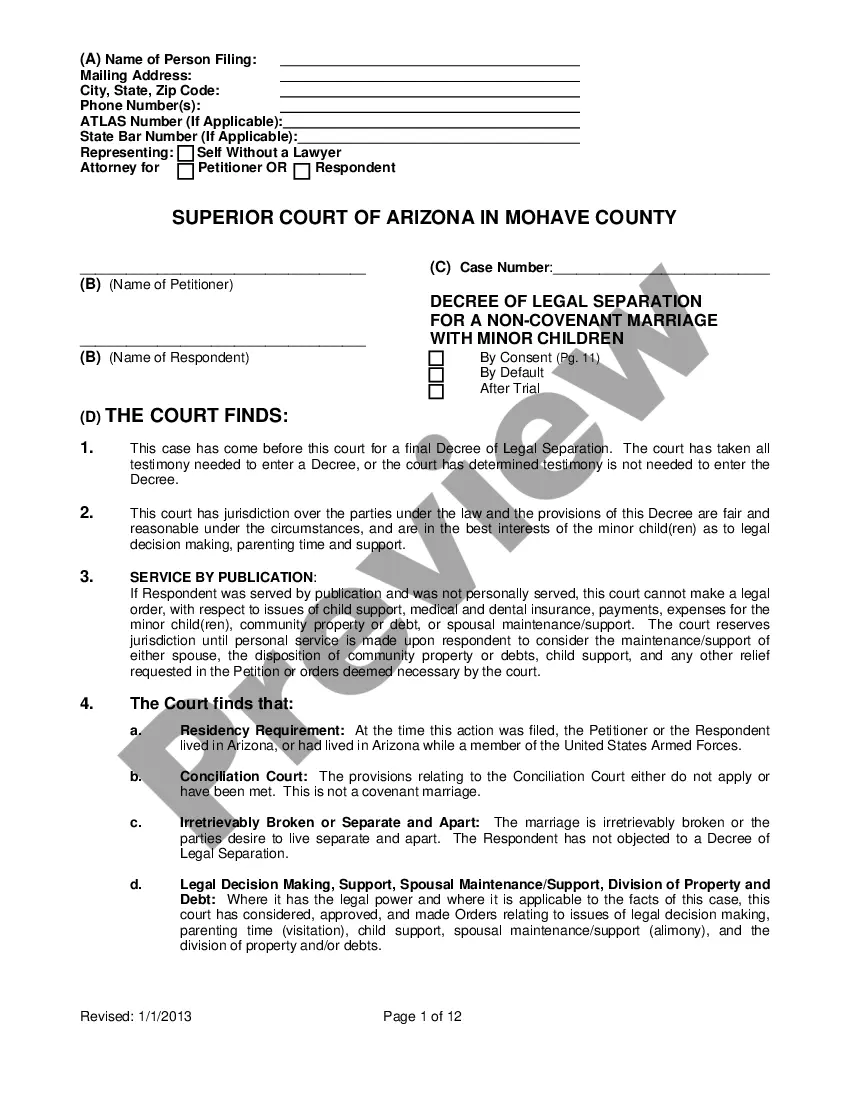

Locating the appropriate valid document template can be quite challenging. Clearly, there is a multitude of templates accessible online, but how can you discover the accurate version you require? Utilize the US Legal Forms platform. The service offers thousands of templates, such as the Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor, that can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to access the Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor. Use your account to search through the legal forms you have previously acquired. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and read the form description to confirm this is indeed the right one for you. If the form does not satisfy your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Buy now button to obtain the form. Select the pricing plan you desire and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to download professionally crafted paperwork that meet state requirements.

Form popularity

FAQ

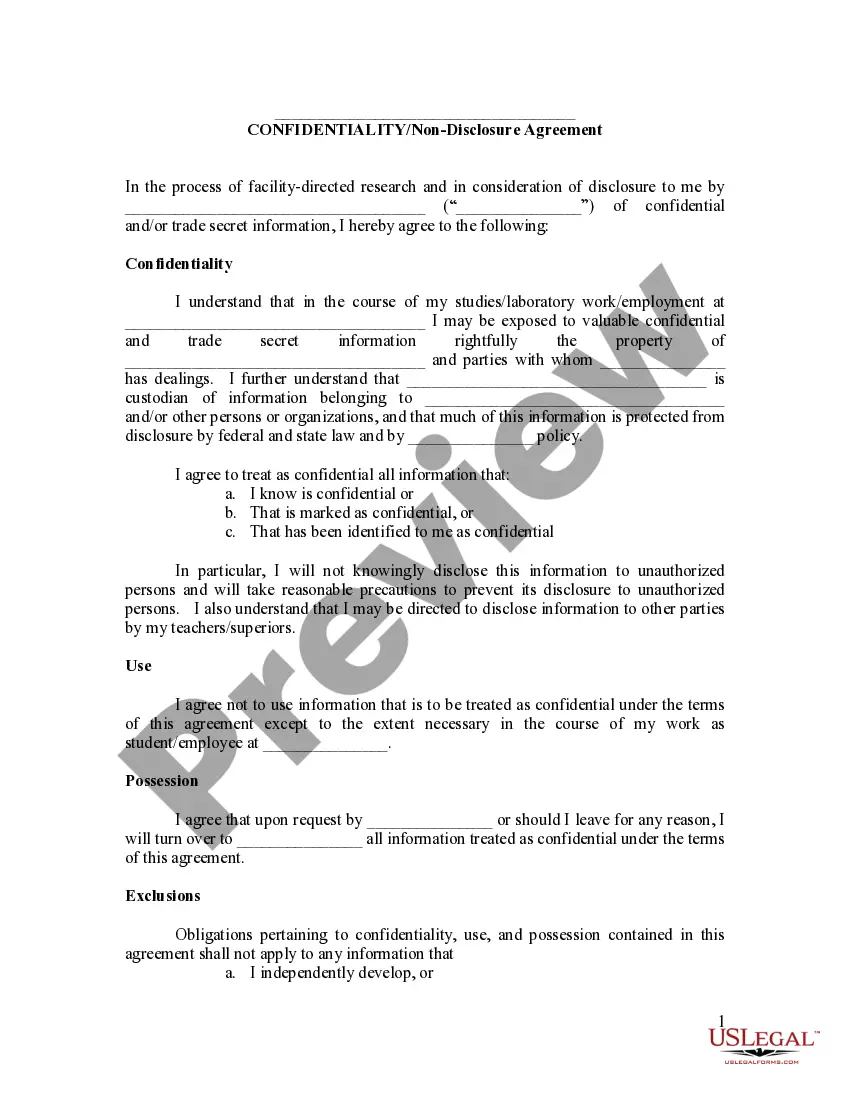

To fill out an independent contractor form, begin by entering your personal information, such as your name and contact details. Next, provide specifics about the services you will offer and the duration of the contract. Make sure to review the terms and conditions laid out in the form to confirm your understanding before submission. Utilizing tools from USLegalForms can simplify this process for a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor.

When writing an independent contractor agreement, begin with a clear title that identifies the document. Include key elements such as the contractor's information, project description, payment structure, and deadlines. It's important to address other important areas like revision rights and intellectual property to avoid misunderstandings. For a comprehensive template, consider using USLegalForms, especially tailored for a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, start by providing essential details, such as your name, address, and the scope of work. Next, outline the payment terms, including how and when you will receive payment. Finally, ensure you include any relevant clauses, such as confidentiality or termination terms, to protect both parties. Using a platform like USLegalForms can guide you through this process, particularly for a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor.

To write a contract as an independent contractor, start by clearly defining the scope of work, payment structure, and terms for termination. Ensure all parties understand their rights and obligations. If you’re uncertain, the uslegalforms platform offers user-friendly templates to assist you in creating a detailed Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor.

In Puerto Rico, self-employment tax can be around 15.3%, similar to the United States federal rate. This tax encompasses Social Security and Medicare contributions, and it applies to your net earnings as a self-employed individual. It's crucial for dietitians to factor this into their financial planning when implementing a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor.

Yes, you can write your own legally binding contract, as long as it includes the essential elements such as parties involved, services provided, payment terms, and signatures. However, creating a comprehensive document can be challenging. Using the templates available on the uslegalforms platform can help you draft a solid Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor that meets legal standards.

To be authorized as an independent contractor in Puerto Rico, you must obtain the necessary licenses and permits based on your profession. For dietitians, this often includes meeting state requirements and completing any certification processes. Once you’re certified, you can create a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor to formalize your practice.

A basic independent contractor agreement outlines the working relationship between the contractor and the client. This contract specifies service expectations, payment terms, and project deadlines. For those entering the field of dietetics in Puerto Rico, having a clear Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor is essential for professional clarity and legal protection.

The law 75 in Puerto Rico establishes a framework for relationships between suppliers and independent distributors. It ensures that any termination of these contracts cannot happen arbitrarily and must be justified. For dietitians entering a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor, this law is vital to ensure fair treatment and protect their business interests.

Law 75 is a specific regulation in Puerto Rico that focuses on safeguarding the interests of independent distributors. It aims to prevent unjust termination of distributor agreements without proper cause or notice. For professionals considering a Puerto Rico Dietitian Agreement - Self-Employed Independent Contractor, familiarizing yourself with law 75 will help you better navigate your rights and responsibilities.