Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor

Description

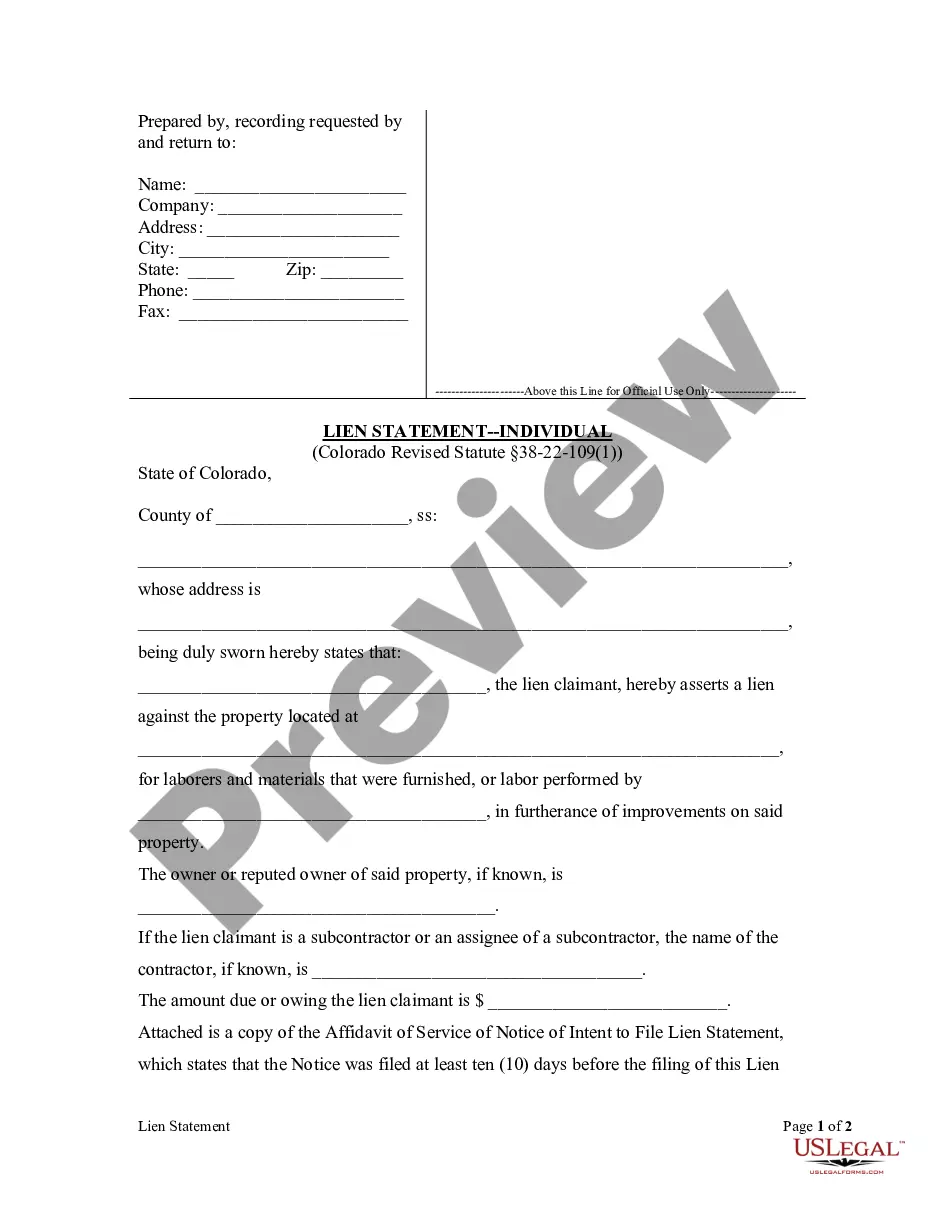

How to fill out Physical Therapist Agreement - Self-Employed Independent Contractor?

Locating the appropriate sanctioned document format could pose a challenge.

Unquestionably, there are numerous templates accessible online, but how can you find the sanctioned form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

Once you are certain that the form is appropriate, click the Acquire now button to obtain the form. Choose the pricing plan you need and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the sanctioned document format to your device. Complete, edit, print, and sign the obtained Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest library of legal forms where you can find various document templates. Utilize the service to download properly crafted files that comply with state regulations.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your area/region. You can preview the form using the Preview button and review the form description to confirm it is suitable for you.

- If the form does not meet your expectations, use the Search field to locate the correct form.

Form popularity

FAQ

Yes, you can be an independent contractor as a therapist in Puerto Rico. Many therapists choose this route for its flexibility and control over their practice. However, it is crucial to have a well-drafted Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor to outline expectations and responsibilities. This agreement helps protect your rights and avoids potential misunderstandings with clients.

Creating a Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor involves several essential steps. Start by defining the scope of services, terms of payment, and duration of the contract. Next, ensure compliance with local laws governing independent contractors in Puerto Rico. Utilizing platforms like UsLegalForms can simplify this process by providing customizable templates tailored to your needs.

To fill out an independent contractor agreement, begin by including your identifying information and a description of the services provided. Reference the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor for specific stipulations relevant to your role. Make sure to include payment details and conditions for termination, then review before signing.

Yes, Puerto Rico has a self-employment tax that applies to independent contractors. As a self-employed individual, you are responsible for paying this tax, which supports Social Security and Medicare. It's advisable to consult with a tax professional to understand how the tax applies to your income under the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form involves entering your basic information and detailing the scope of work, as highlighted in the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor. Be sure to include payment structures and your tax identification number. After ensuring all sections are complete and accurate, submit the form as necessary.

Writing an independent contractor agreement begins with outlining the services you will provide, as referenced in the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor. Include payment terms, deadlines, and any special requirements. Ensure both parties review and sign the agreement to formalize the contract, protecting your interests.

To fill out a declaration of independent contractor status form, start by providing your personal information, including your name and contact details. Next, clearly indicate your role as a self-employed independent contractor, referencing the Puerto Rico Physical Therapist Agreement - Self-Employed Independent Contractor. Finally, review the completed form for accuracy and submit it as required, ensuring all sections are properly filled.