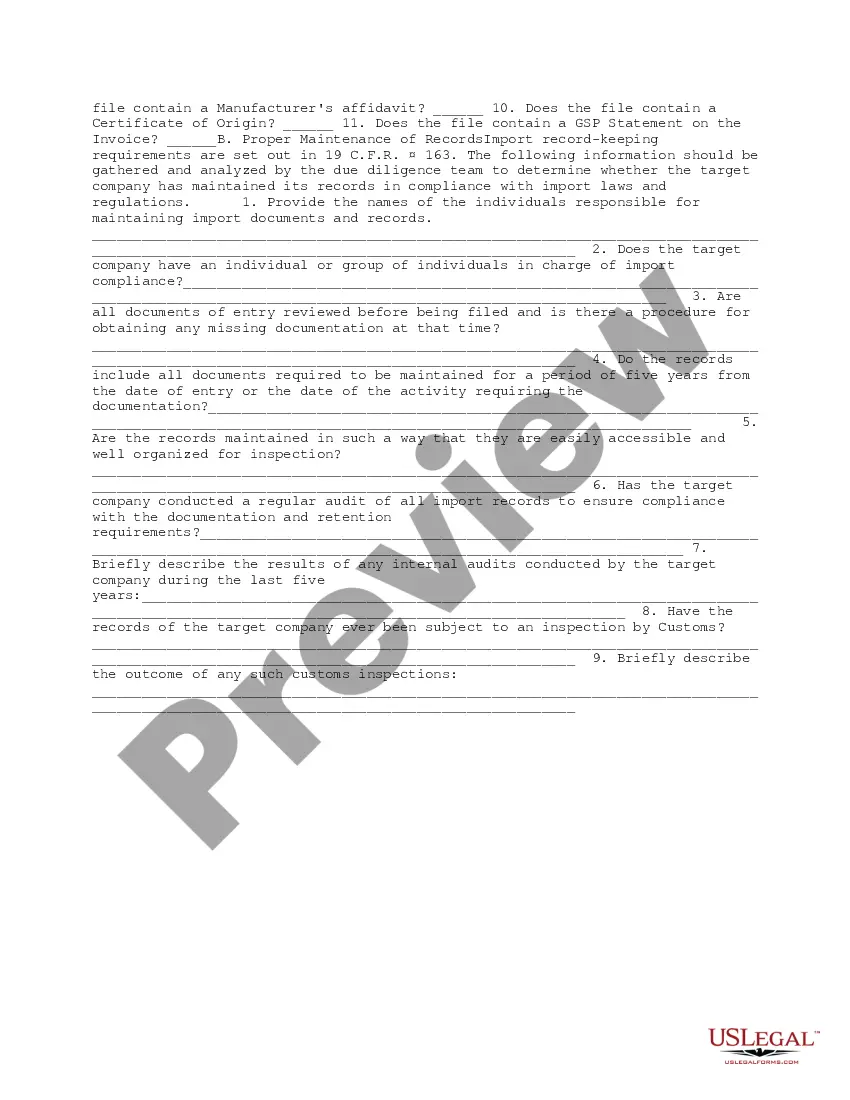

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Puerto Rico Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

If you require to aggregate, obtain, or generate official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A range of templates for commercial and personal ends are organized by categories and indications, or keywords.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device.

- Employ US Legal Forms to find the Puerto Rico Import Compliance and Records Review Due Diligence with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to access the Puerto Rico Import Compliance and Records Review Due Diligence.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the page to find alternative templates.

- Step 4. Once you locate the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your information to create an account.

Form popularity

FAQ

Customs Documentation means a customs declaration and other documents to be submitted at customs clearance as stipulated in the Customs Act, whether by letter or in electronic form.

Solution. An import transaction involves various documents, such as a bill of lading, certificate of origin, and shipment advice. However, a shipping bill is not required for an import transactionit is a document required in connection with an export transaction.

Documents required for import customs clearance in IndiaBill of Entry:Commercial Invoice.Bill of Lading / Airway bill :Import License.Insurance certificate.Purchase order/Letter of Credit.Technical write up, literature etc. for specific goods if any.Industrial License if any.More items...

When importing a good or product, it is the responsibility of the importer of record to be compliant with import regulations.

Below, we outline the steps involved in importing of goods....Import proceduresObtain IEC.Ensure legal compliance under different trade laws.Procure import licenses.File Bill of Entry and other documents to complete customs clearing formalities.Determine import duty rate for clearance of goods.

Customs clearance is a necessary procedure before goods can be imported or exported internationally. If a shipment is cleared, then the shipper will provide documentation confirming customs duties that are paid and the shipment can be processed.

Import and export documents The Foreign Trade Policy, 2015-2020 mandates the following commercial documents for carrying out importing and exporting activities: Bill of lading or airway bill; Commercial invoice cum packing list; Shipping bill or bill of export, or bill of entry (for imports).

List of Documents required for Imports Customs ClearanceBill of Entry.Commercial Invoice.Bill of Lading or Airway Bill.Import License.Certificate of Insurance.Letter of Credit or LC.Technical Write-up or Literature (Only required for specific goods)Industrial License (for specific goods)More items...?

Must-have Shipping Documents for ImportsBill of Lading. This is the most important document not only for exporters but for importers too.Commercial Invoice cum Packing List. Again, the importer needs this document just as much as the exporter.Bill of Entry. The third must-have document for importers is a bill of entry.

There are four basic import documents you need in order to clear customs quickly and easily.Commercial Invoice. This document is used for foreign trade.Packing List. Provided by the shipper or freight forwarder, the packing list may be used by customs to check the cargo.Bill of Lading (BOL)Arrival Notice.