Oregon Letter to Board of Directors regarding recapitalization proposal

Description

How to fill out Letter To Board Of Directors Regarding Recapitalization Proposal?

Have you been in a place the place you need to have documents for sometimes business or person uses just about every working day? There are tons of legitimate papers layouts accessible on the Internet, but finding ones you can depend on is not effortless. US Legal Forms delivers thousands of kind layouts, much like the Oregon Letter to Board of Directors regarding recapitalization proposal, that happen to be written to fulfill federal and state requirements.

If you are previously familiar with US Legal Forms site and have your account, basically log in. After that, you are able to down load the Oregon Letter to Board of Directors regarding recapitalization proposal template.

Unless you come with an account and wish to start using US Legal Forms, follow these steps:

- Discover the kind you will need and make sure it is to the proper city/region.

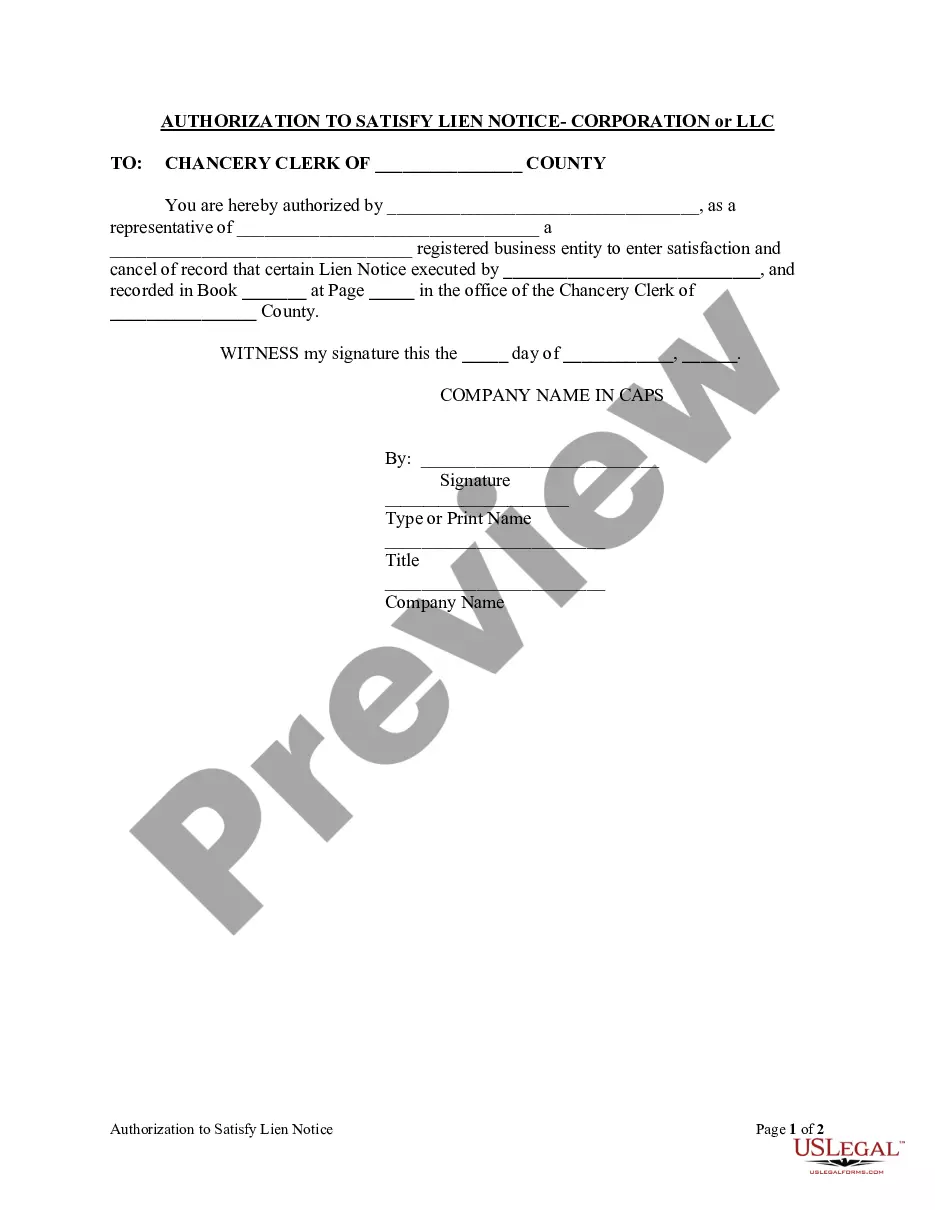

- Use the Review switch to review the form.

- Browse the explanation to actually have chosen the correct kind.

- When the kind is not what you`re seeking, use the Look for industry to find the kind that fits your needs and requirements.

- When you get the proper kind, click on Acquire now.

- Opt for the costs program you want, submit the desired details to make your bank account, and buy an order making use of your PayPal or credit card.

- Decide on a hassle-free document format and down load your backup.

Find each of the papers layouts you have bought in the My Forms menu. You may get a more backup of Oregon Letter to Board of Directors regarding recapitalization proposal any time, if needed. Just click on the necessary kind to down load or printing the papers template.

Use US Legal Forms, by far the most extensive collection of legitimate kinds, in order to save efforts and stay away from blunders. The service delivers expertly made legitimate papers layouts that can be used for an array of uses. Generate your account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

How to write a proposal letter Introduce yourself and provide background information. State your purpose for the proposal. Define your goals and objectives. Highlight what sets you apart. Briefly discuss the budget and how funds will be used. Finish with a call to action and request a follow-up.

How to write a project proposal Write an executive summary. The executive summary serves as the introduction to your project proposal. ... Explain the project background. ... Present a solution. ... Define project deliverables and goals. ... List what resources you need. ... State your conclusion. ... Know your audience. ... Be persuasive.

You can divide a proposal letter into three main sections, the problem, its solution and your qualifications for solving the issue. Consider the problem to be your "why." This is the purpose or reasoning for the proposed project. The problem is the issue or task you hope to solve.

In summary, being compliant, competent, and comprehensive are essential qualities in proposal management. By being compliant, you ensure that your proposal meets all the specified requirements. You demonstrate your skills and expertise in managing the proposal development process by being competent.

Essential, your business proposal can follow this format: Title. Table of contents. Executive summary. The problem statement. The proposed solution. Qualifications. The timeline. Pricing, billing and legal.