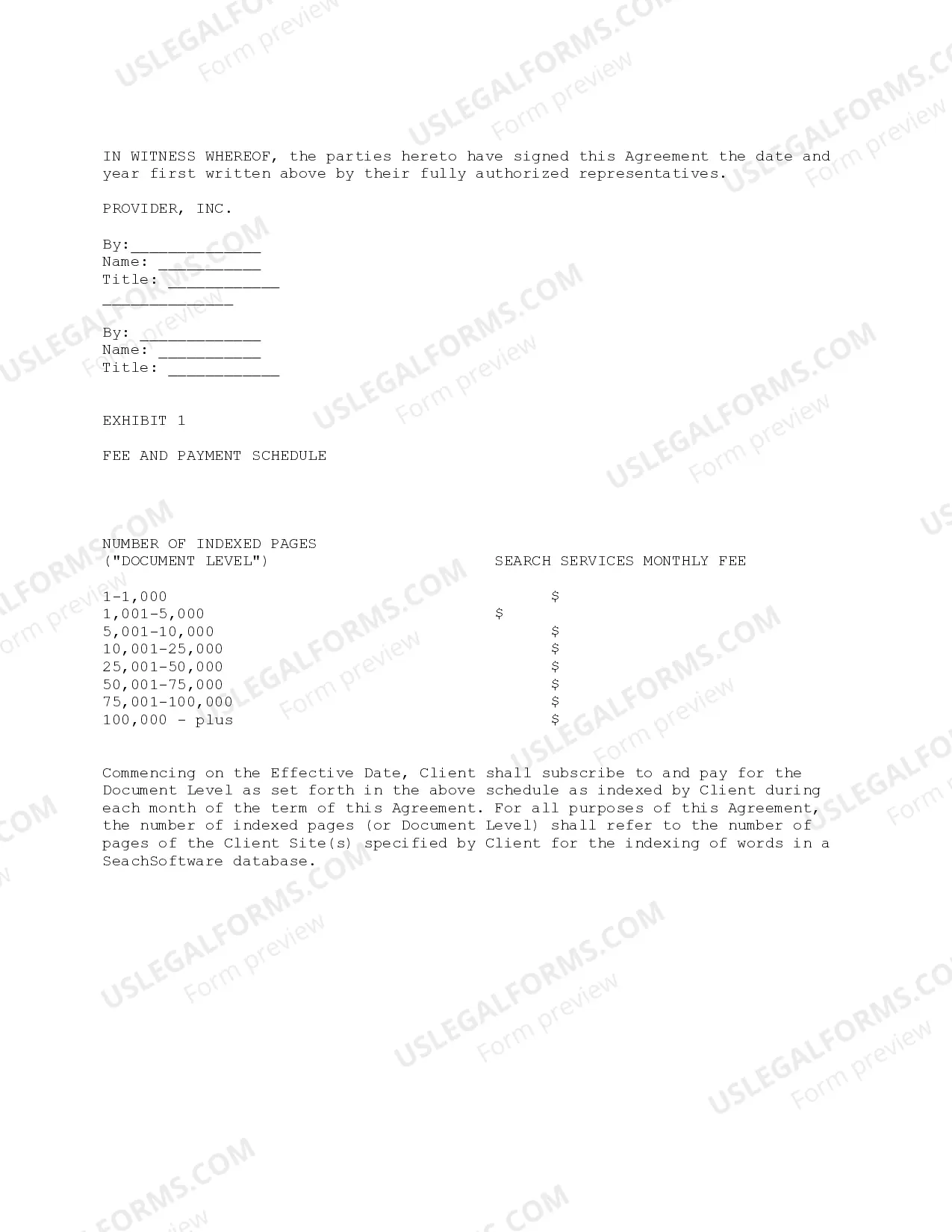

This form is used by a web search services provider and company or individual to set forth the terms and conditions under which the search services provider will provide services to another company or individual.

South Dakota Search Engine Services Agreement

Description

How to fill out Search Engine Services Agreement?

US Legal Forms - one of the largest libraries of authorized kinds in America - delivers a wide array of authorized file layouts you can download or printing. Utilizing the site, you can find thousands of kinds for company and person purposes, sorted by types, states, or search phrases.You can find the most recent variations of kinds just like the South Dakota Search Engine Services Agreement in seconds.

If you already possess a subscription, log in and download South Dakota Search Engine Services Agreement in the US Legal Forms local library. The Down load option will appear on each type you perspective. You gain access to all in the past acquired kinds inside the My Forms tab of the account.

In order to use US Legal Forms for the first time, listed here are simple instructions to help you get began:

- Be sure to have picked the best type to your town/state. Select the Review option to check the form`s information. Look at the type description to actually have selected the proper type.

- If the type does not suit your needs, take advantage of the Lookup industry on top of the display screen to obtain the one who does.

- If you are content with the shape, confirm your decision by simply clicking the Get now option. Then, pick the costs program you favor and offer your credentials to sign up to have an account.

- Method the financial transaction. Make use of credit card or PayPal account to accomplish the financial transaction.

- Select the file format and download the shape on your system.

- Make alterations. Fill up, revise and printing and indication the acquired South Dakota Search Engine Services Agreement.

Each and every format you included with your bank account lacks an expiry date which is yours permanently. So, if you would like download or printing yet another duplicate, just proceed to the My Forms segment and then click about the type you require.

Obtain access to the South Dakota Search Engine Services Agreement with US Legal Forms, probably the most substantial local library of authorized file layouts. Use thousands of expert and status-particular layouts that meet up with your small business or person requirements and needs.

Form popularity

FAQ

A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

A licensed Master Electrician in South Dakota is a person having the necessary qualifications, training, experience, and technical knowledge to plan, lay out, and supervise the installation and repair of electrical wiring, apparatus, and equipment for electric light, heat and power in ance with the standard rules ...

Use tax applies to all goods and services that are used, stored, or consumed in South Dakota. The purchaser or con- sumer is responsible for reporting and remitting the 4% state use tax, plus applicable municipal use tax in the filing period in which the purchaser receives or is invoiced for the goods or services.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

With few exceptions, the sale of products and services in South Dakota are subject to sales tax or use tax. Services such as auto repair, maintenance, body repair, oil changes, and customizing are subject to state and municipal sales tax.

Starting July 1, 2023, South Dakota's Medicaid expansion allows individuals to qualify for Medicaid by raising the income requirement to 138% of the Federal Poverty Level (FPL), up to $41,400 for a family of 4, and adding childless adults.

Use tax applies to all goods and services that are used, stored, or consumed in South Dakota. The purchaser or con- sumer is responsible for reporting and remitting the 4% state use tax, plus applicable municipal use tax in the filing period in which the purchaser receives or is invoiced for the goods or services.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.