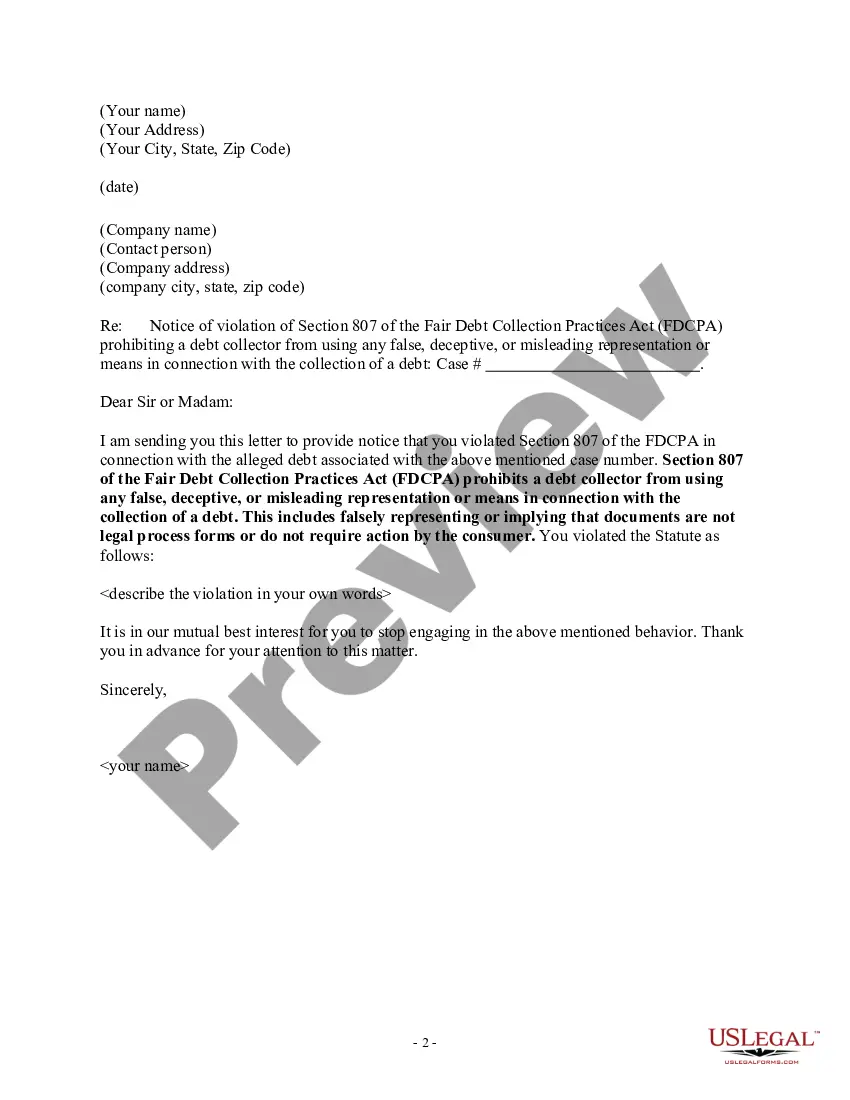

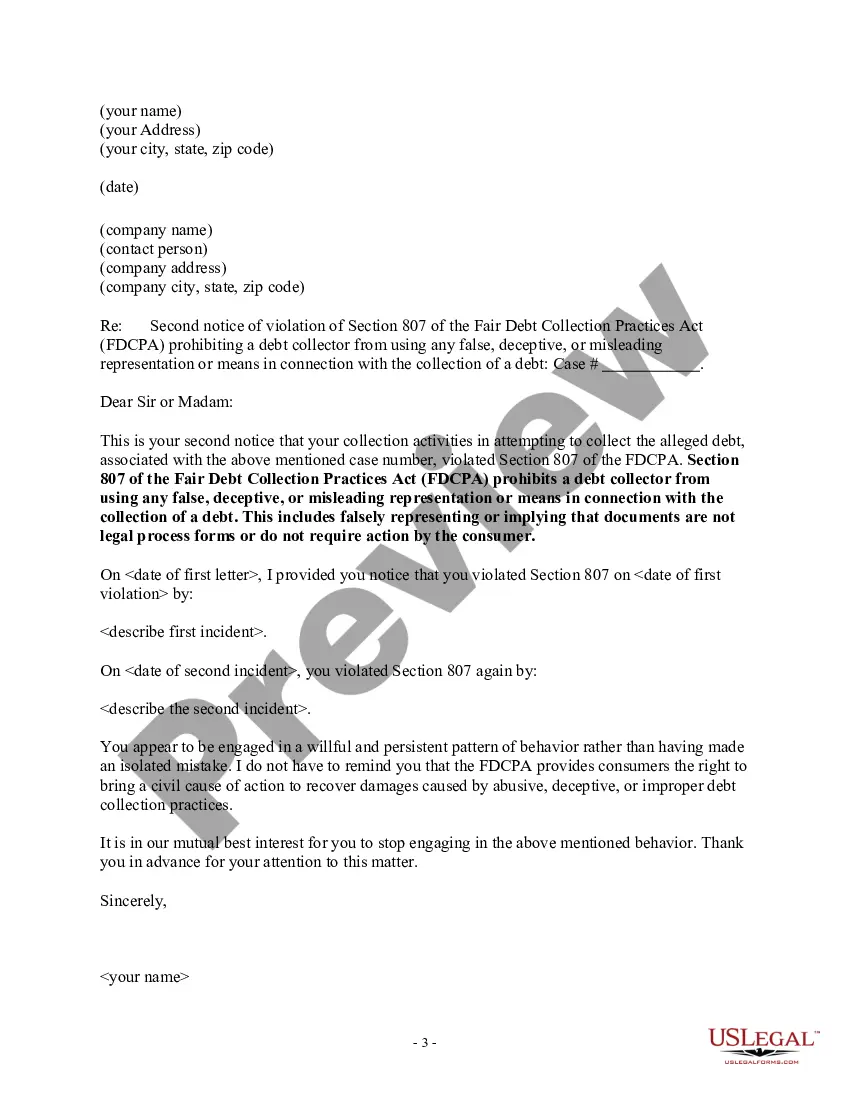

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Puerto Rico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

If you desire to be thorough, download, or print valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Utilize the site's user-friendly and convenient search feature to locate the documents you require.

Numerous templates for business and personal applications are categorized by types and states, or keywords.

Step 4. After identifying the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Puerto Rico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Utilize US Legal Forms to find the Puerto Rico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Puerto Rico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to examine the content of the form. Never forget to read the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to discover alternative versions of the legal form template.

Form popularity

FAQ

The most common violation of the Fair Debt Collection Practices Act involves debt collectors falsely representing documents as legal processes that require action. This can lead to confusion and unnecessary stress for consumers, especially regarding the 'Puerto Rico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.' It is essential for consumers to understand their rights and recognize instances of misleading communication. Platforms like USLegalForms can provide the necessary resources and templates to ensure you address violations effectively.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

A debt collector may state that certain action is possible, if it is true that such action is legal and is frequently taken by the collector or creditor with respect to similar debts; however, if the debt collector has reason to know there are facts that make the action unlikely in the particular case, a statement that

It is generally a good idea to tell the debt collector in writing that you have an attorney. If your attorney fails to respond to the debt collector within a reasonable period of time or your attorney says that the debt collector may get in touch with you directly, then the debt collector may contact you.