Puerto Rico Payout Agreement

Description

How to fill out Payout Agreement?

If you wish to acquire, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Leverage the site's straightforward and efficient search functionality to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Puerto Rico Payout Agreement. Each legal document template you acquire is yours to keep indefinitely. You have access to all forms you have saved in your account. Go to the My documents section and select a document to print or download again. Be proactive and download and print the Puerto Rico Payout Agreement with US Legal Forms. There are millions of professional and state-specific documents you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Puerto Rico Payout Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the Puerto Rico Payout Agreement.

- You can also access documents you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

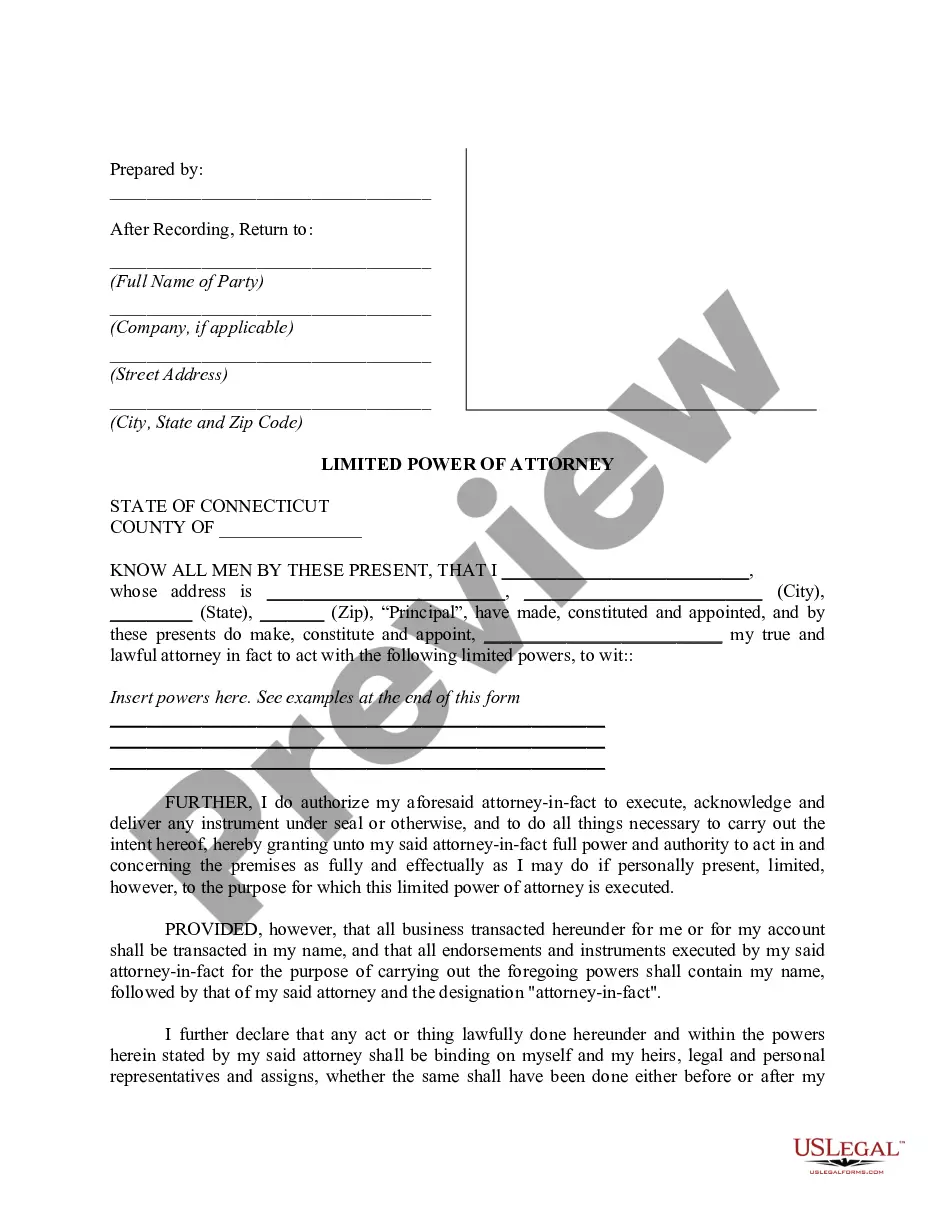

- Step 2. Use the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document.

- Step 4. Once you have found the form you need, click the Get Now button. Select the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

Restrictive covenantsNon-compete clauses in employment contracts are valid and enforceable in Puerto Rico under general freedom of contract principles but must comply with requirements established by the Supreme Court of Puerto Rico.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Although the EPA does not apply outside the United States, such claims are covered by Title VII, which also prohibits discrimination in compensation on the basis of sex.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

It is essentially a form of monetary assistance in preparation for the Christmas season. To compute this is you take your monthly basic salary, divided by 12 (months in a year), times the number of months within a year you have rendered your service.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

For Christmas bonuses in excess of $600, but not in excess of $1,500, the employer must withhold a 7% tax from the total amount of the bonus, and FICA and Medicare.

As a rule, employers with more than 15 employees are required to pay 6% of the employee's salary, up to a salary cap of $10,000, which is equivalent to a $600 bonus. Employers with up to 15 employees are required to pay 3% of the employee's salary, up to a salary cap of $10,000, which is equivalent to a $300 bonus.

Known sometimes as a 13-month-salary, the Christmas bonus is one given to employees at the end of the year. This practice will depend on the company's size, resources and financial performance, but the average holiday bonus is reportedly around $1,800, though the range could be anywhere from $100 to $5,000.