Puerto Rico Employee Stock Option Plan of Vivigen, Inc.

Description

How to fill out Employee Stock Option Plan Of Vivigen, Inc.?

You may commit hours on-line looking for the legal papers template that suits the federal and state demands you want. US Legal Forms supplies 1000s of legal kinds which are evaluated by specialists. It is simple to obtain or print the Puerto Rico Employee Stock Option Plan of Vivigen, Inc. from our service.

If you already have a US Legal Forms accounts, you can log in and click the Download option. Following that, you can complete, change, print, or signal the Puerto Rico Employee Stock Option Plan of Vivigen, Inc.. Every legal papers template you acquire is your own forever. To have yet another version for any bought form, go to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms website initially, stick to the easy directions below:

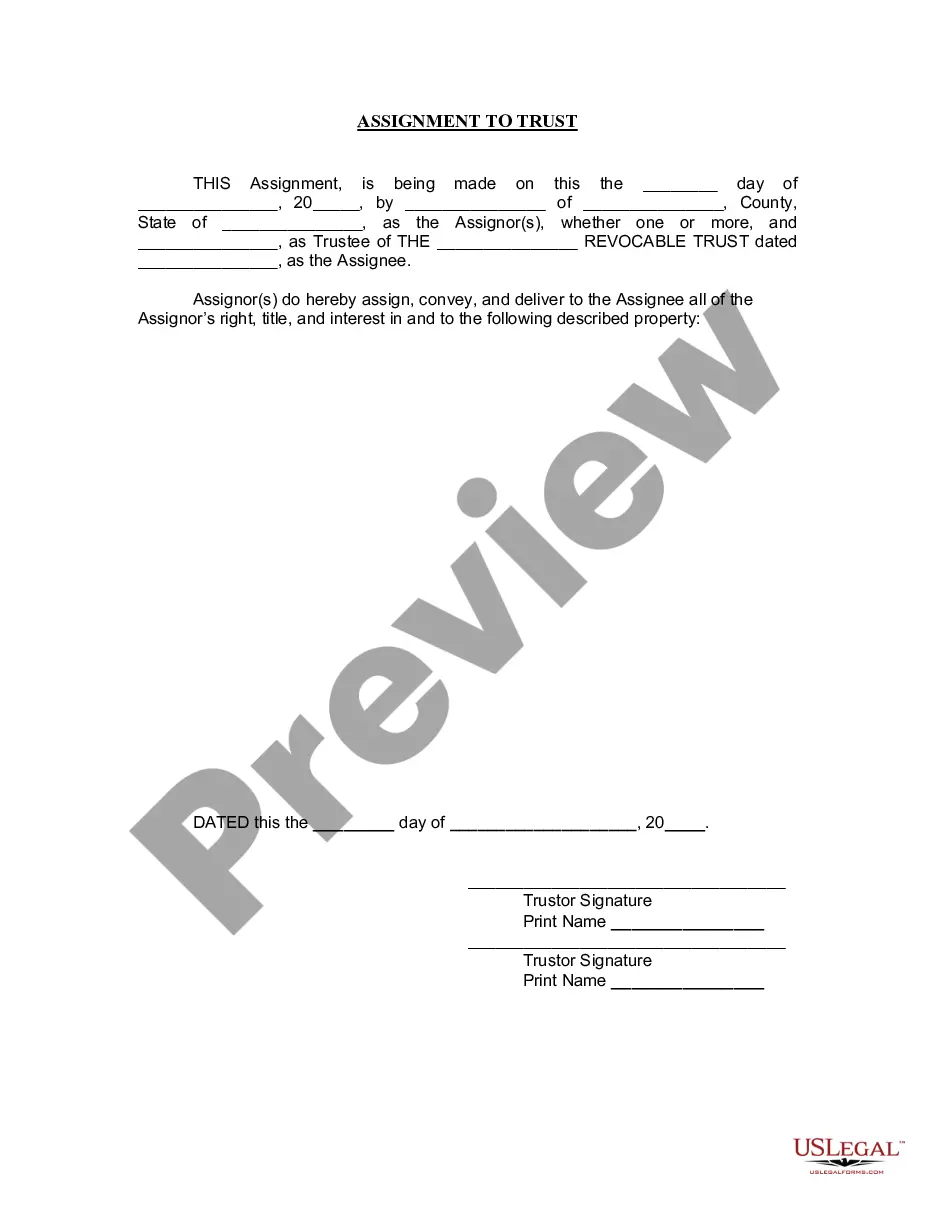

- Very first, make sure that you have selected the correct papers template for your county/area of your liking. Read the form explanation to make sure you have selected the right form. If offered, make use of the Review option to look from the papers template as well.

- In order to get yet another model of the form, make use of the Search industry to discover the template that fits your needs and demands.

- Once you have found the template you would like, simply click Acquire now to proceed.

- Select the pricing strategy you would like, key in your accreditations, and sign up for an account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal accounts to fund the legal form.

- Select the file format of the papers and obtain it in your product.

- Make changes in your papers if required. You may complete, change and signal and print Puerto Rico Employee Stock Option Plan of Vivigen, Inc..

Download and print 1000s of papers templates while using US Legal Forms Internet site, that provides the greatest variety of legal kinds. Use professional and status-certain templates to handle your company or person requirements.

Form popularity

FAQ

Hear this out loud PauseAs a reminder, property taxes in Puerto Rico are paid twice a year, with the first installment due at the end of June and the second at the end of January.

Hear this out loud PausePuerto Rico is an unincorporated territory of the United States and Puerto Ricans are U.S. citizens; however, Puerto Rico is not a U.S. state, but a U.S. insular area. Consequently, while all Puerto Rico residents pay federal taxes, many residents are not required to pay federal income taxes.

Hear this out loud PausePuerto Rico residents generally do not pay federal income taxes, but they do pay taxes to the Puerto Rico government. And Puerto Rico keeps those taxes low for certain businesses and individuals. Under the Act 60 Export Services Tax Incentive, a qualified business enjoys a corporate tax rate of only 4%.

Puerto Rican residents are taxed in Puerto Rico on their worldwide income, no matter where the income is sourced. Puerto Rican non-residents are only taxed in Puerto Rico on their Puerto Rico-source income. Income for services performed is sourced to Puerto Rico based on where the services are performed.