Louisiana Proposal to decrease authorized common and preferred stock

Description

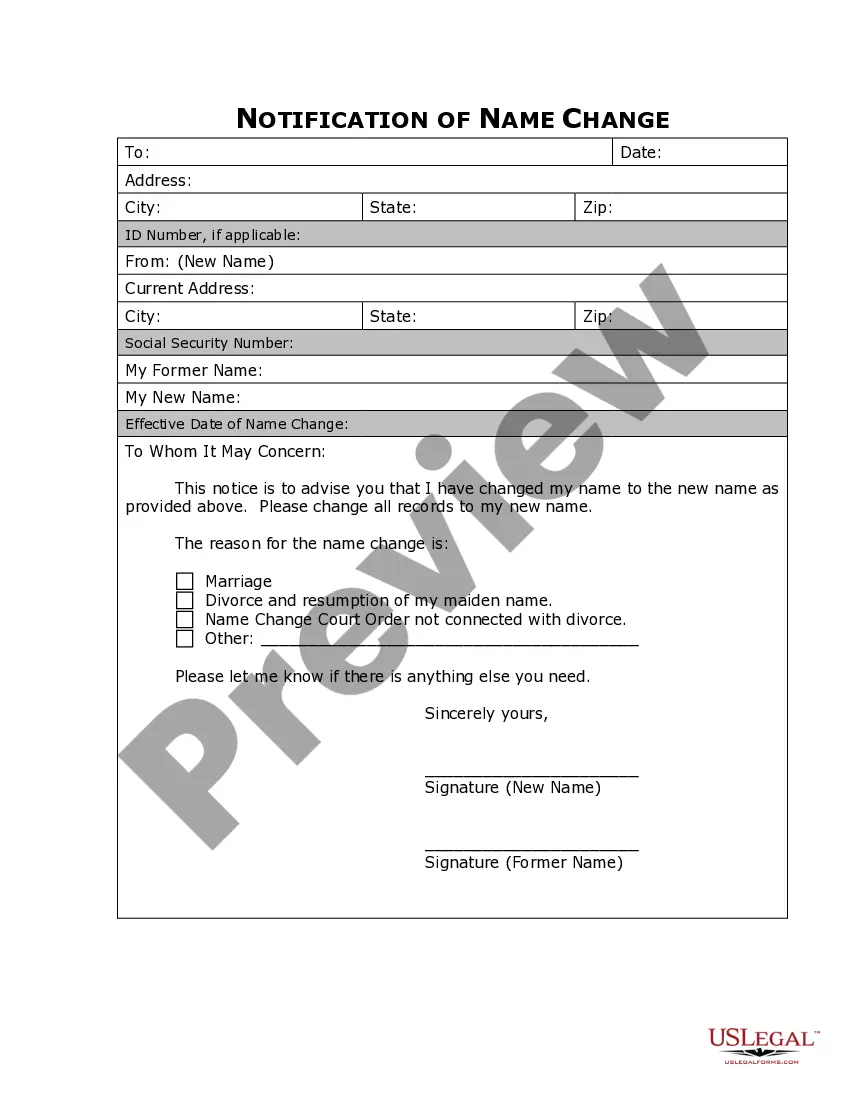

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

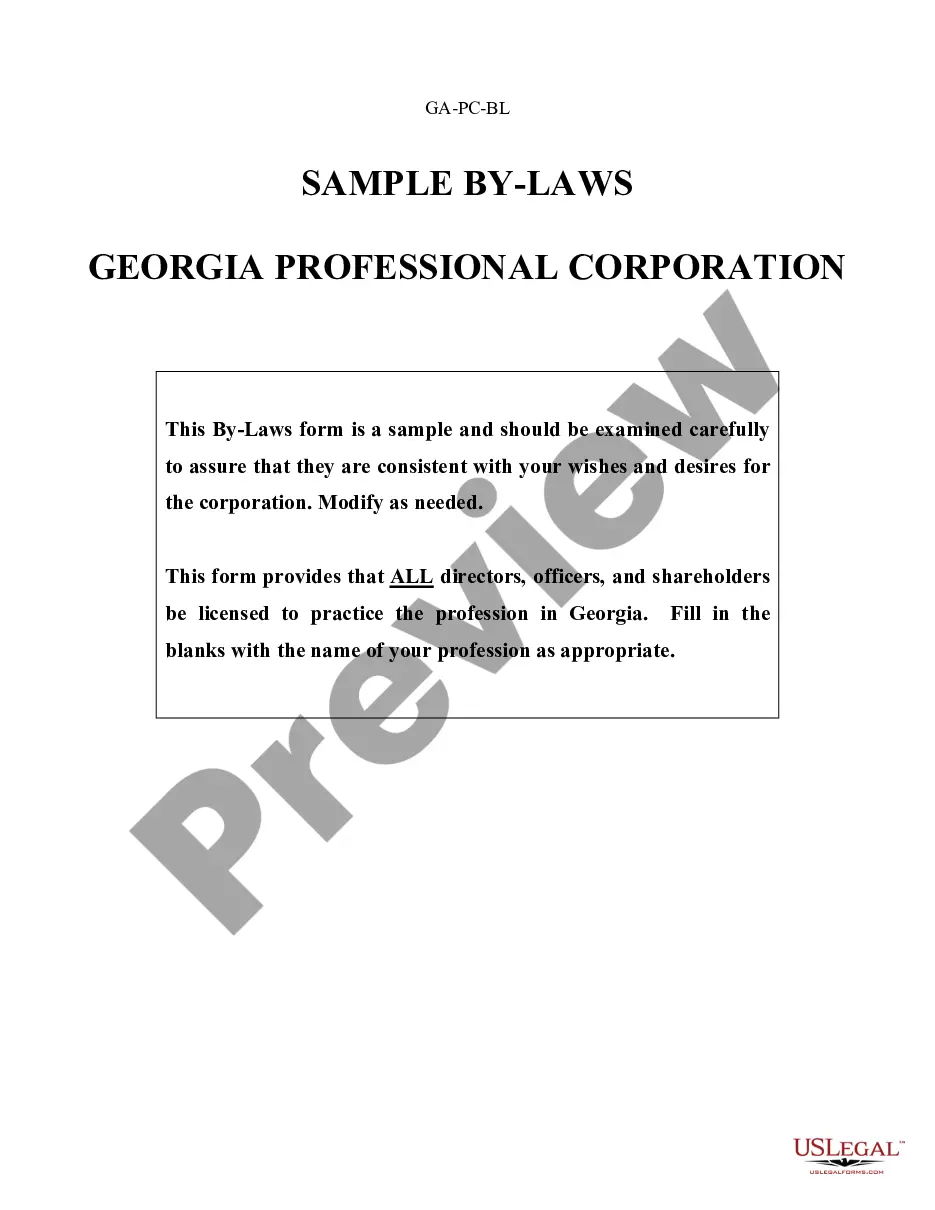

If you have to comprehensive, down load, or printing lawful papers web templates, use US Legal Forms, the biggest assortment of lawful types, that can be found online. Make use of the site`s simple and hassle-free research to obtain the papers you will need. Various web templates for organization and personal purposes are sorted by groups and says, or search phrases. Use US Legal Forms to obtain the Louisiana Proposal to decrease authorized common and preferred stock within a few clicks.

When you are presently a US Legal Forms customer, log in for your account and click the Down load option to obtain the Louisiana Proposal to decrease authorized common and preferred stock. You may also accessibility types you previously saved inside the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that appropriate city/land.

- Step 2. Utilize the Review method to examine the form`s articles. Never overlook to see the information.

- Step 3. When you are not happy with all the form, utilize the Lookup area on top of the screen to get other models in the lawful form format.

- Step 4. Upon having found the shape you will need, click on the Acquire now option. Opt for the prices prepare you prefer and include your references to sign up for the account.

- Step 5. Process the transaction. You may use your charge card or PayPal account to finish the transaction.

- Step 6. Choose the structure in the lawful form and down load it in your product.

- Step 7. Comprehensive, edit and printing or indication the Louisiana Proposal to decrease authorized common and preferred stock.

Every lawful papers format you acquire is your own property for a long time. You have acces to each and every form you saved within your acccount. Go through the My Forms area and choose a form to printing or down load again.

Be competitive and down load, and printing the Louisiana Proposal to decrease authorized common and preferred stock with US Legal Forms. There are many professional and state-particular types you can utilize for your organization or personal demands.

Form popularity

FAQ

Preferred stock dividend payments are not fixed and can change or be stopped. However, these payments are often taxed at a lower rate than bond interest. In addition, bonds often have a term that mature after a certain amount of time. There is theoretically no "end date" to preferred stock.

Key Takeaways Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

We would generally consider preferred stock to be a fixed-income investment, with the value being affected primarily by changes in interest rates and the credit outlook of the company, without the upside appreciation potential of common stock.

The main disadvantage of owning preference shares is that the investors in these vehicles don't enjoy the same voting rights as common shareholders. 1 This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

Advantages of Preferred Shares No dilution of control: This type of financing allows issuers to avoid or defer the dilution of control, as the shares do not provide voting rights or limit these rights. No obligation for dividends: The shares do not force issuers to pay dividends to shareholders.

Advantages of preference shares No interference: Generally, preference shares do not carry voting rights. Therefore, a company can raise capital without dilution of control. Equity shareholders retain exclusive control over the company.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options.

Advantages of Preferred Shares No dilution of control: This type of financing allows issuers to avoid or defer the dilution of control, as the shares do not provide voting rights or limit these rights. No obligation for dividends: The shares do not force issuers to pay dividends to shareholders.