Louisiana Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

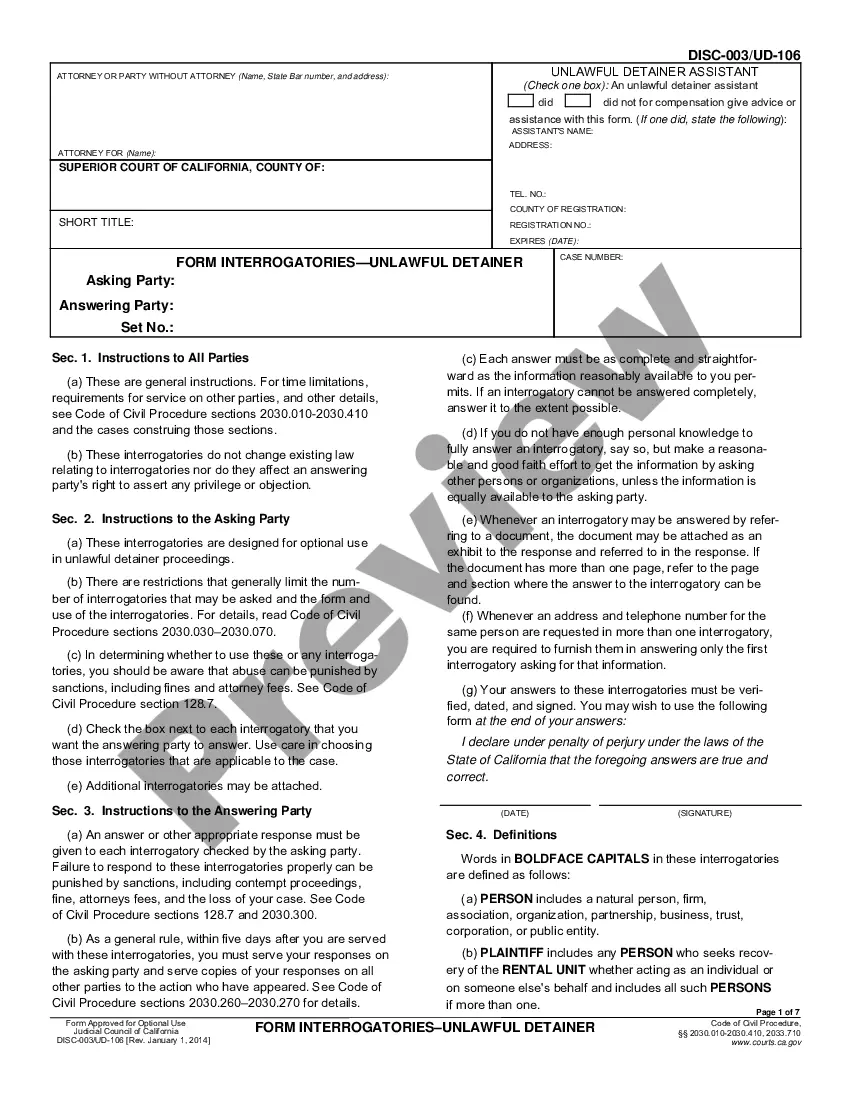

How to fill out Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

Are you presently within a place in which you require paperwork for possibly organization or specific functions virtually every day? There are a variety of authorized document layouts accessible on the Internet, but discovering kinds you can trust isn`t simple. US Legal Forms delivers a large number of kind layouts, such as the Louisiana Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment, that are written to satisfy state and federal specifications.

If you are previously familiar with US Legal Forms internet site and possess a free account, basically log in. After that, you are able to obtain the Louisiana Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment format.

If you do not have an profile and need to start using US Legal Forms, abide by these steps:

- Get the kind you want and make sure it is for that right town/region.

- Take advantage of the Review switch to examine the form.

- Read the outline to ensure that you have chosen the correct kind.

- If the kind isn`t what you are looking for, make use of the Search discipline to get the kind that suits you and specifications.

- Whenever you find the right kind, just click Acquire now.

- Pick the prices prepare you want, fill out the required information to create your account, and pay for the order with your PayPal or credit card.

- Pick a hassle-free data file structure and obtain your backup.

Get every one of the document layouts you have purchased in the My Forms menu. You can obtain a more backup of Louisiana Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment whenever, if needed. Just click on the necessary kind to obtain or produce the document format.

Use US Legal Forms, the most considerable selection of authorized kinds, to save time and stay away from faults. The service delivers professionally made authorized document layouts that can be used for a range of functions. Produce a free account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Probably the two most common reasons for amending the Articles are to effect: a change of the name, and. a change of the purpose statement.

What is Amended and Restated? ?Amended? means that the document has ?changed?? that someone has revised the document. ?Restated? means ?presented in its entirety?, ? as a single, complete document. ingly, ?amended and restated? means a complete document into which one or more changes have been incorporated.

Articles of Incorporation must be amended to alert the state to major changes. Changes that qualify for state notification include changes to: address. company name.

What is the purpose of articles of incorporation? Articles of incorporation are important documents because they serve as legal proof that your company is established in your state. The articles contain mandatory provisions - which provide the state government with certain basic information about the corporation.

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

Yes, a company can change the number of authorized shares it is allowed to issue. Public companies must often notify existing shareholders and call for a shareholder vote. The measure is then often reviewed at the following shareholder meeting.

How to Amend Articles of Association Review Existing Articles of Association. ... Propose Amendments. ... Hold a Meeting to Pass a Resolution. ... File Amended Articles of Association. ... Update Internal Records.

How to file a Louisiana Corporation Amendment: You amend the articles of your Louisiana Corporation by submitting a change form by mail, fax, or in person along with the filing fee to the Louisiana Secretary of State. If you are a domestic corporation the easiest way to file amendments is online.