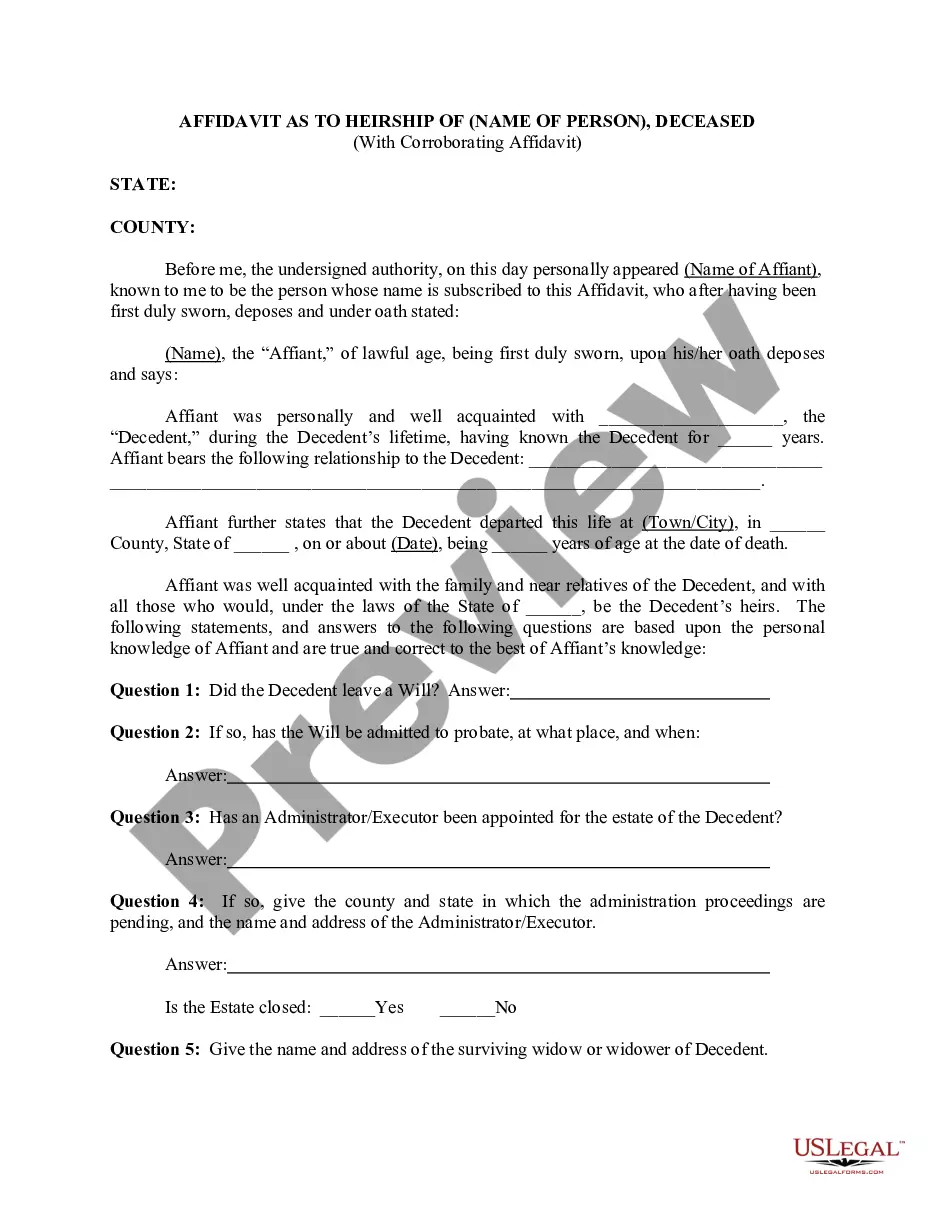

Affidavit of Death and Heirship (Information to Include in Affadavit)

Description

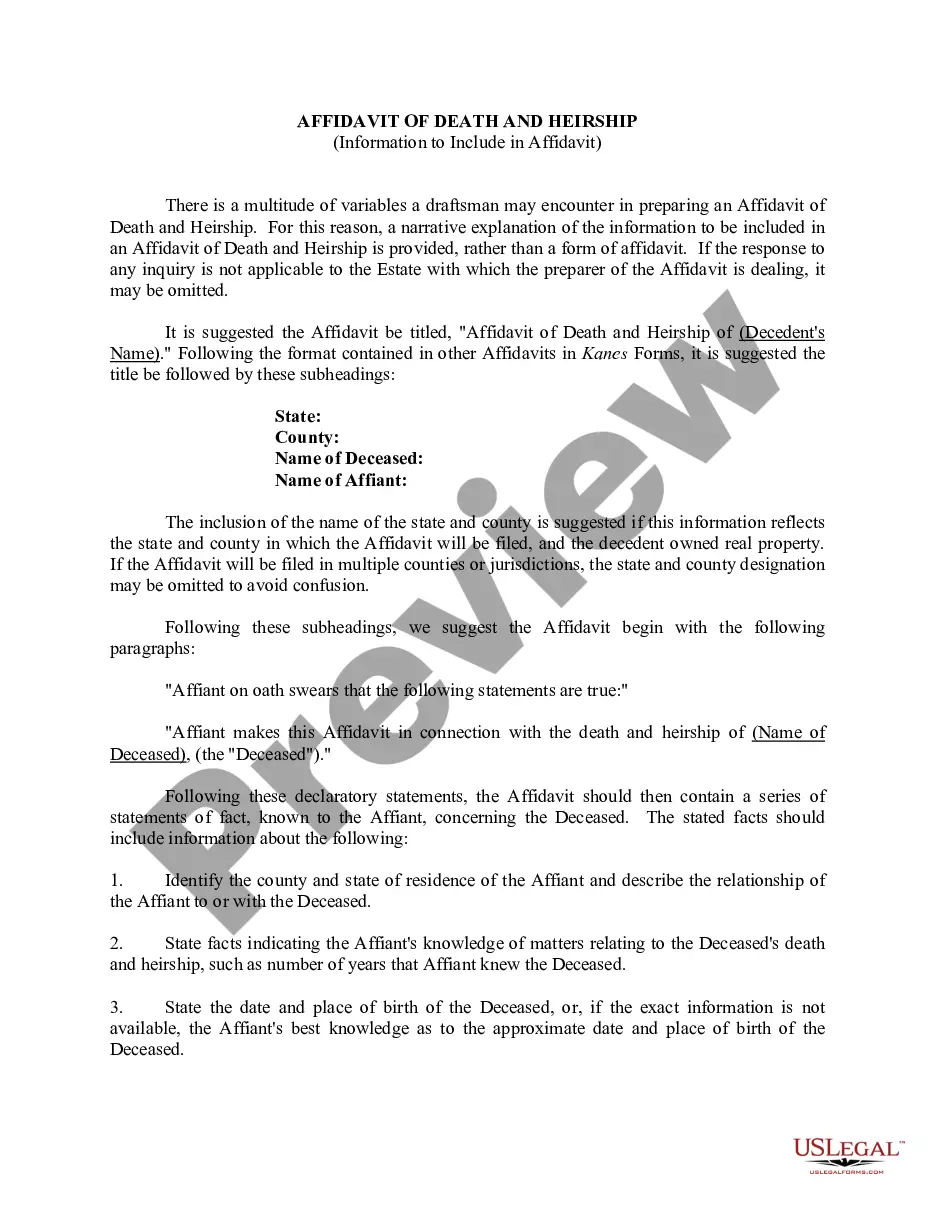

How to fill out Affidavit Of Death And Heirship (Information To Include In Affadavit)?

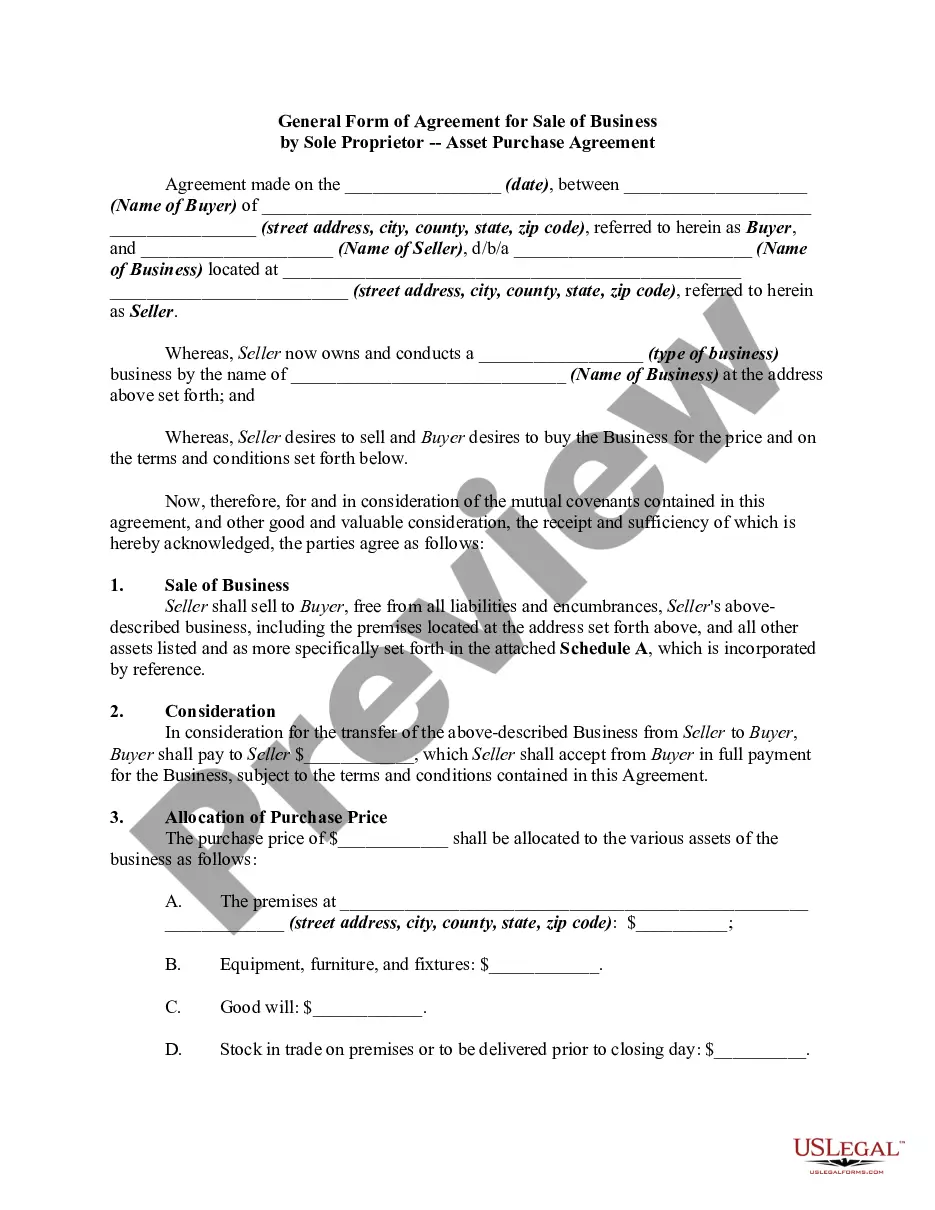

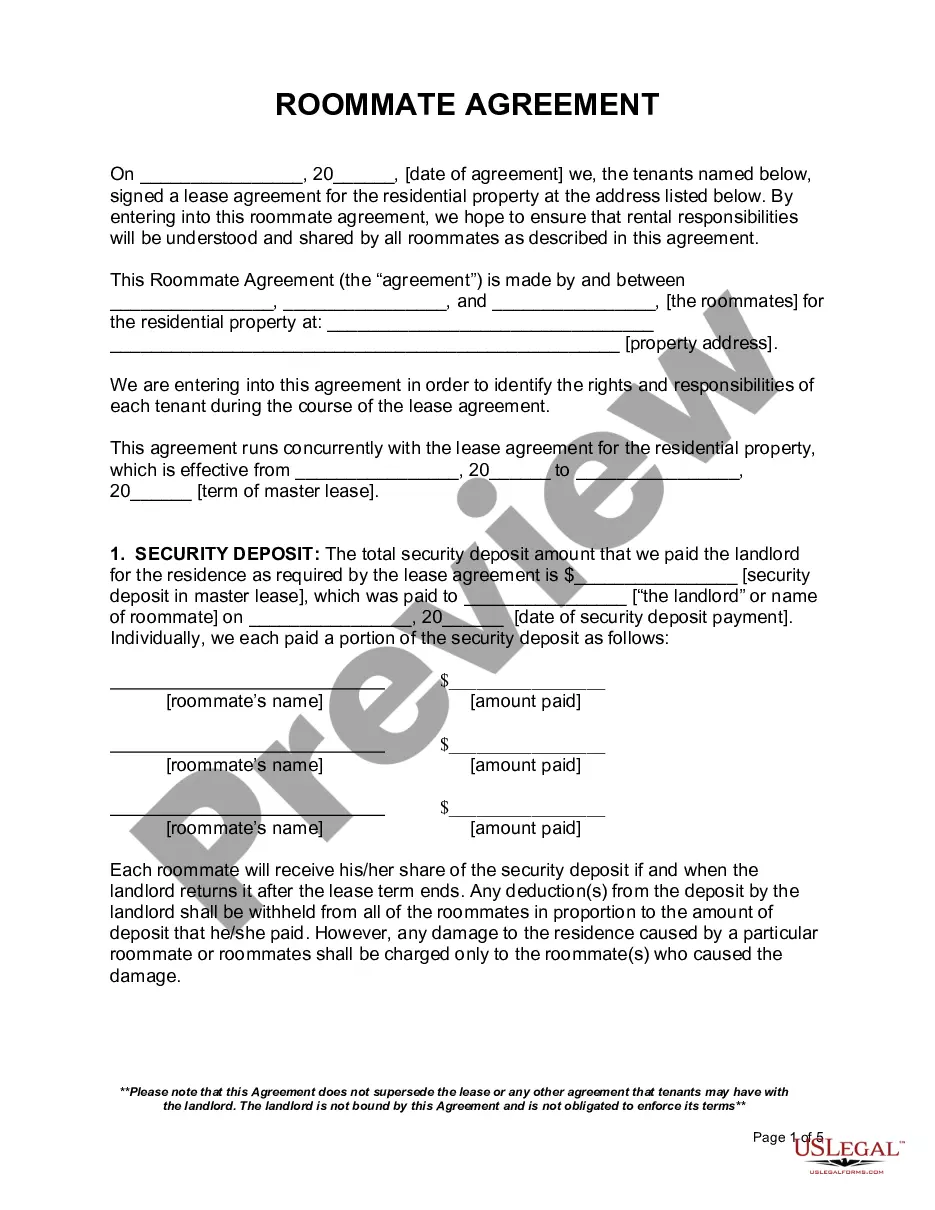

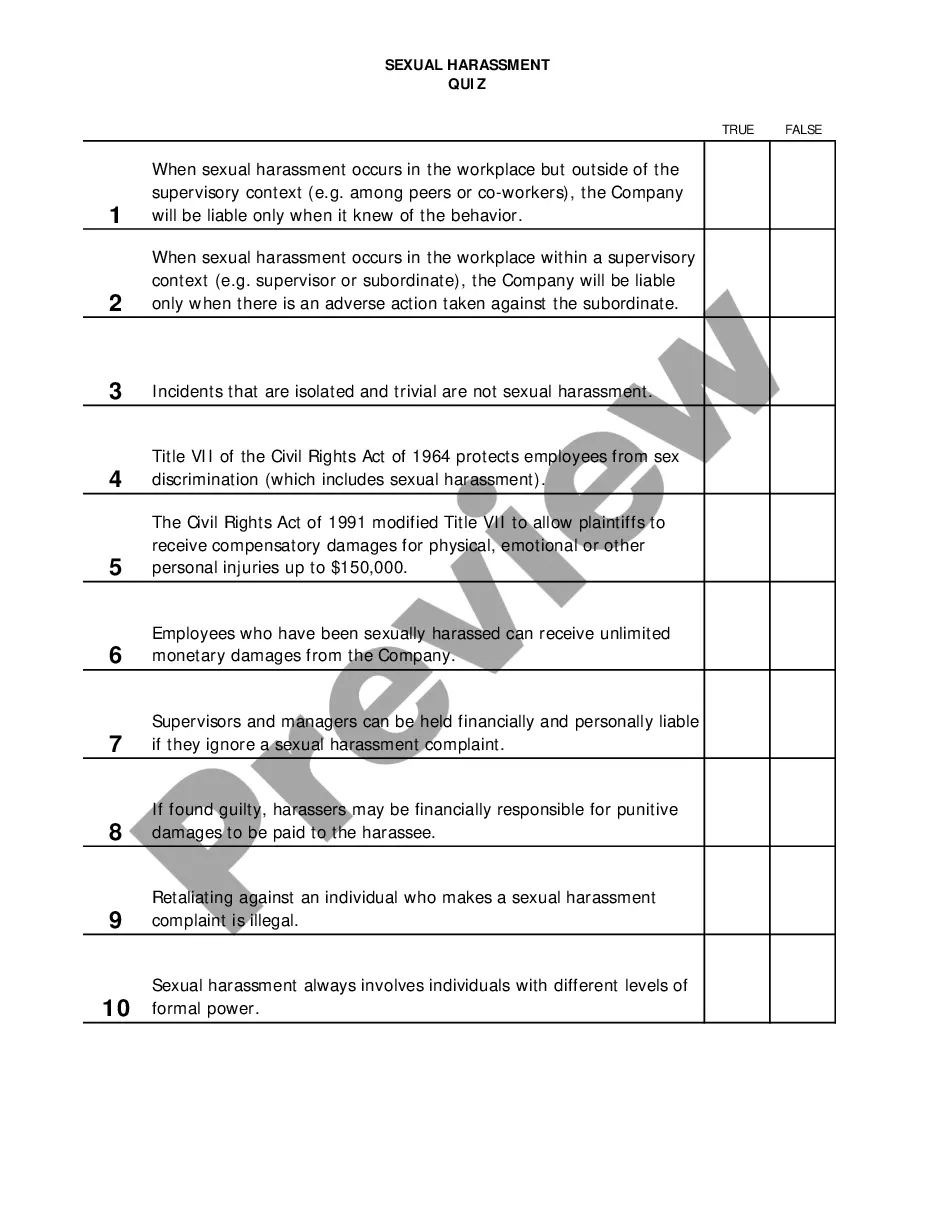

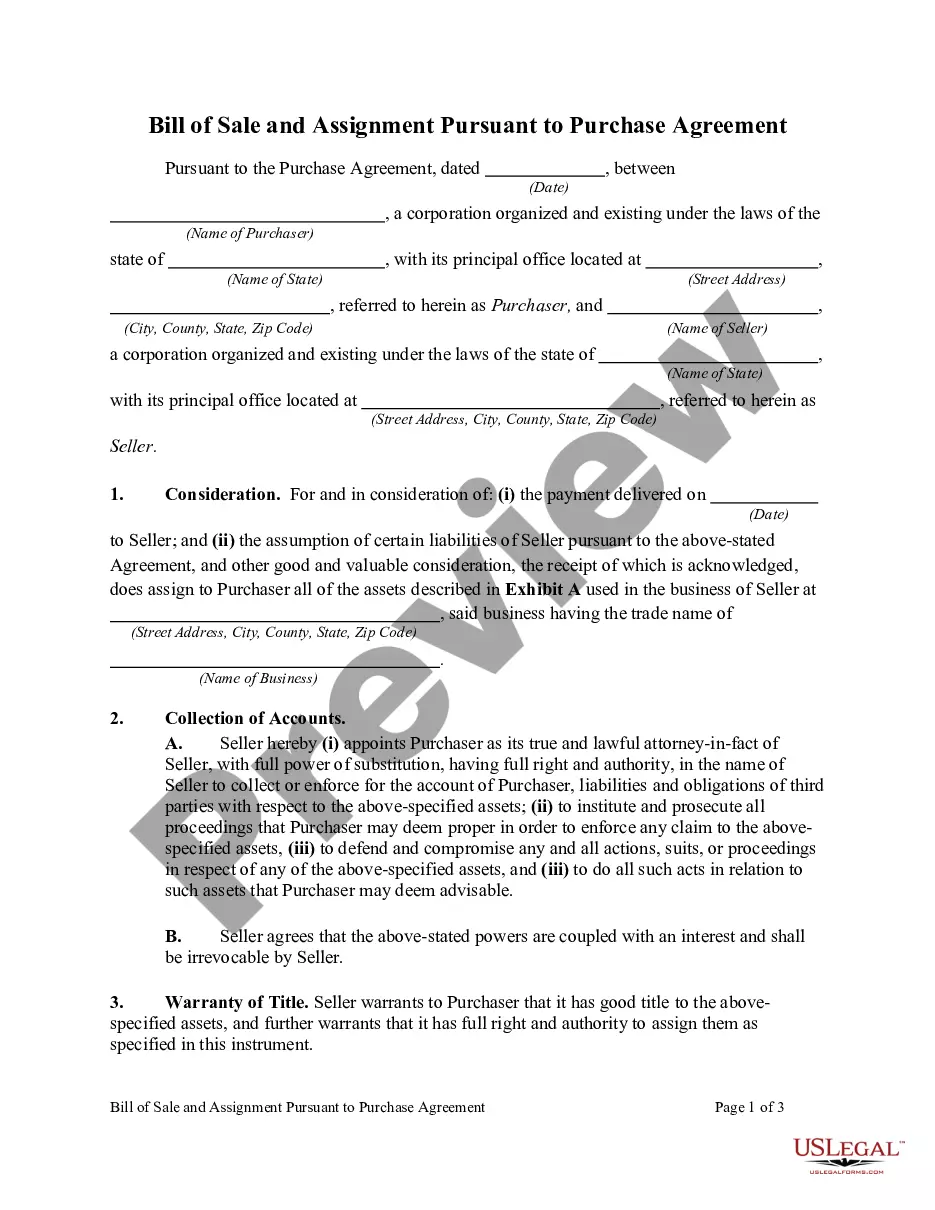

When it comes to drafting a legal document, it is easier to leave it to the specialists. However, that doesn't mean you yourself can’t get a template to use. That doesn't mean you yourself cannot get a template to utilize, however. Download Affidavit of Death and Heirship (Information to Include in Affadavit) from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you are registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Affidavit of Death and Heirship (Information to Include in Affadavit) fast:

- Make confident the form meets all the necessary state requirements.

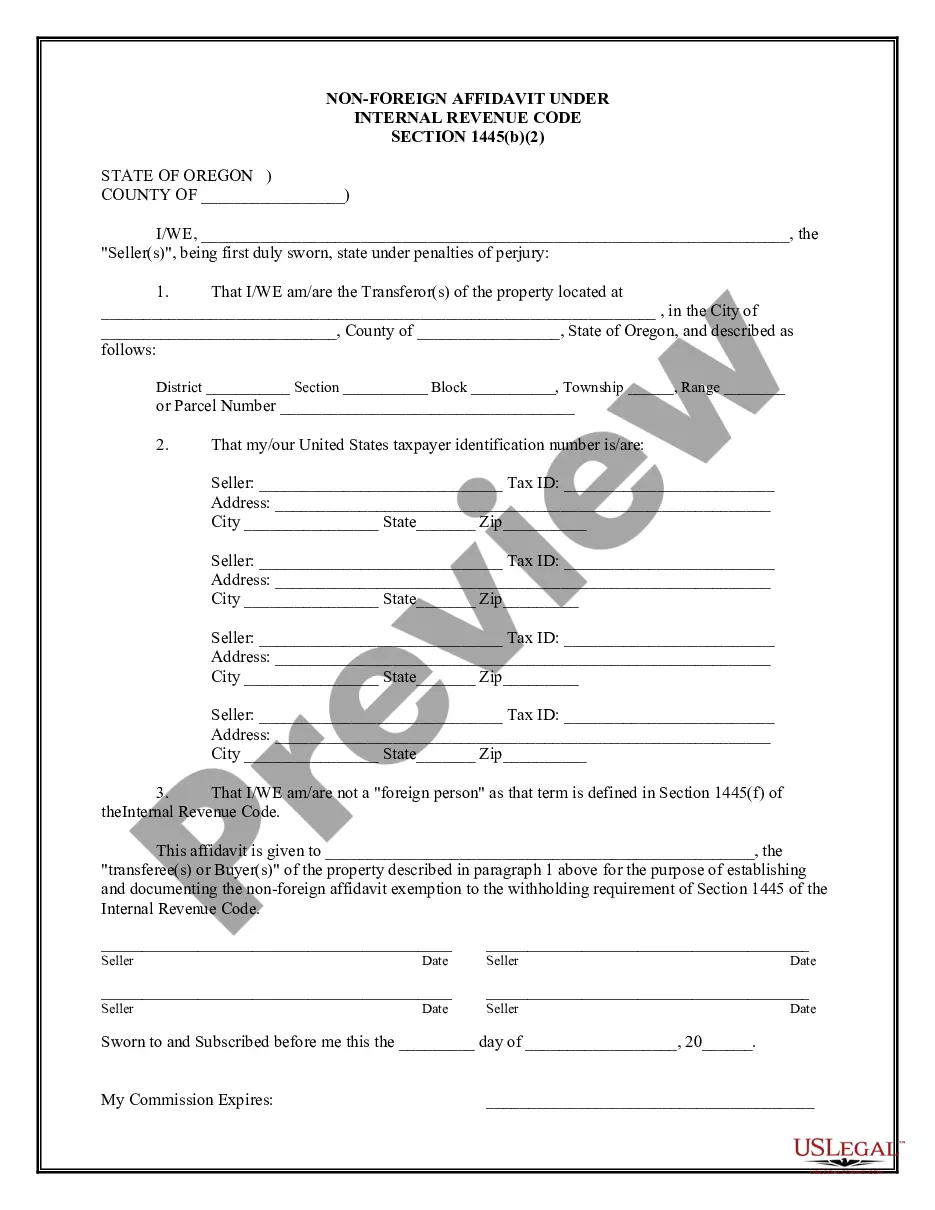

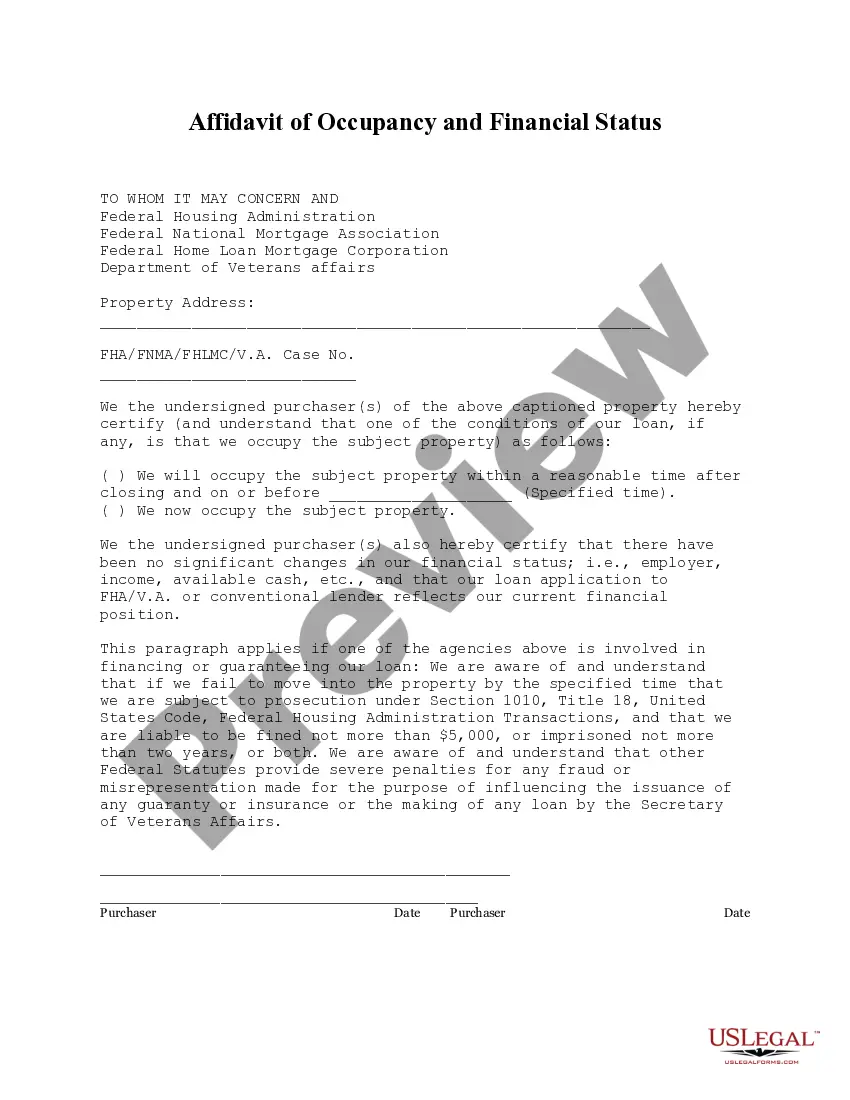

- If available preview it and read the description prior to buying it.

- Click Buy Now.

- Select the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

When the Affidavit of Death and Heirship (Information to Include in Affadavit) is downloaded it is possible to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

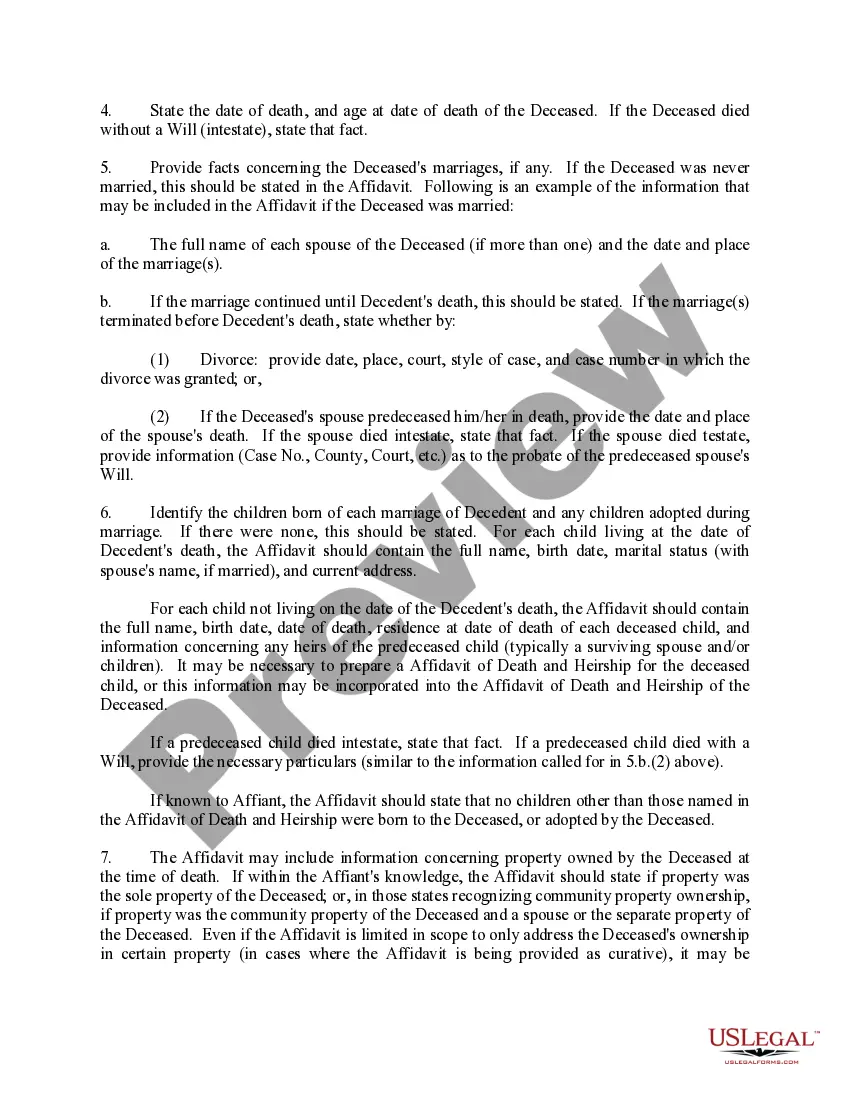

Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor). Create the new deed. Sign and notarize the deed. File the deed in the county land records.

Affidavit of Descendants. Use this form to identify all the descendants of a deceased account owner or beneficiary, or to state that there are no living descendants, in order to determine (or confirm) who inherits in the event the individual has died or is disclaiming the assets.

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

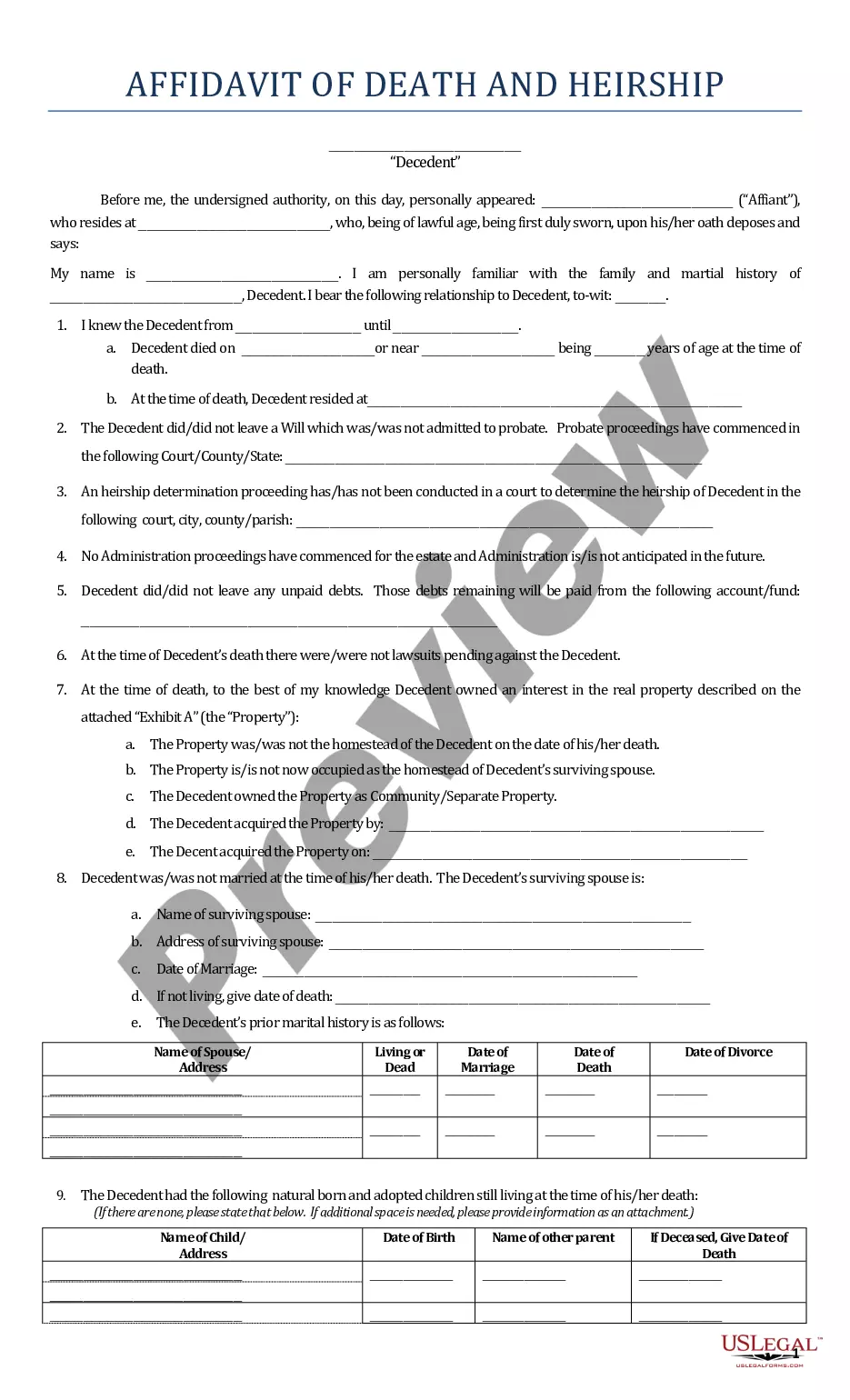

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.