Puerto Rico Employee Evaluation Form for Farmer

Description

How to fill out Employee Evaluation Form For Farmer?

Are you currently in a circumstance where you require documentation for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Employee Evaluation Form for Farmer, which are designed to comply with state and federal regulations.

Choose the pricing plan you prefer, complete the required information to create your account, and pay using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Employee Evaluation Form for Farmer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

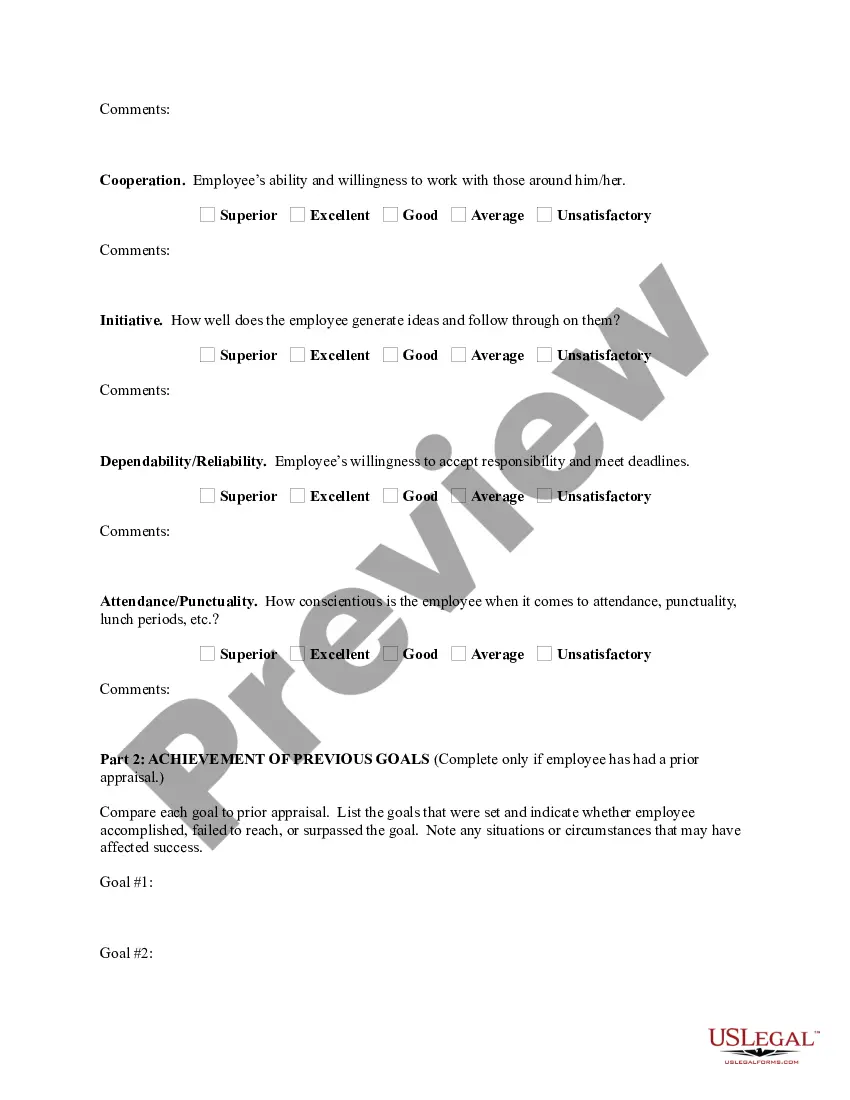

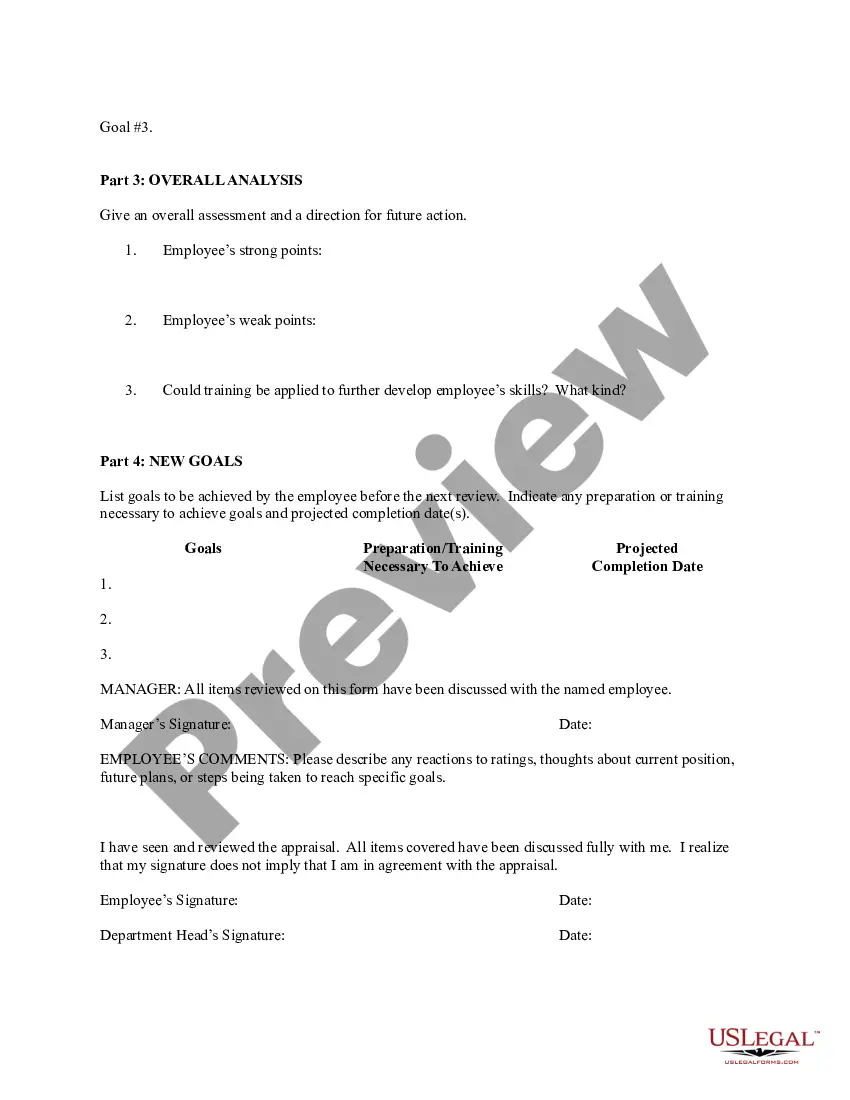

- Use the Preview button to examine the form.

- Read the description to make sure you have chosen the correct form.

- If the form is not what you need, use the Search field to find the form that fits your needs.

- Once you obtain the correct form, click Get now.

Form popularity

FAQ

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.

Farming are three types:-Subsistence farming. Subsistence farming is described as family farming because it meets the needs of the farmer's family.Commercial Farming. In this farming, crops are growing for sale in the market.Home Farming:- Home farming includes terrace farming, gardening.

According to the United States Internal Revenue Service, a business qualifies as a farm if it is actively cultivating, operating or managing land for profit. A farm includes livestock, dairy, poultry, fish, vegetables and fruit.

Evaluation of agricultural projects and programsRe-examine, in the light of project developments, the adequacy of the project logic laid out in planning and appraisal documents.Determine the adequacy of the project to address and overcome the situational constraints and thereby promote the desired results.More items...

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

To qualify for the tax assessment reduction, a landowner must have no less than five acres of farmland actively devoted to an agricultural or horticultural use for the two years immediately preceding the tax year being applied for and meet specific minimum gross income requirements based on the productivity of the land

So there are really two ways your farm business can be valued the market value, which is market price less taxes, and an intrinsic value based on the value of past and anticipated future cash flows. A guideline I use to determine the intrinsic value of a privately owned business is five to seven times past earnings.

Qualifying Farmer Determination Taxpayers are qualifying farmers for purposes of this special rule if: the individual's gross income from farming is at least 662154 percent of their total gross income from all sources for the taxable year or.