Puerto Rico Applicant Comparison Form

Description

How to fill out Applicant Comparison Form?

Are you in a position where you require documents for occasional business or personal purposes almost every workday.

There are numerous legal document templates accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms provides a vast array of form templates, including the Puerto Rico Applicant Comparison Form, which are designed to comply with state and federal regulations.

Once you identify the correct form, click Buy now.

Choose the payment plan you prefer, enter the necessary information to process your payment, and complete your transaction using either PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Puerto Rico Applicant Comparison Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

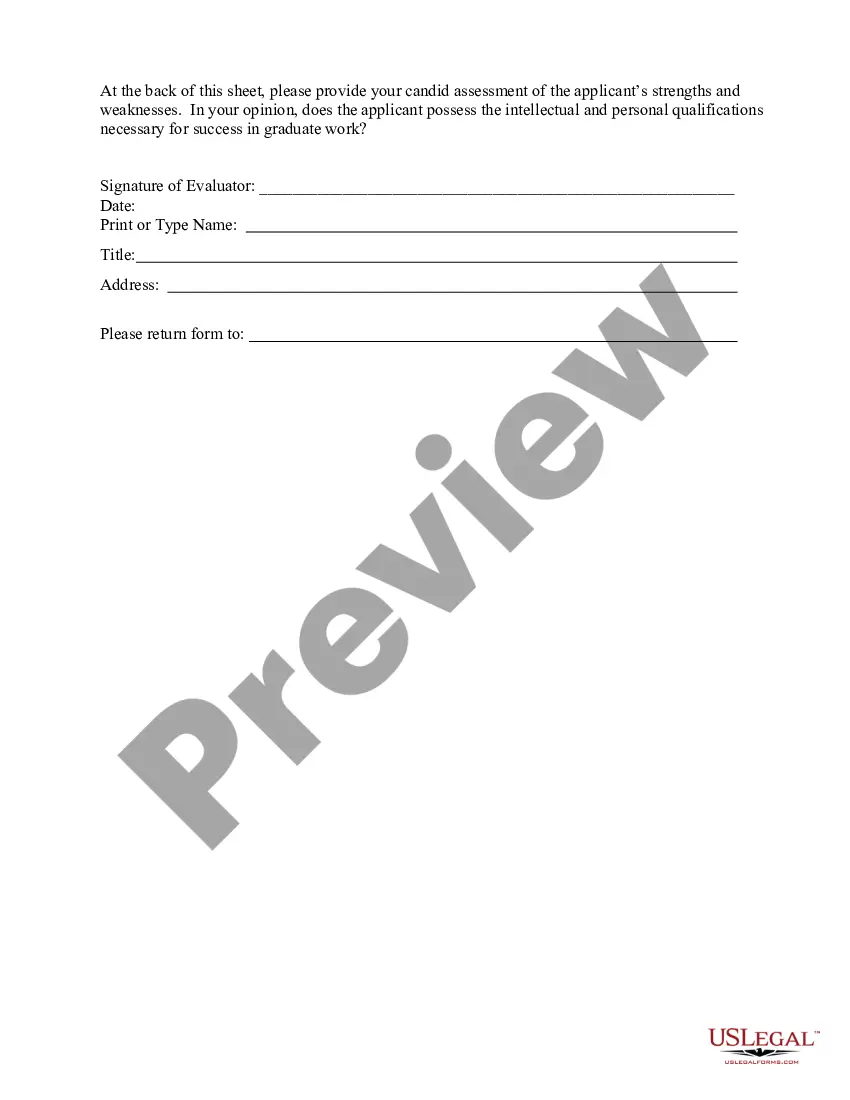

- Utilize the Preview feature to review the form.

- Examine the description to guarantee you've selected the proper form.

- If the form isn't what you are searching for, use the Search field to locate the form that fits your needs and specifications.

Form popularity

FAQ

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Form 1040-PR is for residents of the Commonwealth of Puerto Rico (PR) who are not required to file a United States (US) Form 1040, Form 1040A, or Form 1040EZ income tax return. Form 1040-PR is generally used to report and pay self-employment income tax to the US.

To exclude Puerto Rico income from a return where the taxpayer is a bona fide resident of Puerto Rico, from the Main Menu of the tax return (Form 1040) select: Income menu. Other income. Section 933 Excluded Income from Puerto Rico.

2 As a result, although Puerto Rico belongs to the United States and most of its residents are U.S. citizens, the income earned in Puerto Rico is considered foreign- source income and Puerto Rico corporations are considered foreign.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

If you are a bona fide resident of Puerto Rico during the entire tax year, you'll file the following returns: A Puerto Rico tax return (Form 482) reporting your worldwide income. A U.S. tax return (Form 1040) reporting your worldwide income. However, this 1040 will exclude your Puerto Rico income.