Guam Demand Bond

Description

How to fill out Demand Bond?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you will need.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can easily download or print the Guam Demand Bond from my service.

If available, utilize the Review button to browse through the document template as well. To get another version of the form, use the Search field to find the template that suits your needs. Once you have found the template you want, click on Buy now to proceed. Select the pricing plan you wish, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to your document if needed. You can complete, edit, sign, and print the Guam Demand Bond. Access and print a vast number of document templates using the US Legal Forms Website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you may complete, modify, print, or sign the Guam Demand Bond.

- Each legal document template you purchase is yours for years.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city that you choose.

- Read the form details to make sure you have chosen the right form.

Form popularity

FAQ

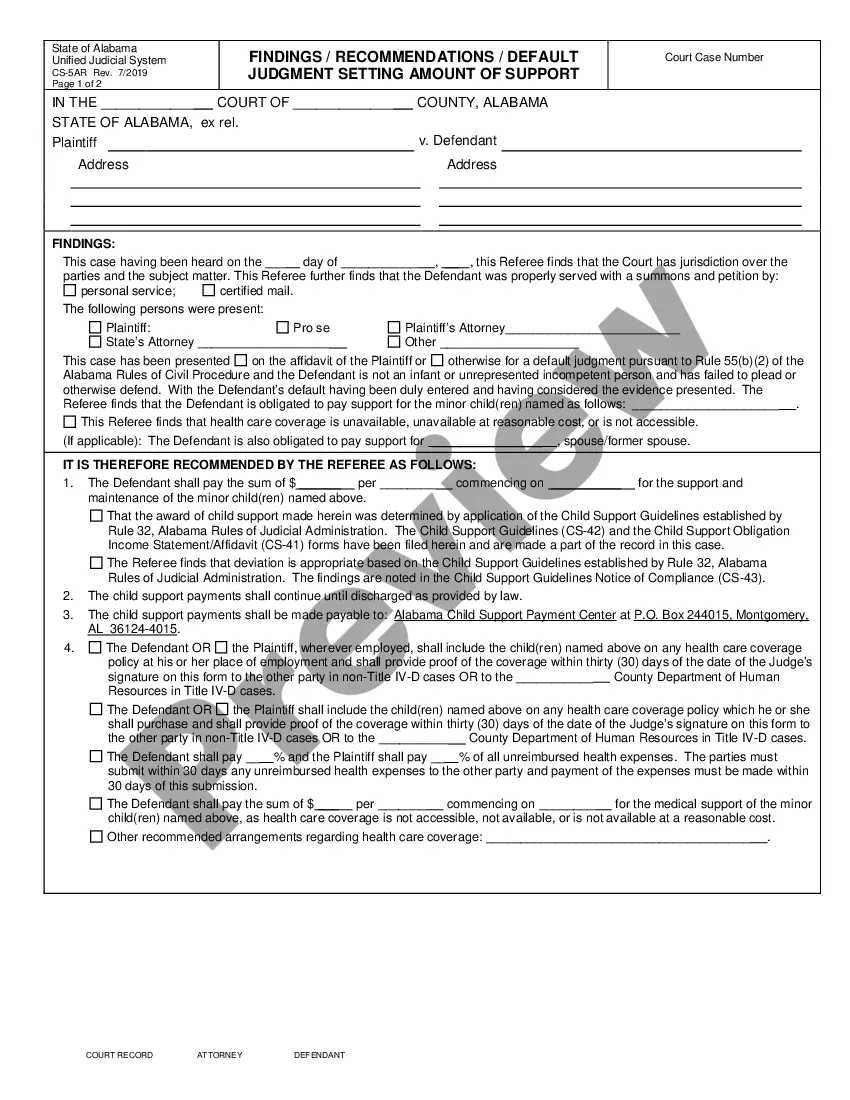

When filling out a bond form, start by entering your details in the designated sections, ensuring accuracy in names and addresses. Clearly outline the specific obligations associated with the Guam Demand Bond within the form. Double-check all entries for correctness before signing. If you find this process daunting, the uslegalforms platform can provide user-friendly templates that guide you through each step.

Filling a bond form involves several key steps, starting with entering the principal's information, including their name and address. Next, ensure you accurately describe the purpose of the bond, referencing the Guam Demand Bond where appropriate. Finally, include signatures from all relevant parties, along with the date of completion. Utilizing uslegalforms can streamline this process, as it offers easy-to-follow instructions and pre-filled templates.

To fill out a performance bond, start by gathering all necessary information about the project and the parties involved. You will need to ensure that the bond clearly states the obligations of the principal and the surety. It's crucial to include the project details, such as location and timeline, and ensure that the Guam Demand Bond is correctly referenced. If you need assistance, consider using the uslegalforms platform, which provides templates and guidance for completing performance bonds.

Getting a customs bond involves a few straightforward steps. First, determine the type of bond you need, like the Guam Demand Bond, based on your shipping requirements. Next, choose a reliable surety provider or a customs broker to handle your application. For convenience, consider using US Legal Forms, which offers comprehensive resources to help you complete your application accurately and efficiently.

The time it takes to obtain a customs bond, such as a Guam Demand Bond, can vary based on several factors, including the surety company’s processing time and your credit history. Typically, you can receive approval within a few hours to a couple of days after submitting your application. If you use online services like US Legal Forms, you can expedite the process by accessing pre-filled forms and expert guidance. This efficiency allows you to start your shipping process without unnecessary delays.

To obtain a customs bond, you need to apply through a surety company or an authorized customs broker. Start by providing your business information, including your Employer Identification Number (EIN) and details about your shipments. Once your application is submitted, the surety will evaluate your creditworthiness and issue the Guam Demand Bond if approved. Utilizing a platform like US Legal Forms can streamline this process by providing necessary forms and guidance.

Personal and Corporate Income Tax Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one return?either to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam.

U.S. territories can be divided into two groups: Those that have their own governments and their own tax systems (American Samoa, Guam, The Commonwealth of Puerto Rico, The Commonwealth of the Northern Mariana Islands and the U.S. Virgin Islands), and.

An average of three tropical storms and one typhoon pass within 180 nautical miles (330 km) of Guam each year. Since 1962, ten of thirteen major disaster declarations resulted from typhoons, and two of the other disasters were associated with climate [2].

Income from bonds issued by state, city, and local governments (municipal bonds, or munis) is generally free from federal taxes. * You will, however, have to report this income when filing your taxes. Municipal bond income is also usually free from state tax in the state where the bond was issued.