Puerto Rico Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

If you wish to obtain, download, or print official document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Employ the site's user-friendly interface to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you require, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Puerto Rico Domestic Partnership Dependent Certification Form.

- Employ US Legal Forms to acquire the Puerto Rico Domestic Partnership Dependent Certification Form in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Get button to obtain the Puerto Rico Domestic Partnership Dependent Certification Form.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

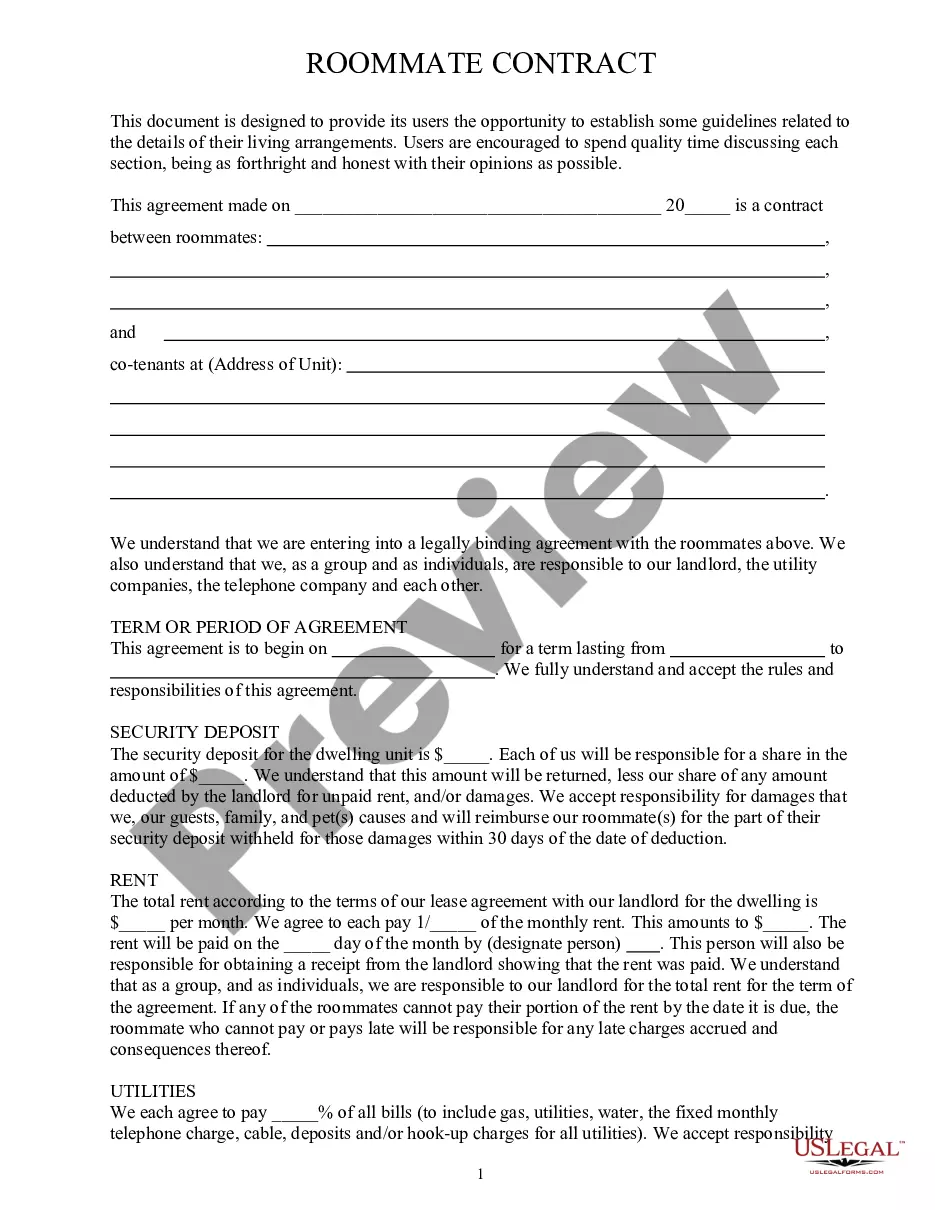

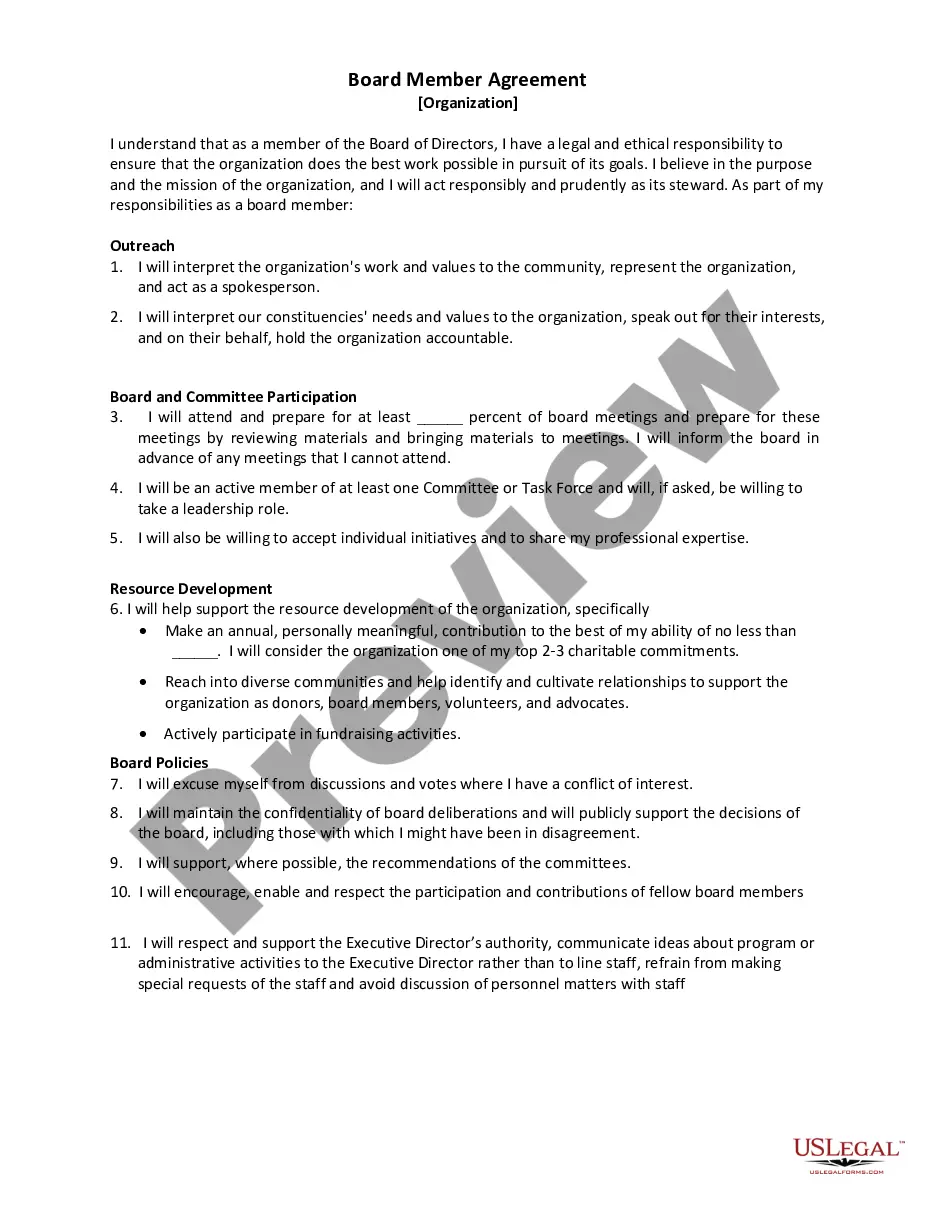

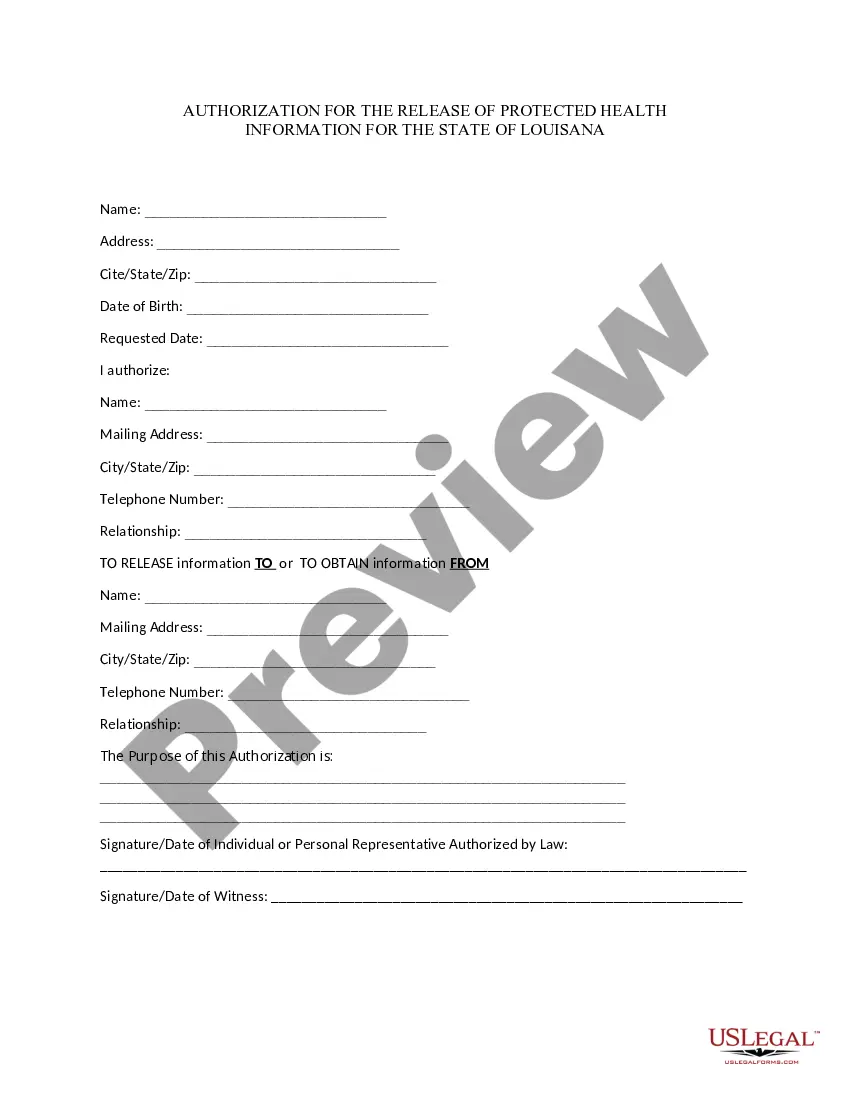

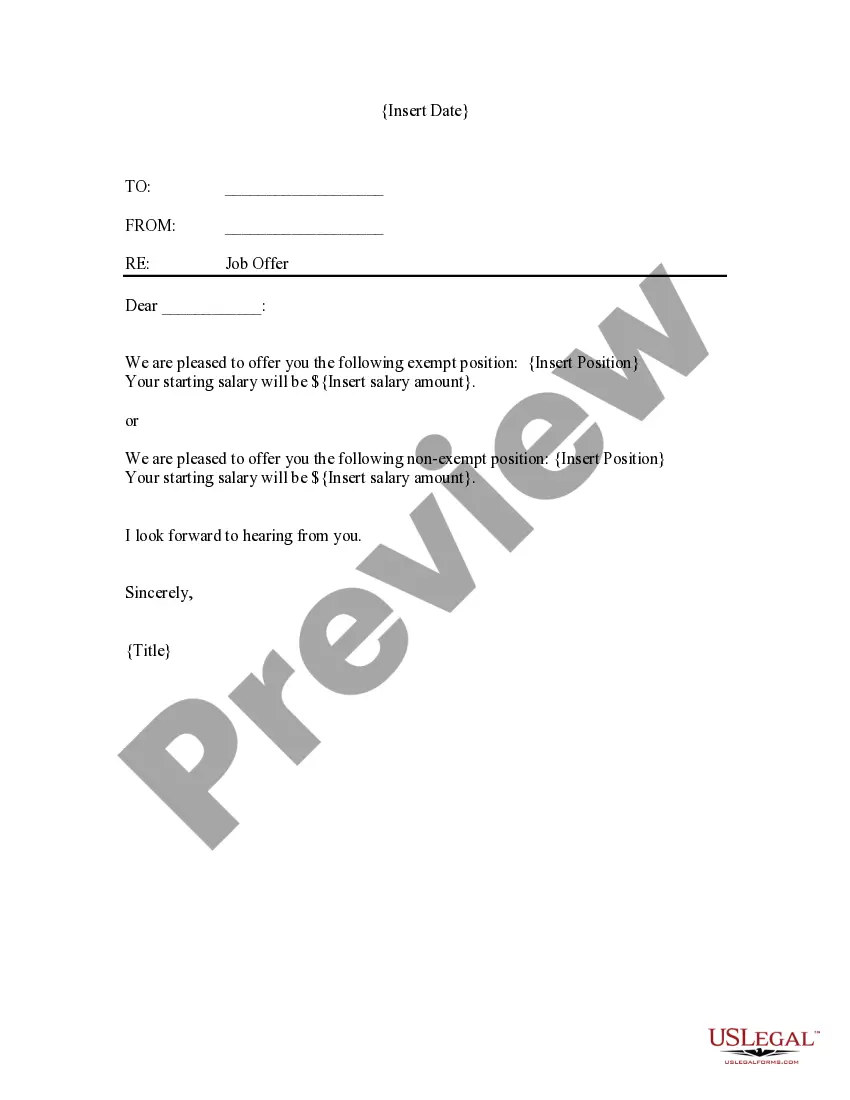

- Step 2. Use the Preview option to review the form’s content. Be sure to read the information carefully.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Federal law treats benefits for spouses, children and certain dependents the same way. However, a domestic partner is not considered a spouse under federal law.

Under specific circumstances, one partner in an unmarried couple can claim a cohabiting partner as a dependent and qualify for a tax break. The IRS defines dependents as either close relatives or unrelated persons who live in the taxpayer's household as the principal place of abode and are supported by the taxpayer.

While you may think you can have anyone as a beneficiary, you can't. A beneficiary must have an insurable interest. What is insurable interest? It means that person or entity, as a beneficiary, would face financial hardship upon your death.

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money received from: You and other people.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

A domestic partner can be broadly defined as an unrelated and unmarried person who shares common living quarters with an employee and lives in a committed, intimate relationship that is not legally defined as marriage by the state in which the partners reside.

You can claim someone as a dependent on your tax return if, according to IRS rules, they are a qualifying relative - boyfriend/girlfriend, sibling, etc. - or a qualifying child dependent. A Qualifying Relative is a person who meets the IRS requirements to be your dependent for tax purposes.