Puerto Rico Agreement between Co-lessees as to Payment of Rent and Taxes

Description

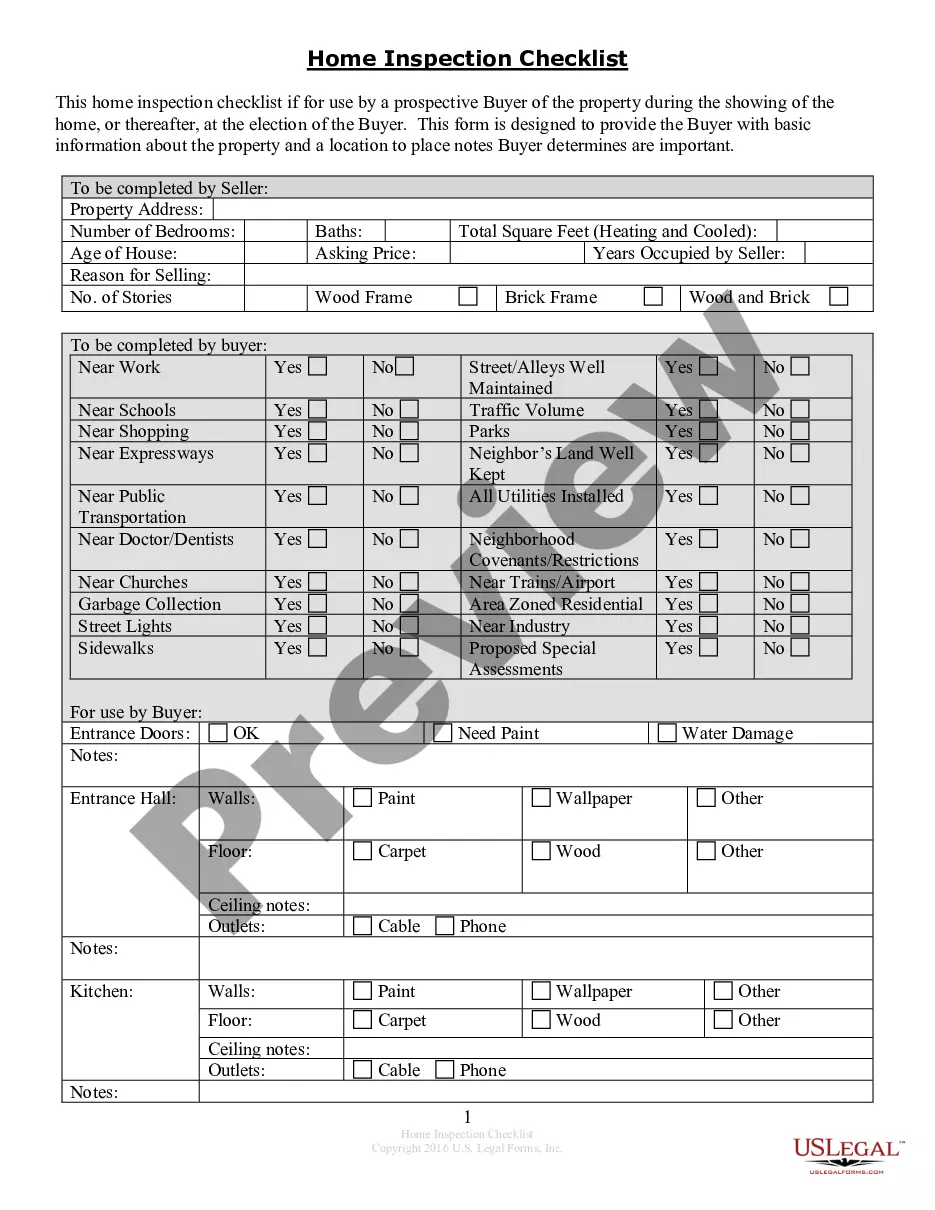

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

If you need to comprehensive, obtain, or printing legal record themes, use US Legal Forms, the largest selection of legal types, that can be found on-line. Use the site`s easy and handy search to discover the papers you will need. A variety of themes for company and personal reasons are sorted by categories and states, or keywords. Use US Legal Forms to discover the Puerto Rico Agreement between Co-lessees as to Payment of Rent and Taxes in a few click throughs.

In case you are already a US Legal Forms consumer, log in for your account and click the Down load button to get the Puerto Rico Agreement between Co-lessees as to Payment of Rent and Taxes. You can even accessibility types you previously downloaded in the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate town/country.

- Step 2. Make use of the Review option to look over the form`s content. Don`t forget to read the description.

- Step 3. In case you are not satisfied using the develop, take advantage of the Search industry on top of the monitor to get other types of your legal develop format.

- Step 4. Once you have found the shape you will need, click on the Acquire now button. Select the pricing program you like and put your credentials to sign up for the account.

- Step 5. Approach the transaction. You should use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal develop and obtain it in your device.

- Step 7. Complete, modify and printing or indication the Puerto Rico Agreement between Co-lessees as to Payment of Rent and Taxes.

Each legal record format you get is the one you have for a long time. You may have acces to each and every develop you downloaded with your acccount. Click the My Forms segment and decide on a develop to printing or obtain once again.

Remain competitive and obtain, and printing the Puerto Rico Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms. There are many specialist and state-specific types you can utilize for your company or personal needs.

Form popularity

FAQ

What Is a Lessor? A lessor is essentially someone who grants a lease to someone else. As such, a lessor is the owner of an asset that is leased under an agreement to a lessee. The lessee makes a one-time payment or a series of periodic payments to the lessor in return for the use of the asset.

A nonresident alien not engaged in a trade or business in Puerto Rico is generally taxed at a flat rate of 29% (withheld) on Puerto Rican-sourced profits and income including investment income, rental income and capital gains. Nonresidents may choose to operate as a trade or business.

Nearly all leases contain covenants, that is, where the landlord and tenant promise each other to do, or not to do, certain things in relation to the land, eg, landlord promise to keep premises in repair and tenant may promise not to use premises for any trade or business.

Under the previous lease guidance (FASB ASC 840), a lease is defined as a contractual agreement between a lessor (owner of an asset) and a lessee (user of an asset) that allows the lessee to use the asset for a period of time in exchange for consideration.

Treatment of deferred rent during transition to ASC 842 Deferred rent is most often a liability, or negative balance, representing accrued rent expense ? the total rent expense recognized is more than all of the cash payments made through that specific point in time.

However, generally a lease is a contract describing the terms under which one party (tenant) agrees to rent property owned by another party (landlord).

A lease agreement is an arrangement between two parties ? lessor and lessee, by which the lessor allows the lessee the right to use a property owned or managed by the lessor for a specified period of time, in exchange for periodic payment of rentals. The agreement does not provide ownership rights to the lessee.

Lessor's Agreement means a Landlord's Disclaimer and Consent entered into by a Person leasing real estate to the Borrower or a Guarantor pursuant to which such Person makes certain agreements for the benefit of the Agent and the Banks with respect to the locations covered thereby.